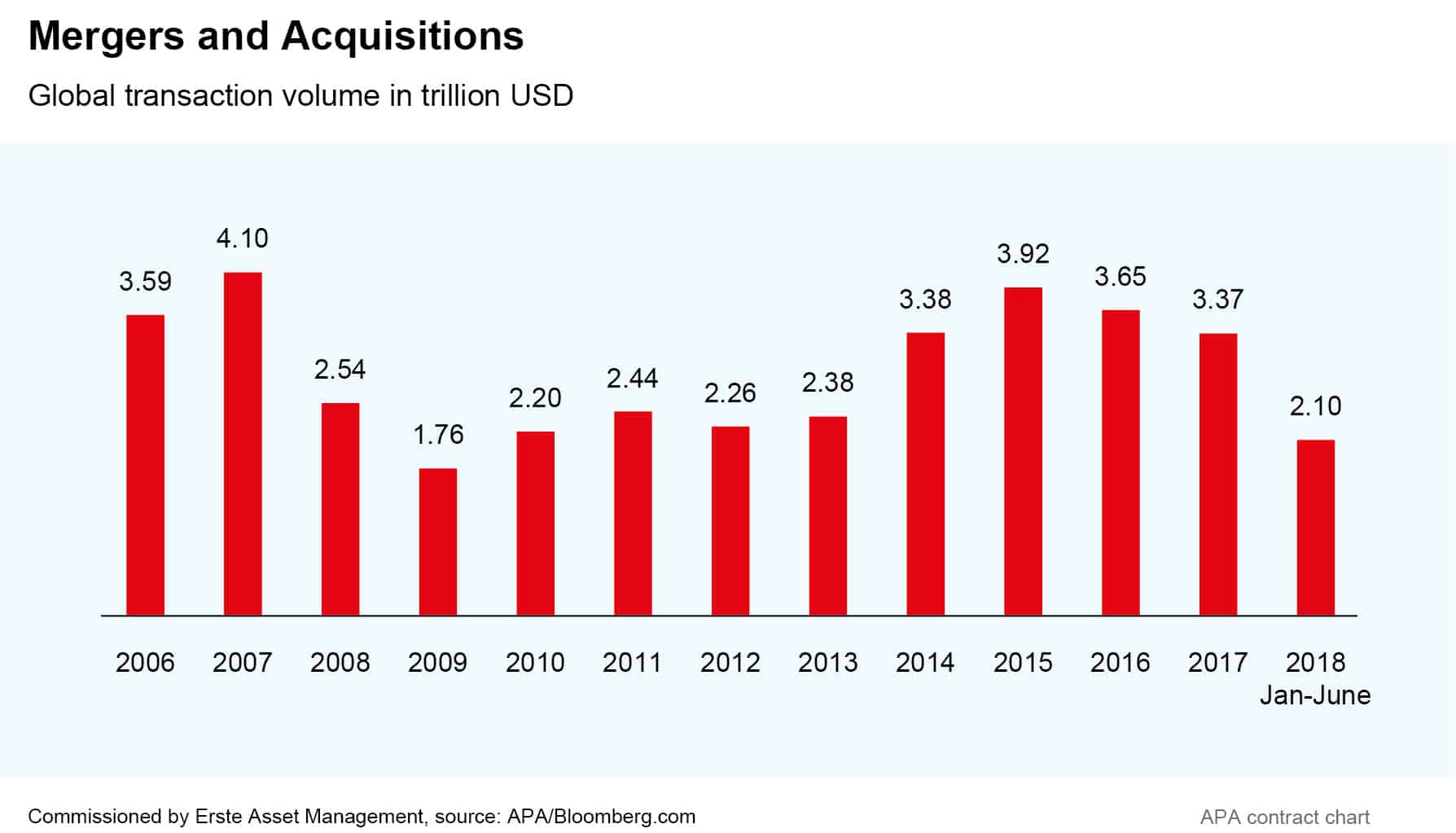

2018 could be a record year for mergers, at least if the exceptional first half of the year is any indicator. According to data from the Bloomberg news agency, the transaction volume of announced mergers and acquisitions in the first half of the year amounted to USD2.1tn, a year-on-year increase of around 36 per cent. In 24 deals, the transaction volume exceeded the USD10bn mark. Projected over the year as a whole, this figure could exceed the previous record of USD4.1tn set in 2007.

According to experts, the main drivers of this development were the US tax reform, high stock valuations and robust global economic growth. This year, the largest mergers have so far been announced in the health care and media industries. Japanese pharmaceutical company Takeda announced the purchase of the Irish pharmaceutical manufacturer Shire for USD62bn. In addition, health insurer Cigna offered USD54bn for a takeover of service provider Express Scripts.

Meanwhile in the media and telecommunications industry, T-Mobile US and their competitor Sprint drew attention with a USD26bn merger deal. In addition, the US cable tv giant Comcast and the media group 21st Century Fox are currently competing for the British broadcasting group Sky. With 34 billion dollars, the highest offer here has so far come from Comcast.

Analysts eyeing merger activity with caution

However, the current bout of mergers could soon come to an end. With an annual transaction volume of more than USD2.5tn, the past few years have gone well, according to the Bloomberg calculations. However, it is this development that makes analysts sceptical as to whether and for how long this pace can be maintained.

The experts cite geopolitical risks such as the trade war between the USA and China as potential obstacles. In addition, key interest rates in the USA are continuing to rise, and there are concerns about a weakening economy and increasing regulatory uncertainties. In March, for instance, US President Donald Trump prohibited the takeover of the 140-billion-dollar Qualcomm chip group by a Singapore competitor Broadcom. The reason given was that the deal could compromise the US national security. However, the regulatory risks were somewhat mitigated by the US ruling in June that approved the USD85bn purchase of Time-Warner by AT&T despite criticism from the US government.

History also shows that very strong mergers and acquisitions activity does not necessarily have to be a positive sign. The last two times the transaction volume reached similar levels, market specialists noted, saw the dot-com bubble burst of 2001 and the financial crisis of 2007 in the following year respectively.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.