All articles on the topic “Financial Know How”

Stable coins: a new megatrend?

Stable coins are currently a hot topic in the crypto and finance industry. But what is behind this special form of cryptocurrency and why are stable coins relevant?

Back to the Basics: Understanding High Yield Bonds

What distinguishes high-yield bonds and how do they differ from other bonds? We explain this in today’s blog post. You will also learn which funds investors can use to invest specifically in companies in the high-yield segment.

The four seasons: when should I buy equities, Bitcoin, or gold?

Just as in nature, there are different seasons in the economy. This also has an influence on the stock markets – depending on the season, different asset classes such as equities, gold or bonds make sense. The good news for investors is that you don’t necessarily have to worry about the seasons; you can simply leave it to the experts.

Investment strategy: Turning points

The good performance of equities has suffered a small setback since the end of March. Such turning points are difficult to predict on the markets – and yet there are a few approaches and indicators that can provide clues.

What is the key interest rate?

Ahead of the ECB’s upcoming interest rate decision, there is much discussion about the central banks’ interest rate policy and the key interest rate – will it be lowered or not? Its development has a significant influence on the economy and the financial markets. In this article, we discuss the role of the key interest rate and which interest rates are relevant.

🍋 Dividend basics for shareholders

An increasing number of investors, when selecting shares, do not only focus on share price performance, but also on a stable, high dividend – for good reason.

Phillips curve: Is there a risk of structurally higher inflation?

Inflation rose sharply in 2021 due to several supply shocks. Although there is a clear downward trend. However, the supply shocks could also have a structural effect on inflation. A look at the Phillips curve model can shed light on this.

Best of Charts: News from the inflation

Even though inflation has weakened recently, it remains an important topic for private individuals as well as for companies and the markets. What might happen next in terms of inflation and how long will the restrictive monetary policy stay with us? A look at some important financial charts will shed some light on this.

Bond investments – via yield and spread

How do I choose corporate bonds for my investment? In the current blog article, our expert Johann Griener gives an insight into the currently achievable yields of different credit rating segments. He also explains the spread that can be achieved with corporate bonds.

Compound interest – how to make interest work for you

Interest ensures that the money in the savings account or invested in securities grows. If you have already saved or invested some money, you will receive interest on the interest again. This is compound interest. Compound interest makes your money grow even faster, especially if you don’t touch the money for years and interest rates are high.

Investing in the bond market – the charm of short maturities

When should one invest one’s capital in the bond market and which maturity would currently be favourable? These questions are not so easy to answer and depend, among other things, on the preferences of the respective investor. In our recent blog, expert Johann Griener gives an insight into the current market environment and clarifies the most important questions about bonds and maturity.

Germany slides into technical recession: What does that mean?

The German economy slipped into a technical recession in the first quarter. What does this mean for the largest economy in the euro zone and what is a technical recession?

Damage makes wise – Herd panic and the lessons learned

Last weekend, for the third time in two months, a US bank found itself in turmoil. After Signature Bank and Silicon Valley Bank (SVB) slid into crisis in March after customers withdrew billions in funds, First Republic Bank has now been hit. A look at the history books shows that banking crises and bank runs have happened time and again. However, the lessons learned from them helped to make the banking system more robust and stable.

Funds in focus: World Fund Day 2023

On 19 April, the Austrian financial sector once again focuses on funds. And for good reason: funds provide easy access to the investment markets and are suitable for retirement provision and investment.

Inflation: How to protect your savings

Inflation continues to make life more expensive and does not stop at the savings of Austrians. More about the future outlook and possible protection strategies.

Why women should start investing

The financial reality of Austrian women still does not look rosy in 2023. However, as a recent study shows, more and more women have a desire for financial independence. Women are increasingly aware of their financial circumstances and want to actively do something about them.

An extraordinary year for alternative investments

The year 2022 was a challenging one on the stock markets. However, compared to the asset classes equities and bonds, alternative investments clearly outperformed. Read more in the blog post by senior fund manager Christian Süttinger.

5 tips for building capital with investment funds

For many investors, a fund savings plan is a useful way to build up capital over the long term. To make sure this works, our expert Johann Griener has 5 useful tips for getting over difficult market times.

Decision to invest taken – what happens next?

As an investor, you will come across several parties or institutions in the fund selection and securities account opening process.

Understanding fund risks – nothing ventured, nothing gained

In this blog we analyse the different types of risk that one should be aware of before investing in a fund. We show which considerations should be made regarding the time of entry and the investment period.

How to invest in corporate bond funds

Yields on corporate bonds in both the investment grade and high-yield segments have risen significantly in recent months. This means that there are currently interesting entry levels again.

Our expert Johann Griener explains in his blogpost how to take advantage of this opportunity with a corporate bond fund.

What types of funds are there?

Actively managed funds and ETFs – what is the difference? Behind an actively managed fund there are always fund managers who influence the composition of the fund and actively look after the weighting of individual securities. Actively managed funds can therefore react to different market phases and are realigned by the fund managers if necessary. […]

How can I invest my money wisely?

There are many reasons to make income-oriented provisions – be it to provide for retirement or maternity leave, to save for larger investments or to finance the education of children or grandchildren.

How a bond fund “works”

Interest rates are back, which means that investing in bonds and bond funds again offers opportunities for attractive returns. Our expert Johann Griener explains how a bond fund works and what you should bear in mind when investing.

Interest rates are back

After many years of low interest rates, the tide has turned in recent months. This is also creating some opportunities on the bond market again, as our expert Johann Griener explains in his article.

Best of Charts

Consumer prices, interest rates, purchasing managers’ sentiment, bond yields, stock market prices, corporate profits, commodities – all these influence the financial markets. We provide an overview of the most important charts that fund managers pay attention to.

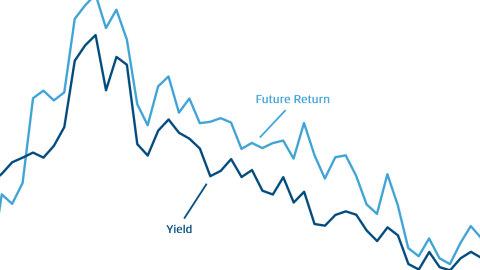

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

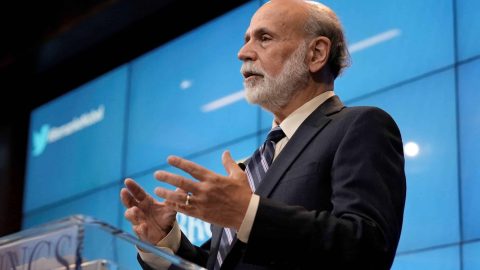

From crisis manager to Nobel laureate

This year’s Nobel Prize in Economics will be awarded to three US economists for their research on banking and financial crises. Among them is Ben Bernanke, who was chair of the US Federal Reserve when the financial crisis hit in 2008 and the global economy was teetering precariously close to the brink for weeks.

What happens to equities when interest rates rise?

So far, the year 2022 has brought significant price losses on the stock markets. Inflation and rising interest rates are often cited as the reason. But why is that the case?

Austria goes green

The first green bond of the Republic of Austria was issued on 24 May 2022 and is meeting with high demand. The majority of the proceeds will go towards clean and sustainable transport, e.g. the expansion of the railway network. In which other areas will the Green Bond invest?

Inflation at its peak – what are the reasons?

At 5.2% y/y, consumer price inflation for the OECD region reached the highest value in October since 1997. Has inflation peaked, or are we at the outset of a sustained period of high inflation?

Stagflation – a serious risk scenario

In recent months, the risk of stagflation (the simultaneous occurrence of economic stagnation and inflation) has increased. Without the pandemic, output would be higher and inflation lower: bottlenecks in production and logistics have slowed economic activity and caused prices in the goods sector to rise sharply.

Big Big Data

When it comes to series streaming, online shopping and sports, data accompanies us through our daily lives. Even in the economy, forecasts are made on the basis of data analysis. How does Big Data create opportunities for the future??

Financial Markets: robo investment vs. human judgment

It is impossible not to notice the rising interest in algorithm-based investing. Fund manager Mikuláš Splítek argues the case of whether a robo-advisor or human judgment is better to beat the market.

Has gold lost its shimmer?

After a strong increase in the last 5 years, the gold price has weakened recently. Will demand for the precious metal increase again?

Hedge fund Archegos Capital’s default causing a big stir

Hedge funds have often been talked about in the past because a failure of their sometimes risky investment strategies can trigger chain reactions in the financial industry and the markets, as was the case recently with Archegos Capital. But hedge funds often take on an important role with their alternative investment strategies. Read more on our blog.

What does the term “SPAC” mean?

A differently designed path to the stock exchange has gained in importance since 2020. The term for this is SPAC (“Special Purpose Acquisition Company”). What’s behind it?

Tokens and coins: how cryptocurrencies differ from each other

According to industry sources, all of the Cryptocurrencies combined recently hit the $ 1,000Billion. Our Senior Research Analyst Harald Egger goes into the individual coins and tokens that are currently in circulation.

A Black Mink Event – COVID-20

In the USA the fight for the White House is still raging. Meanwhile, in Copenhagen, 9,000 kilometers away, Danish Prime Minister Mette Frederiksen declared that all minks in the country would be killed to contain the spread of a new SARS CoV-2 variant. What is a Black Min Event?

How to invest in the world of Industry 4.0

There is no question that new technologies will play a crucial role in everyday life. Understanding the trend and taking a reasonable action from investment point of view requires to have specific knowledge and setup specific metrics.

SERIES: The next 10 years – longterm outlook

You need a mixture of history, economics and politics to hear through the everyday noise and recognize the big trends of the future. In our new series, Erste AM’s investment team identifies those factors that will determine the next 10 years.

Navigating the corona crisis with s Fund Savings Plan – opportunity or risk?

Price declines on the investment markets! Is total loss pre-programmed or do crises perhaps also offer opportunities?

The 6-point guide shows what you can do in a crisis with the s Fund Savings Plan.

What is helicopter money?

While traditional monetary policy measures are also employed, the focus has recently shifted to a concept that has always been the subject of debate: helicopter money.

Coronavirus: The economic effects of epidemics and pandemics

What are the economic effects of an epidemic or pandemic? Our Experts went through relevant studies in order to be able to give a well-founded assessment. The results are surprising.

First virtual chart analyst – bot learns to “look at” charts

The intuition of an experienced chart analyst contributes significantly to a correct forecast. With the help of around one million charts of shares, Erste AM trained the world’s first virtual chart analyst.

Equities and funds are gaining popularity

Flexibility and security are still the priorities of Austrian households in investing. However, higher yielding investment forms are becoming increasingly popular.

USA: Inverse yield curve fuels fear of recession

In the US bond market, the yield on two-year government bonds had risen above the yield on ten-year bonds, creating the rare situation of an inverse yield curve. This was last the case in 2007.

Investment horizon – phrase or mathematics?

Under the search term “investment horizon” there are numerous definitions on the internet. What does the term “investment horizon” actually mean? In our blog post we give an overview of the most important features of the investment horizon.

Transformation process in China

China accounts for just under 16% of world gross domestic product, making it the second largest economy in the world. Can this success story be continued – what speaks for and what against it?

Ethical, environmentally conducive, lucrative: what is sustainable investment?

I have my ethics and morals: more and more people want to invest their capital ecologically and ethically. What is sustainable investment and how does it work?