A glance at traditional economic categories such as economic growth, inflation, and monetary policy suggests a favourable environment for the markets. However, the possible escalation of the trade conflict between the USA and China has brought up a latent risk and has been the dominant factor on the markets for a number of days now.

Growth rates positive

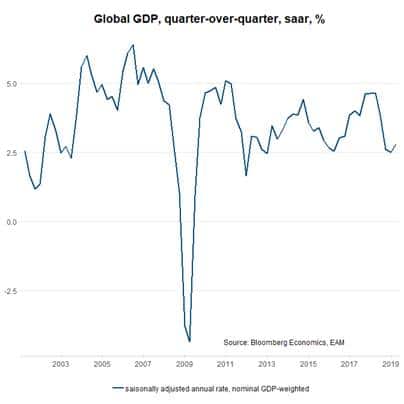

We have seen three positive aspects in connection with real global economic growth.

- Economic growth increased relative to Q4 of 2018. This means that the stabilisation after the decline of last year has kicked in sooner than expected.

- At +2.7 percent (annualised), the growth rate estimate is close to potential. This is mainly due to the growth rates in the USA and China, which have exceeded the original forecasts. Only a few weeks ago we expected a rate of 2.0 to 2.5 percent.

- We have seen some survey-based indicators improve. As for the global Purchasing Managers’ Index (PMI), the important sub-components production and order intake have increased, and the Chinese PMI recorded higher import demand. Also, growth expectations have improved.

Labour market supported

The strong labour market in the developed economies is an important supportive element for economic growth. The low unemployment rates and the robust development of employment growth are beneficial to income and thus consumption growth. That being said, the labour market is no leading indicator of economic activity.

Growth risks on the downside

The goods sector remains weak. This means industrial production, goods exports, and capital expenditure in the corporate sector. The latter are kept on low levels mainly by falling earnings growth and the declining business sentiment. The deteriorating sentiment is also due to the increased level of uncertainty with regard to the future relations between the USA and China.

Rivalry USA – China

The latent risk for failing negotiations between the USA and China has turned into an issue dominating the markets on the back of just one tweet by US President Trump from the beginning of May. The markets had not priced in this risk adequately. The tweet by President Trump, in which he threatened a further increase in tariffs, triggered a correction on the markets. There are basically six sticking points, and they do not all concern trade policies:

- The USA demanding a reduction of its balance of trade deficit with China. This is based on the assumption that balance of trade deficits are generally bad. While textbooks would claim otherwise, heterodox opinions are in fashion. Economists often point out that when buying a good from a supermarket, the consumer’s “balance of trade” with the supermarket is negative, but this does not result in demands that they should produce the milk at home rather than buy it from the supermarket. Here, an agreement may be reached.

- China demanding an immediate cancellation of the tariffs already being levied. While the USA does not want to give up this trump card just yet, an agreement seems possible.

- Protectionism: termination of subsidies, reduction of barriers (including the abandonment of the forced transfer of know-how). Here, a compromise may be reached, too.

- Better protection of intellectual property. An agreement could be reached in this area as well.

- Demands of a change in Chinese industrial policies (“Made in China 2025”). China is unlikely to abandon its goals, i.e. to upgrade the Chinese industrial sector and to achieve technology leadership.

There are of course three possible scenarios:

- Extension: both countries allow themselves more time for negotiations. The persistent uncertainty continues to dampen the sentiment in the business sector.

- No agreement (i.e. escalation). Increased tariffs and additional restrictions in foreign direct investments on both sides would be negative for the global economy.

- Agreement / defusion. A compromise would be positive for the global economy.

Expansive central bank policies

Generally speaking, central bank policies have become even more expansive. The most important driving factor for the asset price increase in the first quarter was the changes in geopolitical positioning of many central banks, from “tightening, i.e. interest rate hikes” to “neutral” or even “loosening, i.e. interest rate cuts”.

In the USA, the markets have already priced in interest rate cuts. At the same time, the signals sent out by the Fed suggest that it will wait patiently to see whether, after its earlier decrease, the underlying inflation (1.6 percent y/y in March) will bounce back towards the symmetric central bank target of 2 percent, or whether it will remain too low. This means that the reasoning for an expansive policy has changed. At first, it was the turbulences on the financial markets, later the economic risks. Now, the argument is that inflation is too low. The interpretation suggests that the management of the market expectations (i.e. guidance) by the central bank will not explicitly or directly contradict the priced-in expectations of interest rate cuts. As a result, a significant risk (interest rate hike expectations) has become less sizeable, at least for this quarter.

Outlook

Economic growth is currently neither too high (overheating) nor too low (recession); inflation is low. A potentially negative factor has become less pronounced with the fallen risk of interest rate hikes. The central bank policies remain expansive. These aspects imply an improved environment for the markets, ceteris paribus.

However, the risks are clearly skewed to the downside.

- Industrial production and capital expenditure by companies are still weak.

- Rivalry USA vs. China: whether the threats launched against China are of a tactical nature to build up pressure or whether they are based on a different sort of motivation, is ultimately not as important as the realisation that any further escalation of the trade conflict between the USA and China would come with negative repercussions for the global economy and thus for risky asset classes, both in the short and the long run.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.