Heads of state, high-ranking economic experts and business leaders came together at the World Economic Forum’s annual meeting in Davos, Switzerland, to exchange views and opinions. Amid concerns about the Chinese-US trade war, Brexit and a looming economic downturn, this year’s WEF meeting saw numerous calls for increased international cooperation.

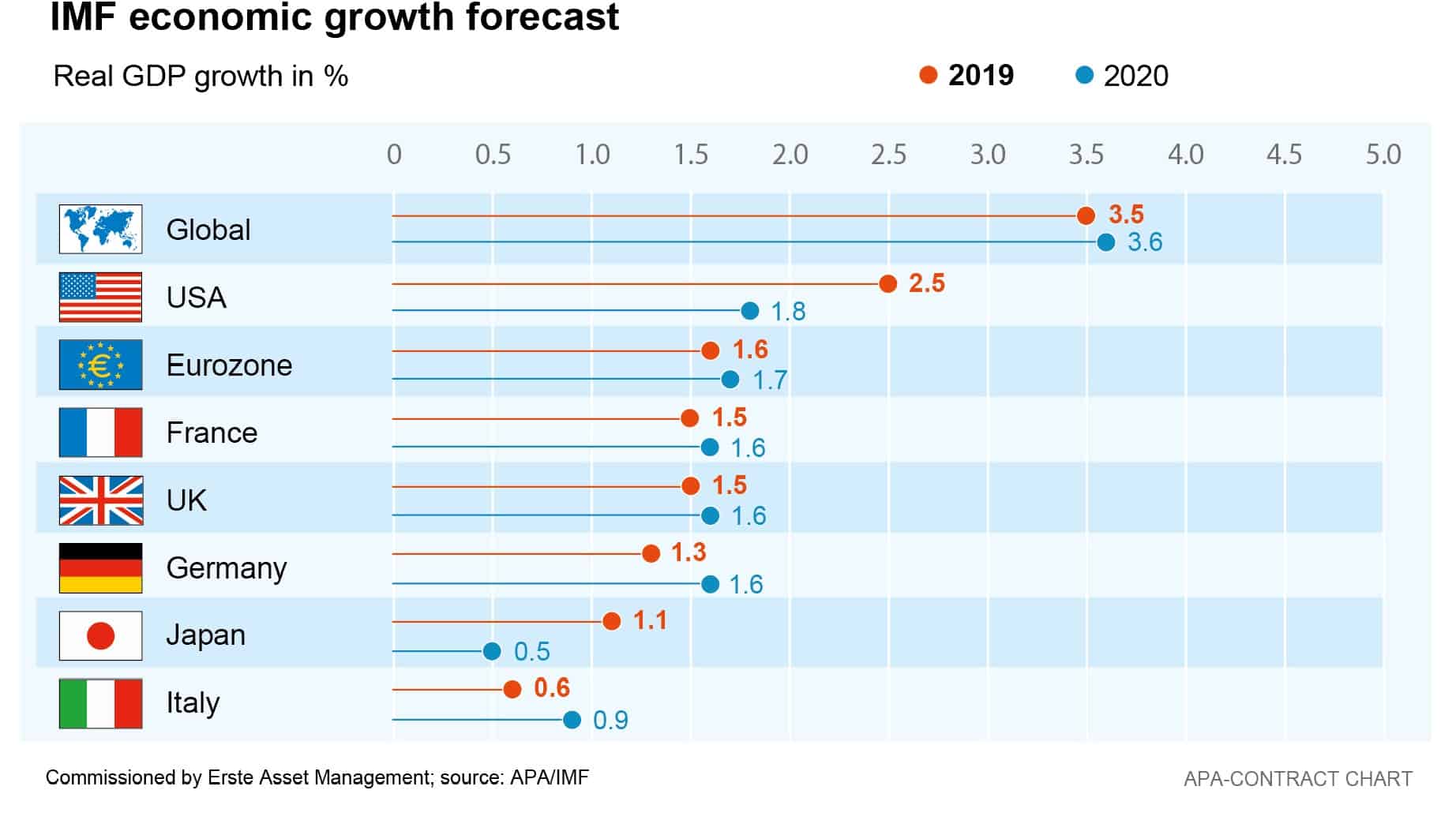

The International Monetary Fund (IMF) opened the meeting prominently, warning in its “World Economic Outlook” about an impending downturn of the world economy. Against the background of the trade dispute and other uncertainties, the outlook for the global economy has dimmed somewhat, the current IMF forecast finds. The global GDP growth estimate has been reduced to 3.5 per cent this year and 3.6 percent for 2020, where the forecasts still lay at 3.7 per cent respectively in October.

“A global recession is certainly not yet imminent,” said IMF Managing Director Christine Lagarde at the report’s presentation in Davos. “But the risk of a stronger decline in global growth has certainly increased.”

“The slowdown seems to be coming sooner than expected,” IMF Deputy Managing Director David Lipton told Reuters TV. While the economy is still doing well, there are numerous risks, ranging from trade disputes to poorer financing conditions, Lipton said.

Merkel bangs the drum for multilateral cooperation

Against this background, several heads of state called for increased international cooperation and a renunciation of protectionism in Davos. Germany’s Chancellor Angela Merkel called for further free trade agreements, explaining that she is seeking allies for multilateralism: “Anything else would lead to misery,” Merkel emphasised, adding that she would like to see a reform of the major international organisations to reflect the massively increased influence of economies such as China or India.

Japan, which currently heads the group of the 20 largest industrialised and emerging countries (G-20), also spoke out in favour of strengthening the multilateral order. “Japan is determined to maintain and develop free, open and rule-based international order,” Prime Minister Shinzo Abe declared at the WEF.

Without naming the US, Abe called for confidence in the international trade regime to be restored. The World Trade Organization (WTO) has an important role to play as the guardian of free trade. However, US President Donald Trump, seeing his country badly treated by the WTO, went as far as to threaten the US’s resignation.

China’s Vice President Wang Qishan sees international trade regime seriously endangered, criticising that many countries were looking inwards more and more, putting a damper on international trade and investment, while unilateralism, protectionism and populism are increasing. Wang described economic globalisation as an “inevitable trend”. Wang emphasised the enormous potential utilizable, if the individual countries’ competitive advantages were exploited and economic ties strengthened. In response to the challenges facing the world, he declared that countries must take this course of action jointly and actively.

Wang made no mention of the ongoing trade war with the USA in his speech. A scheduled meeting in Davos to discuss the trade conflict with US President Trump was not held due to Trump’s cancellation at short notice. However, Trump’s was not the only prominent cancellation: France’s President Emmanuel Macron and UK Prime Minister Theresa May also did not attend the WEF this year due to domestic political problems. Austria was represented by Federal Chancellor Sebastian Kurz and Foreign Minister Karin Kneissl.

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.