Early last week, hopes for a timely solution to the trade conflict between the US and China soared: “substantial progress” in the recent negotiations caused US President Donald Trump to postpone a deadline for additional tariffs on imports from China. As is his wont, Trump announced this on Twitter. Without any agreement, punitive duties on Chinese goods could have been raised or new tariffs introduced from 1 March. However, this case seems to be averted for the time being.

US economic growth fell in Q4

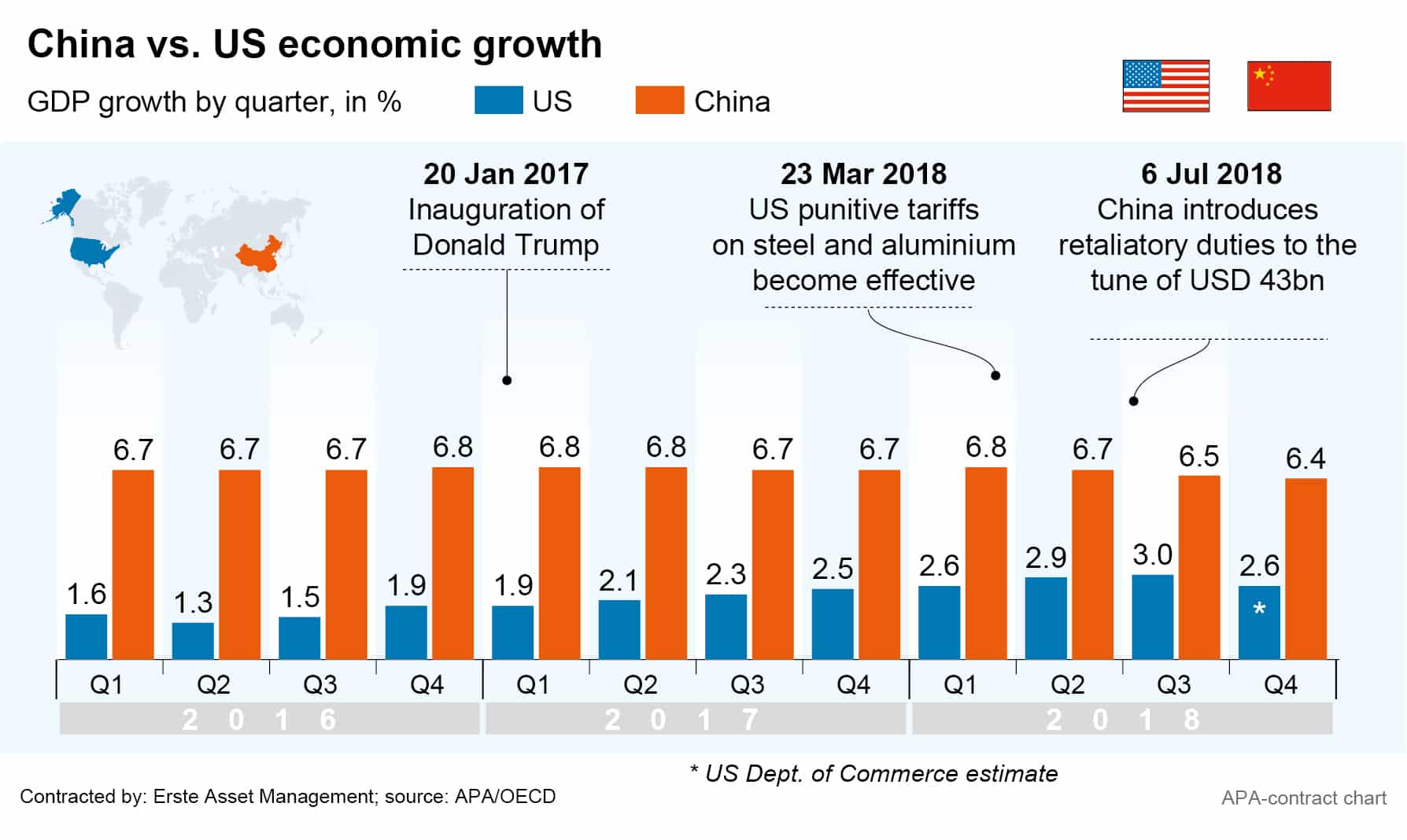

Current economic data shows a mixed picture for the impact of the trade dispute on the US economy so far. While the GDP grew by 2.9 percent in 2018 overall – the strongest growth in three years – the growth lost momentum in Q4 (Source: U.S. Department of Commerce, 28 February 2019). The Department of Commerce in Washington announced on Thursday that annualised US economic growth fell to 2.6 per cent between October and December, from 4.1 per cent in Q2. The OECD’s calculation method, which compares a quarterly result with that of the previous year, yielded 3.0 per cent growth in Q3, compared with 2.9 per cent in Q2.

Chinese economy extremely weak

However, according to official data, Chinese economic growth has suffered an even more serious setback, falling to 6.4 per cent in Q4 – this is the lowest rate in 28 years, never mind the 2008 financial crisis (Source: National Bureau of Statistics of China, 21 January 2019).

The extent to which the world’s two largest economies would suffer as a result of a more intense trade war is one of the subjects of a recent study by Munich-based Ifo Institute (Source: „Trump’s trade attack on China – who laughs last?“, EconPol Policy Brief 13, February 2019). In the study, conducted as part of the EconPol Europe research network, Gabriel Felbermayr and Marina Steininger investigated the impact, the two superpowers’ threats of a 25 per cent surcharge on all goods would have: “China would lose much more than the USA in absolute and relative terms,” the Ifo researchers conclude. US economic output would fall by 9.5 billion euros, China’s by as much as 30.4 billion euros.

Even without new tariffs the US Congressional Budget Office (CBO) foresees a definite negative impact: on average, the GDP will be 0.1 per cent lower over the next ten years if tariffs remain at the current level, according to a CBO report published at the end of January (Source: „The Budget and Economic Outlook: 2019 to 2029“, 28 January 2019).

Customs dispute causing an emotional roller coaster ride

Just how fervently market players are hoping for a resolution of the dispute was evidenced by the reactions of the stock markets to Trump’s confident news last Monday. The Shanghai Composite, the leading index for the Chinese mainland stock exchange, jumped a whopping 5.60 per cent after Trumps tweet. Wall Street, reacting likewise to the relaxation between the US and China, closed with some satisfying consolidation.

However, hopes did not last even a week: On the day the first estimate of US GDP growth in Q4 2018 was published, Trump left Hanoi early and without reaching the much anticipated agreement in the disarmament negotiations with North Korean ruler Kim Jong-un. Still in Vietnam, The US President put a damper on hopes of an end to new punitive tariffs by announcing that he would also break off the negotiations with China.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.