The trade war, a cooling world economy, and growing uncertainties in the domestic market – the problems faced by the Chinese economy seem to be mounting.

The typical image of the Chinese dragon depicts a massive, wingless, bulk-headed reptile only distinguishable from a snake by its four clumpy legs. Comparing the Chinese economy to this fabled creature, I propose the four legs keeping the entire creature aloft to be consumption, export, infrastructure and debt. At the moment three of the four legs appear very shaky.

Big City Retail Blues

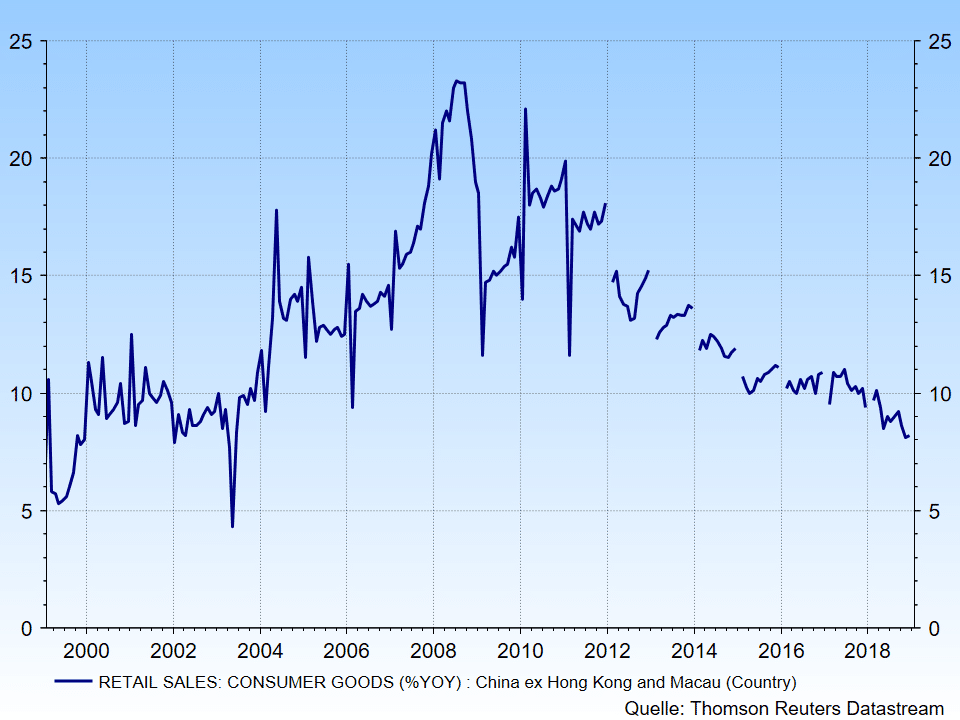

While domestic consumption is growing steadily, YoY growth rates in city retail sales where most of the high value added goods are consumed has been on a steady decline since 2010. Since 2015 YoY growth appeared stable, which led analyst to believe sales might surge once more. The trade dispute of 2018 brought in its wake weakened consumer confidence and an end to these hopes. A further slowing in growth is now the most likely scenario.

A Pyrrhic U.S. Trade War Victory?

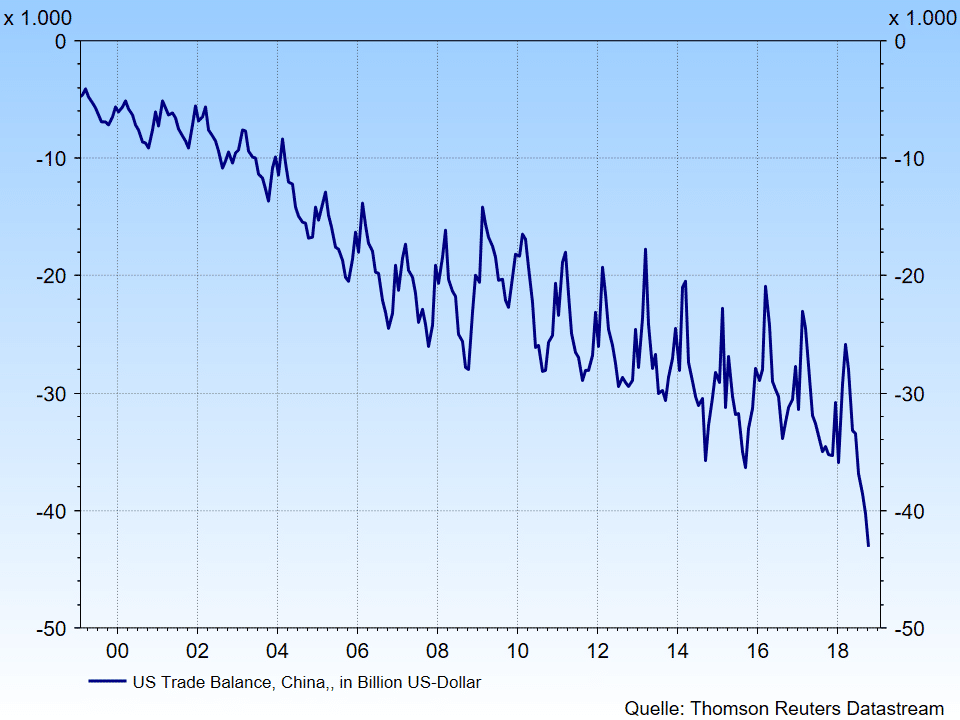

The U.S. – China trade dispute was the dominating issue of 2018 even though knock-on impacts are only beginning to manifest. In December 2018, the Chinese trade surplus with the U.S. surged to new records. While there are contradicting explanations for this exceptionally high number, one thing is for certain, Donald Trump and the trade hawks in his administration will take notice. A trade deal grows more elusive and the dispute will continue to weigh down on growth.

The U.S. – China trade dispute was the dominating issue of 2018 even though knock-on impacts are only beginning to manifest. In December 2018, the Chinese trade surplus with the U.S. surged to new records. While there are contradicting explanations for this exceptionally high number, one thing is for certain, Donald Trump and the trade hawks in his administration will take notice. A trade deal grows more elusive and the dispute will continue to weigh down on growth.

No More Bridges To Build

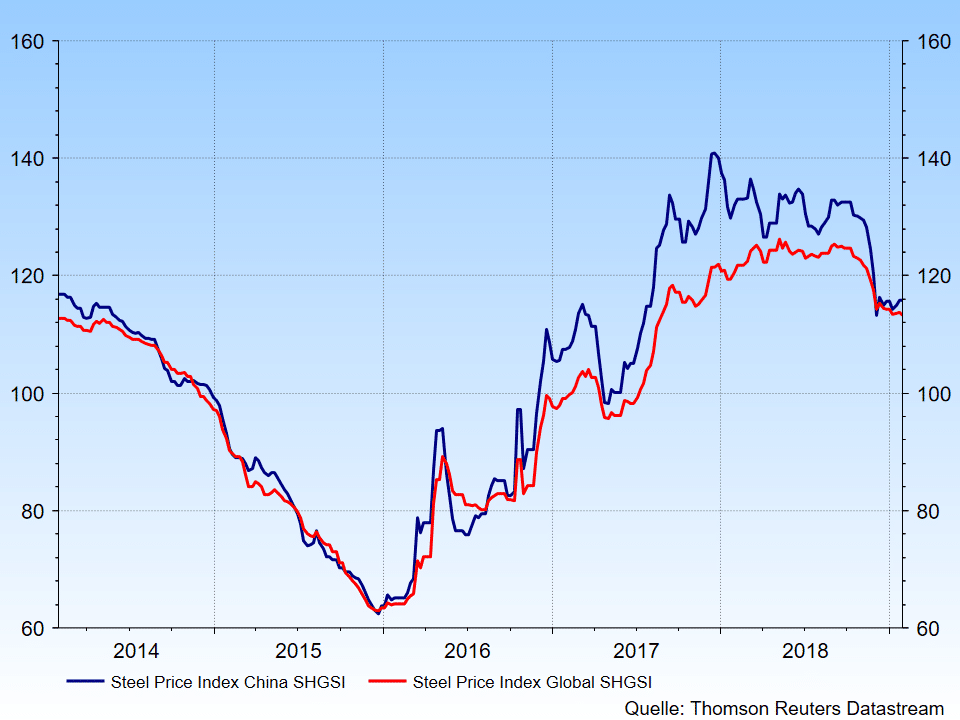

If consumption is the life blood of the Chinese economy then infrastructure is the backbone. It keeps SOEs afloat and sets the stage for future growth. It primarily depends on two commodities: concrete and steel. After a stellar rally since 2015, steel prices have fallen in 2018 (left chart), signaling a drying up of the infrastructure pipeline. While the latest infrastructure spending spree was poised to end at some point, the sharp inclination in steel prices was a surprise and might herald rocky waters ahead.

Three Down, One To Go?

With three wobbly legs the dragon economy now leans on its fourth leg, debt, on which the Chinese government certainly exerts a great degree of influence through the obedient BOC. While debt levels are high already, I believe there is still some room to maneuver before debt levels become worrisome. In conclusion, China finds itself beleaguered by problems, over some of which it has little control. China certainly has found out the hard way what it means to challenge the U.S. economic hegemony and suffered not only national humiliation through the slippery thumbs of a twitter-president, but was also forced to take look in the mirror and acknowledge home-brew problems that were ignored for too long. Whether this will usher in a recession in China (i.e. a period of 5% or lower growth) or simply a period of medium growth is not decided yet, but I put a higher probability on the latter scenario. The Chinese dragon can well enough slither along on one leg alone rather than disappear in a ball of flames.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.