Investors are already familiar with stocks. Equity funds and mixed funds in particular offer the opportunity to invest in a large number of companies in an efficient manner. The stock market career of companies usuaally begins with the initial public offering (the IPO, “Initial Public Offering”). At this point in time, the business model of a company has already proven itself and reached a critical size. Being traded on an exchange now is the next step in opening up to all investors.

A new way of approaching investors

A differently structured route to the stock exchange has gained in importance since 2020. The term for this is SPAC (“Special Purpose Acquisition Company”). What is behind it? A SPAC is a stock corporation that approaches investors not to offer them an existing business model as a first step. Rather: The capital that comes in during the IPO is only invested in one or more promising companies afterwards. A SPAC is thus initially a mandate to select companies for the investors’ capital.

Even if that sounds paradoxical for a moment, this situation creates advantages for those involved. Investors already have the opportunity to invest in IPOs, even if there are currently none. At the time of an IPO, a company’s shares are often favorably priced to generate interest. Buying shares in a SPAC gives you the opportunity to be part of an IPO in the future without having to find a suitable candidate yourself. On the part of the companies that work with a SPAC, this is one way of going public more cheaply and quickly.

The greatest added value lies in the team of the SPAC itself. You’ll find specialists for all topics that have to do with the capital market. But also industry experts who can specifically approach companies that have not yet considered a regular IPO, although their business model might justify it. Subsequently, the SPAC team also advises the candidate on which measures are helpful. These can also be tips on business strategy.

Even if this concept seems more suitable for institutional investors, SPACs are also an issue for small investors, especially in the USA.

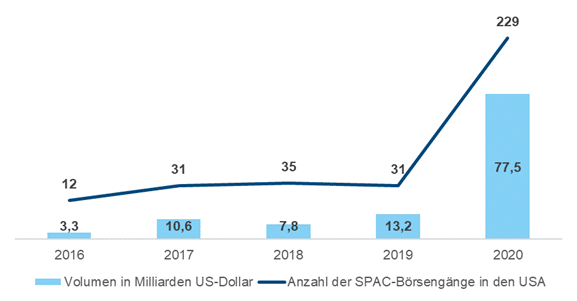

Graphic: Size of the SPAC market in the US

Source: Bloomberg, EAM

The exact process

A SPAC is founded as a stock corporation and goes public. Interested investors buy shares, their capital is transferred to an escrow account. From this point on, the SPAC team has the task of finding one or more companies in which added value can be created through an IPO and who benefit from the cooperation with the experienced experts of the SPAC. Once a goal has been set, all shareholders vote on whether it is a suitable choice or reject it. If the approval has been given, the acquired company merges and the SPAC, which at this point has fulfilled its mandate and ends. The deadline for finding the takeover candidate is typically 2 years and can also expire without success. In this case, the SPAC ends and the money paid is returned.

The share price of SPACs that have not yet found a takeover target still has a fluctuation range that is similar to the general stock market. Or even above, because this topic always inspires the imagination of investors.

SPACs for specialists

SPACs that are already traded on a stock exchange can be distinguished according to whether they are looking for a candidate (“without deals”), or have already found one (“deal announced”), and whether they are multiple targets (“diversified”). There are currently over 500 SPACs worldwide, and about 25% have already named a takeover candidate. The stock prices of SPACs have had an extremely successful 2020. After an equally successful start, the segment has been going through a severe price slump since the beginning of March 2021.

In connection with SPACs, one often thinks of the “private equity” sector. The takeover candidates of SPACs are initially “private”, to be later taken public by merging with the SPAC, and go “public”. Private equity, for its part, invests in non-listed companies, using a fund. One aspect here is also that the private equity team should add value to the company. Occasionally, the cooperation of companies with private equity funds results in an IPO. In a way, SPACs are a transitional stage from the “private” and the “public” world of the capital market.

The discussion about SPACs is sometimes controversial. One possible criticism arises from the fact that, especially for small investors, the costs incurred at the various stages of a SPAC are not made sufficiently transparent.

A recent example

Grab (www.grab.com) is an Asian delivery service for food and consumer durables, as well as a courier service. The company is weighing using an existing SPAC for a quick IPO that could be worth $40 billion. (Source: The Wall Street Journal)

Conclusion

The opportunity to participate in the IPO of interesting companies in, for example, the technology or health care sectors that might not otherwise go public, or for which investors might not be involved from the beginning, has sparked interest in SPACs. SPACs are public companies that offer their shares in exchange for a mandate to acquire a stake in one or more companies that are now still entrepreneur-led, and thus go public.

Legal note:

Prognoses are no reliable indicator for future performance.