All articles on the topic “Markets”

What is helicopter money?

While traditional monetary policy measures are also employed, the focus has recently shifted to a concept that has always been the subject of debate: helicopter money.

Father of value investing – Update from the Investment Division

What has occurred since yesterday ? Benjamin Graham focused on fundamental equity analysis and became widely known as the “father of value investing”. Equity should only be purchased at a discount to its fundamental value. In his book “The Intelligent Investor” Graham creates a character called Mr. Market, a fellow who turns up every day […]

Coronacession

The world is in a state of emergency, with the corona pandemic constituting a global health, economic, and financial crisis. The term “Coronacession” has been created as a chimaera of corona and recession. The central question is how deep the emergency runs and how long it will last. The speed of the development is breath-taking. […]

Restaurants & petrol stations: how do support measures for the economy work?

We’ve repeatedly reported on monetary and fiscal policy measures in recent weeks. Today we want to show the effect of economic stimulus packages with simple examples.

The ordinary becomes special – Update from the Investment Division

What has occurred since yesterday ? Sometimes the ordinary becomes something special. To prove the validity of this heuristic, we will use the database of our Bloomberg terminal once again. On the 24,060 trading days of the leading US index S&P500 since 1928, the average daily change has been +0.02%. In contrast, for almost a […]

Rollercoaster ride continues – Update from the Investment Division

Rollercoaster ride continues. What has occurred since yesterday? And what will we be observing in the coming days? Update from the Investment Division

Historic decline in US equity markets – Update from the Investment Division

What has occurred since yesterday (17.3.2020)? Yesterday´s update started with the advantages of the Bloomberg terminals and also today we used the huge data base. Yesterday we reported on the ten days where the American equity index S&P500 had its largest losses on the same day. These ten days occurred in six different years: 1929, […]

Is China back to work?

When do people in China return to work and how quickly will the economy recover from the coronavirus shock? Our senior fund manager Jenny Teng analyzes the current situation.

Living in volatile times – Coronavirus

The update of our Investment Division What has occurred since yesterday In his address to the National Union of South African Students in Capetown 1966 in regards to the US-American civil rights movement Robert F. Kennedy said the following: „There is a Chinese curse that says: “May he live in interesting times” If we want […]

Distortions on the financial market

The distortions on the financial market continue, and the prices of risky asset classes such as equities and corporate bonds with low credit quality are falling. Market prices have increasingly come to reflect a global recession.

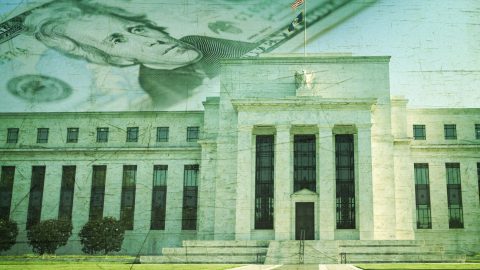

Coronavirus: US rate cut and now what?

The corona virus leaves traces in financial market policy. The US Federal Reserve cut interest rates surprisingly early on Tuesday. Erste AM chief economist Gerhard Winzer explains this measure in our interview.

Coronavirus starting to affect global corporations

Coronavirus: The spread of the virus is the defining issue in the financial markets. Global corporations such as Apple, Adidas and AT&S are also suffering the economic consequences.

Turbulent start of the year for oil

Oil prices came under pressure at the beginning of the year. The consequences of the coronavirus in China were cited as the main reason for the fall in prices.

How does the struggle for a stable oil price continue?

Coronavirus: epidemic in China disrupts recovery scenario

Coronavirus: The economy is increasingly affected by the virus crisis. Will China’s economy be able to withstand the pressure despite resistance? Analysis by Erste AM chief economist Gerhard Winzer.

Climate change and other challenges front and center at the WEF

At the World Economic Forum in Davos, topics from business, politics and science were discussed. However, climate protection received the most attention. How is the global economy doing?

And what is the outlook for 2020?

US banks report good and bad developments in the financial sector

The reporting season with the largest US banks started on Wall Street last week. Their results give a good impression of how the previous year went and what trends can be identified for this year.

2019 stock market review

Our 2019 stock market review: for investors around the world, 2019 was by and large a continuation of the previous year: the trade dispute between the US and China and the back and forth over Brexit remained the dominant topics.

Positive bottom line for our funds in 2019

Only a few weeks left and then 2019 is history. Thanks to booming stock exchanges and yet another increase in bond prices. Investors can look back on a pleasing balance sheet.

Demand in the oil market will not lose momentum until 2030

Against the background of the initial public offering of Saudi Aramco, the international energy agency predicts a robust demand for oil by 2025. Thereafter demand-dynamics will decline sharply due to increase in energy-efficient vehicles.

FT Nordic Investor Outlook – Agile Investment in Uncertain Markets

The FT Nordic Investor Outlook 2019 was dedicated to the topic „Agile Investment in Uncertain Markets“. High caliber speakers were discussing China, ESG and Brexit.

Turkish economy caught between recovery and conflicts

The Turkish invasion in northern Syria and the conflict surrounding it with the USA put the lira under renewed pressure, raising concerns about the Turkish economy’s recovery.

Just how golden is the Czech economy’s golden age?

Although the current phase of the czech economy is not utterly perfect, it can be called a golden age. What is behind all of this ?

No long-term consequences after brief panic in oil market

In the previous week crude oil prices have been the highest since 1991. How is the struggle for stable prices on the oil market going? First AM resource expert Alexander Weiss explains the current situation.

IFA: Smartphone manufacturers pin their hopes on new standard

New smartphones will dominate the international radio exhibition in Berlin until the middle of this week. What does the current market look like & what does that mean for technology stocks?

ARGENTINA CRIES (again) – Status Quo and Quo Vadis

The developments surrounding the election in Argentina & presidential challenger Alberto Fernandez are currently frightening investors. Are we looking at a “default”? Our fund manager Felix Dornaus analyzes the situation.

Weak growth and risks

The recent confrontation between the USA and China in the areas of trade and currency management triggered temporary losses for risky asset classes such as equities. Are the negative implications of an ongoing USA-China conflict strong enough to set off a decline or even a recession?

Looming hard Brexit pushes Pound further down

The hard brexit is described as the most economically unfavorable outcome. First effects can be seen with the Pound.

The Moon Landing – 50 years on: Are private companies taking over the space industry?

Adjusted for inflation, the moon landing cost far more than USD 100 bn by today’s standards. Nowadays the influence of private companies is skyrocketing. They are not just suppliers, but market leaders for many aspects.

Capital market outlook – expansive central banks fuelling risk appetite among investors

At the beginning of July, important stock market indices reached new all time highs. How will economic growth continue & in which asset classes does Erste Asset Management see the best investment opportunities?

Arguments for a continuation of China’s growth story

Why the trade war with the US does not mean the end of the development story and what speaks for the continuation of China’s growth story.

Outlook for the second half of 2019

Many asset classes recorded significant gains. At the same time, the falling tendency of numerous economic indicators has suggested a slowdown in GDP growth. How do these two go together?

Mercosur – EU: Largest free trade zone in the world

After 20 years of negotiation the EU and the South American trade bloc Mercosur announced the formation of the world’s largest free trade zone. The agreement is controversial.

Can India step out from under China’s shadow?

India has been one of the fastest growing economies in the world for several years. Can it step out of China’s shadow or will it stay only a contender?

USA urges Japan to sign trade agreement quickly

Japan is currently on several levels in the spell of US President Donald Trump’s trade policy. Will there be a free trade agreement soon and what would such an agreement mean for the Japanese economy?

Country report – Croatia

Croatia has finally received the long-awaited investment grade rating. What’s next? Our senior fund manager Ivana Kunstek answers the most important questions.

Transformation process in China

China accounts for just under 16% of world gross domestic product, making it the second largest economy in the world. Can this success story be continued – what speaks for and what against it?

Rivalry USA – China dominating the markets

The trade war between China and the USA reaches a new stage. With the announcement by US President Trump threatening to raise the penalty for Chinese imports to 25 percent, the fronts seem hardened. Will there be an early resolution of the trade dispute and what does a further escalation mean for the global economy?

IMF Spring Meeting: Emerging Markets – What’s next?

The IMF Spring Meetings of the International Monetary Fund in Washington hosts events for emerging market investors. Our senior fund manager Felix Dornaus was there & reports on his most important impressions.

Turkey after the local elections

The local elections in Turkey had been built up by President Erdogan to be a test of his policies. What do the results mean for Turkey’s economy?

Stable prospects for Central and Eastern Europe

The countries of Central, Eastern and Southeastern Europe are among the most important economic growth markets for Europe. How are the prospects for next year?

Continuing struggle for stable oil prices

Current situation on the oil market – in the previous week oil prices have been rising for four months.

There is currently a surge but how is the struggle for stable oil prices going? Interested ? Read on here.

Emerging markets corporate bond outlook 2019 + Video

What were the biggest challenges last year, and what are the opportunities in 2019? Emerging markets fund manager Péter Varga answers the most important questions.

USA still going strong

The US economy has developed very solidly since the financial crisis. The current expansion could soon become the longest in US history.

Currently the US remains strong but the key question is: Will it continue? Read on here!

Stabilization or downturn?

The majority of economic indicators point to a slowdown in global real economic growth.

How will this dichotomy between the market and the economic environment be resolved and will there be a stabilization?

Hungary: fiscal and monetary policy news

The European media has been paying attention to unorthodox economic policies in Hungary for years, supporting or opposing them depending where they stand on the political spectrum. At the same time Hungarian decision makers always stress they represent normality. Nowadays the question is: should we finally expect both monetary and fiscal policy normalization in the following years?

Trade dispute escalation averted for now

US President Trump postponed the deadline for new tariffs on imports from China. The key question is: Will there be an early resolution of the trade dispute between the US and China?

Brexit: The Final Countdown

Another Brexit defeat for Theresa May: How are things developing now? On February 27th the question arises: “May-Deal” or “No Deal”?

Constructive central banks

Risky asset classes such as equities have recorded price increases at the beginning of the year. The core question for the investor is: Is this recovery after the sharp decline in Q4 sustainable or not?

Big Trouble in Little China?

Trade war, a possible cooling of the world economy and growing uncertainties at the home market: is the Chinese dragon spinning?

Romania – Nowhere to hide

The Presidency of the Council of the European Union caught Romania in a difficult position, both from a political and macroeconomic perspective. Now the question arises – Quo vadis Romania?