The Turkish lira reflects the difficult situation Turkey is currently in. This year alone, the currency has shed more than 45% of its value to date. Interview update with Anton Hauser, Senior Fund Manager, Eastern Europe bonds.

The yield of the 5Y local currency bond has increased by almost 1000bps to 22.4%. The spread between Turkish government bonds and US-dollar-denominated government bonds has widened by 165bps to 455bps (N.B. 100bps = 1 percentage point).

What is the reason for this development?

The massive current account deficit, the high short-term government debt, the excessively loose monetary policy, and the high political risk have led to a crisis of trust among international investors.

In addition to doubts about the independence of the central bank, the most recent deterioration of the relationship between the USA and Turkey has put further pressure on the Turkish lira. The imposition of sanctions – which at face value are not particularly troublesome – step up the risk further that the relationship between Turkey and international investors may take a turn for the more complex in the foreseeable future.

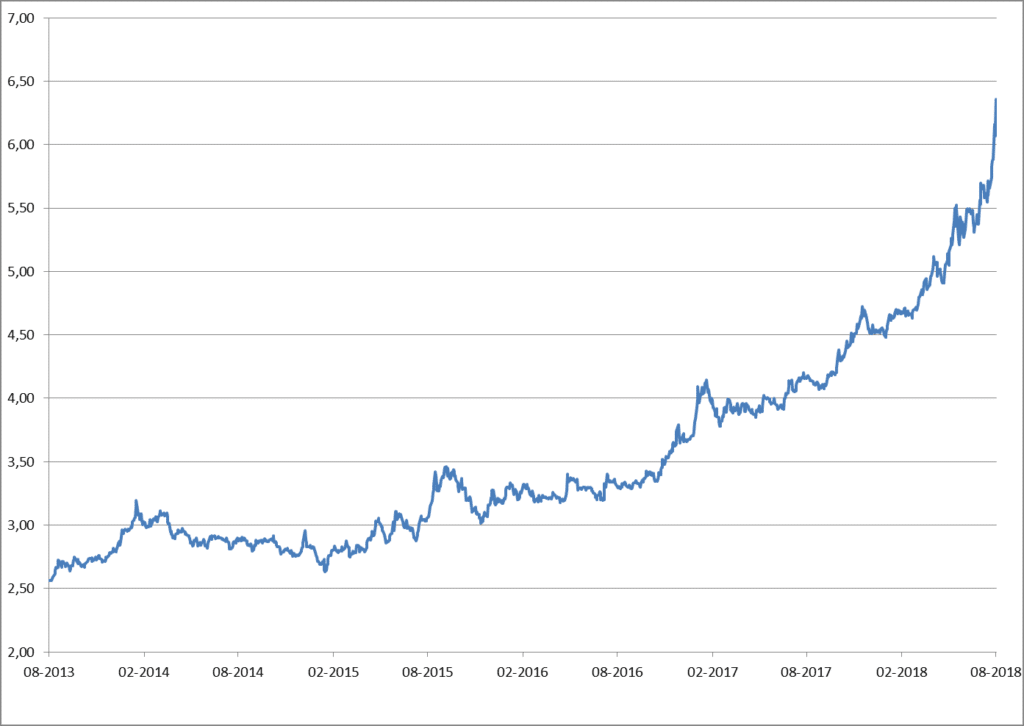

Exchange rate Turkish lira vs. euro (-5Y)

Source: Teletrader.com; as of 9 August 2018, 08:46

How dependent is Turkey on external investors?

At USD 182bn in external debt falling due within the coming twelve months, the external gross financial needs of Turkey are substantial. In addition, the country is running a current account deficit of about USD 55bn, largely caused by the high oil price, and a foreign exchange imbalance in the corporate sector of USD 222bn. The central bank holds foreign reserves of only USD 34bn. This means that the foreign exchange liabilities of Turkey are not in the least covered by currency reserves. While these imbalances are nothing new and financing has been rather stable so far, they do lead to an increase in exposure of Turkey in an environment of rising US interest rates.

What impact does the currency depreciation have?

The rising worries over a hard landing have moved the falling asset quality of banks into focus. Rising interest rates as additional cost factor among private households and the increasing debt burden (i.e. interest and redemption) in foreign exchange of companies that do not generate enough foreign exchange revenues should cause default rates to rise. At the moment, however, the default rate is 2.8% of total debt outstanding, which is low. Also, the Turkish banking sector is well-capitalised and thus protected against any credit defaults.

The only sector that could benefit from the depreciation is the tourism industry. Holidays in Turkey have become cheaper for European tourists.

What is your current assessment?

From our point of view, it is too soon to switch to “positive” for Turkish fixed income and the Turkish currency.

The massive external imbalances of the country, both with regard to flow data (current account) and stock data (significant foreign exchange debt), have been the key drivers of the widening spreads of almost 165bps to 455bps in the year to date. In view of the substantial refinancing needs over the coming twelve months, the challenging international environment, and the government’s propensity towards unorthodox policies (which is unlikely to change after the elections), we maintain our defensive stance. With regard to hard currency instruments, we are prominently positioned in bonds with short remaining time to maturity and low cash prices.

What is your conclusion?

Local currency bonds and the Turkish lira seem to have reached attractive levels. The real effective exchange rate has fallen by more than 20% in the past two years to historical lows. At the same time, real interest rates are in a bandwidth of 4 to 5%, which is high both relative to Turkey’s own history and to other emerging markets. That being said, we think the spreads can still be justified, and given the current economic uncertainties, could widen still. Further fiscal expansion geared towards supporting long-term growth targets (or short-term, politically motivated election pledges) cannot be ruled out, while the slow-down in global liquidity growth in connection with the external imbalances of the country as well as the inflation pressure could push domestic interest rates up even more.

We are prepared for such a scenario and maintain our defensive stance vis-à-vis the Turkish lira and local currency bonds.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.