Investing in the bond market means

- to invest one’s capital in an issuer and to trust that the promised interest (or “coupon”) payments and repayment (redemption) will be executed timely and in full, and

- to look at the issuer’s rating, i.e. the ability and willingness of the debtor to pay.

The promised interest (coupon) payments should never be the sole reason for an investment. More important than the achievable interest is the certainty of full repayment at the end of maturity. In this article we take a look at the currently achievable yields of different credit rating segments and at the spread, the interest premium that can be achieved with corporate bonds.

Corporate bonds offer a spread on government bonds

For many private investors, corporate bonds are more popular than government bonds because they offer an interest rate premium (spread) compared to government bonds with the same remaining time to maturity. But how high is this spread, and what bonds should be used as a reference?

Before investing in the interest rate market, it is important to know that no issuer voluntarily pays more interest than they have to. A (credit-) safe government bond with a comparable maturity can be used as a point of reference and basis. A higher interest rate than this should cover the risks of the respective issuer. Usually, the risk of default is rated by investors as the risk with the highest priority.

Rating agencies are concerned with assessing this risk. They analyse the issuer and then assign a credit rating to a bond. This rating usually comes in the form of letters, with “AAA” (triple A) being the best possible rating. Lower ratings thus have a higher default risk associated with them, which should be compensated for by a correspondingly higher yield.

The yields of Eurozone companies by rating class

Let us first take a look at the yields of corporate bonds of different credit rating segments. Since there are many different companies, we use indices that represent a wide range of remaining time to maturity for the respective segment.

Please note: this chart illustrates indices, no direct investment is possible. Past performance is not indicative of the future development of financial instruments.

At first glance, we can see a lot of lines. By looking at the chart from bottom to top, we can see the following:

- The yield of the German Bund (i.e. the German government bond; shown as an area) is the lowest in the comparison, because it represents the best credit rating.

- AAA euro corporate bonds (BOFA index) currently offer approximately 1% more yield than the German Bund

- The further up we go (chart BOFA indices up to “BBB”), the higher the yield.

The chart also shows that yields change over time, but lower credit rating classes usually have to offer higher yields, as investors demand risk compensation.

The spread as compensation for risk

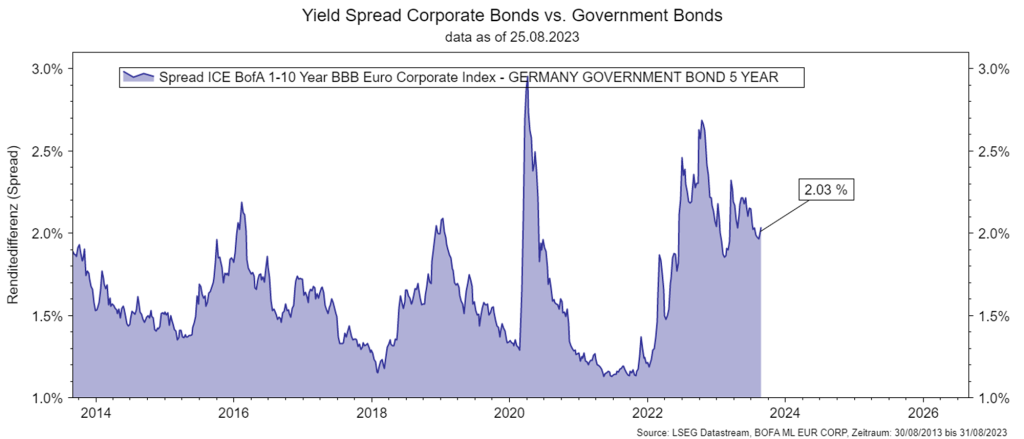

We have seen in the upper chart that nominal yields fluctuate over time. In a second step, we are interested in the risk premium (spread), because this indicates the surplus return we expect from a riskier investment. Here, we have selected the BBB credit rating segment from the example above.

From the chart above we can easily calculate the current spread ourselves (data from indices):

| + BBB yield BBB | 4.63 % |

| – 5Y yield German Bund | 2,59 % |

| Spread: | 2.04 % |

However, bond investors should not only be interested in the current but also the historical spread. After all, how else should one assess whether the time to buy is currently right?

Please note: this chart illustrates indices, no direct investment is possible. Past performance is not indicative of the future development of financial instruments.

In the chart we can see that the spread is subject to fluctuations over time, but currently tends to be in the upper range. These are the calculations from an index that covers a wide range of different bonds from the same credit segment and provides a rough orientation for investors. The data for individual bonds may accordingly differ due to their structure (e.g. issuer, country, maturity, etc.).

Conclusion: bond investments require more know-how than just knowledge of the coupon payments

In this article we wanted to give some background for the selection of corporate bonds. We have shown that yields and spreads change over time. But credit ratings can change over time as well. Downgrades or upgrades can occur. This in turn has a direct impact on the yield of the corresponding bond.

For private investors, the selection and assessment of individual bonds is not a simple matter, because:

- The interest rate markets are constantly in motion and yields can change very quickly, for example due to economic influences.

- For all individual bonds, but especially for longer maturities, there are many variables for private investors to consider. This could be one of the reasons why private investors often prefer corporate bond issues with relatively short maturities.

- Those who are not confident in selecting individual bonds can invest in bond funds (also referred to as fixed income funds), where professionals assess the individual securities and combine them in a broadly diversified fund.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note: an investment in securities also entails risks in addition to the opportunities described.

For further information on “Investing in bonds with short maturitie”, please visit the blog

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.