The previous week saw oil prices climb to their highest levels in four months, with a number of factors contributing to this rise: For one, the US Department of Energy reported a surprising decline in crude oil inventory in the US in the middle of the week. While an inventory of three million additional barrels had been expected, a decline of 3.9 million to 449.1 million barrels was reported.

Furthermore, the massive power outage in Venezuela severely impaired the export of crude oil, according to analysts. Meanwhile, Saudi Arabian Energy Minister Khalid al-Falih expressed his satisfaction with the current situation on the oil market to the news agency Reuters, adding to the unplanned supply shortfalls Saudi Arabia’s announcement to continue producing less oil than the Organization of Petroleum Exporting Countries (OPEC) had actually agreed with other major producers as part of its production cuts.

Saudi Arabia sets the tone

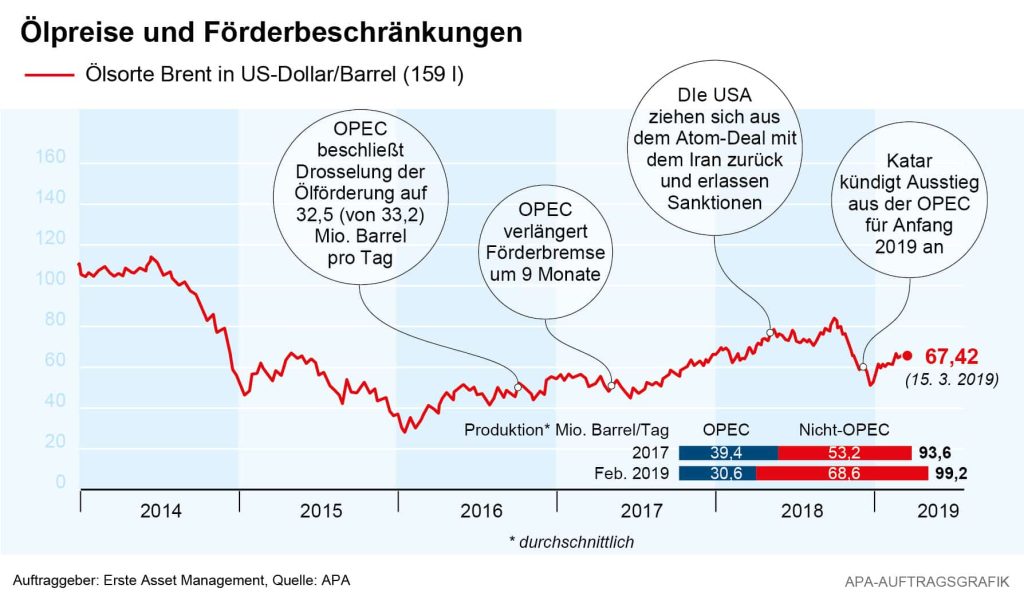

Saudi Arabia, the world’s largest oil producer, is considered the strongest voice in the OPEC. A change in production policy therefore seems unlikely at the next meeting of the OPEC+, the extended group of major producing countries, on 17 and 18 April. Around the turn of the year, the OPEC+’s measures to support oil prices were impacted by Qatar’s withdrawal from the oil cartel; however, they subsequently regained their effectiveness.

The latest OPEC monthly report shows how production cuts have impacted the oil market, estimating global oil production at 99.15 million barrels per day. With the OPEC states contributing 30.55 million barrels a day, this means a slightly reduced share of total production.

No trend reversal in sight

In 2017, the first full year of the agreed production cuts, daily production totalled 92.6 million barrels, with 39.4 million barrels produced by OPEC countries. World production has therefore increased slightly, while the most important countries have significantly reduced their contributions. OPEC expects a global oil consumption rate of around 100 million barrels per day for 2019, indicating slightly lower growth for 2019, as was already the case in the previous year. The reason for this is the weak economy in Europe and North America, among others. The overall picture, however, remains unchanged according to the new monthly report.

US increase oil production

However, the International Energy Agency (IEA) also published its “Oil 2019” report in the previous week, in which the agency warns of the consequences of increased US oil exports. This would change the international crude oil trade flows and profoundly impact geopolitics, said IEA Director Fatih Birol. In the next five years, the USA will increase its oil exports strongly due to shale oil production, exceed the volume of Russian exports and reach Saudi Arabia’s export level. According to the IEA, the United States could be responsible for 70 per cent of the global increase in oil production over the next five years.

With this outlook, a timely end to the struggle over oil prices remains unlikely: while Saudi Arabia and OPEC are determined to keep oil supplies lower, massive increases in exports of US shale oil are expected – which were one of the main reasons for the price drop in recent years to begin with.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.