Latest Posts

Demand in the oil market will not lose momentum until 2030

Against the background of the initial public offering of Saudi Aramco, the international energy agency predicts a robust demand for oil by 2025. Thereafter demand-dynamics will decline sharply due to increase in energy-efficient vehicles.

Artificial Intelligence as investment in the future

Artificial intelligence opens up new opportunities to invest. Which developments and companies are most interesting? And how is the best way to do it?

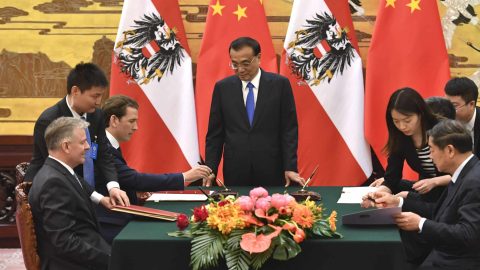

A recovering global economy?

The recovery of the world economy has become more likely: First AM chief economist Gerhard Winzer gives an outlook on whether the trend reversal is done.

FT Nordic Investor Outlook – Agile Investment in Uncertain Markets

The FT Nordic Investor Outlook 2019 was dedicated to the topic „Agile Investment in Uncertain Markets“. High caliber speakers were discussing China, ESG and Brexit.

Equities and funds are gaining popularity

Flexibility and security are still the priorities of Austrian households in investing. However, higher yielding investment forms are becoming increasingly popular.

Turkish economy caught between recovery and conflicts

The Turkish invasion in northern Syria and the conflict surrounding it with the USA put the lira under renewed pressure, raising concerns about the Turkish economy’s recovery.

Changes in mobility

Whereas in previous decades the development in the car industry had almost come to a halt, we have seen momentum picking up in recent years in the development of alternative forms of propulsion in this sector. E-car technology should prevail in the long run – our research partners agree on that. For other technologies such […]

Changes to the investment universe, September 2019 – November 2019

Admitted PowerCell Sweden AB (sector: Electrical Components & Equipment), EAM ESG rating 09/2019 of C; admitted into the investment universe of ERSTE WWF STOCK ENVIRONMENT in September 2019. The company was created as a spin-out from Volvo Group in 2008. PowerCell Sweden AB develops and produces modular and scalable fuel cell stacks and systems. Development […]

Do you feel guilty about driving a car?

Do you feel guilty about driving a car? – What’s this question all about? Whereas the term flygskam (flight shame) has become popular outside of Sweden in recent years, there are far fewer people who feel they need to justify driving a car. It has become routine for booking websites to offer compensation options for […]

Automotive Sector: Engagement and Voting

VW is no longer part of the responsible funds. Reasons for this are the use of cheating software and animal testing.

Automotive sector Facts & Figures

Read more articles from this issue of our ESG letter here. *ESG stands for Environmental, Social and Governance“ – These are the three broad categories according to which companies are examined in sustainable investment. Legal note: Prognoses are no reliable indicator for future performance.

Mobility of the future: moving the traffic of goods onto the rail track

Currently only a third of transport is by rail. However, in domestic transport (i.e. Austria), 60% is possible, and even 85% in cross-border traffic – a clear signal that should be heeded by rail infrastructure strategies. In addition to a socio-ecological tax reform, a comprehensive turn-around in mobility is a crucial factor in the fight […]

TESLA: no investment in environmental funds

Tesla Inc. is not part of the sustainable investment universe of our environmental fund, ERSTE WWF STOCK ENVIRONMENT, which is also the oldest one of the sustainable range of Erste AM and is subject to strict criteria. The underlying rationale of the fund is to invest in products or technologies with particularly high environmental utility […]

Megatrend environment & clean energy: Leveraging the right kind of companies

Mobility, renewable energy, hydrogen – There are currently many megatrends to save the environment. How can we benefit ?

Just how golden is the Czech economy’s golden age?

Although the current phase of the czech economy is not utterly perfect, it can be called a golden age. What is behind all of this ?

Megatrend healthcare: medical care and costs as challenge

Healthcare has never been so important as it is today. Which changed living and consumption habits will influence our future the most?

No long-term consequences after brief panic in oil market

In the previous week crude oil prices have been the highest since 1991. How is the struggle for stable prices on the oil market going? First AM resource expert Alexander Weiss explains the current situation.

IFA: Smartphone manufacturers pin their hopes on new standard

New smartphones will dominate the international radio exhibition in Berlin until the middle of this week. What does the current market look like & what does that mean for technology stocks?

ARGENTINA CRIES (again) – Status Quo and Quo Vadis

The developments surrounding the election in Argentina & presidential challenger Alberto Fernandez are currently frightening investors. Are we looking at a “default”? Our fund manager Felix Dornaus analyzes the situation.

USA: Inverse yield curve fuels fear of recession

In the US bond market, the yield on two-year government bonds had risen above the yield on ten-year bonds, creating the rare situation of an inverse yield curve. This was last the case in 2007.

Weak growth and risks

The recent confrontation between the USA and China in the areas of trade and currency management triggered temporary losses for risky asset classes such as equities. Are the negative implications of an ongoing USA-China conflict strong enough to set off a decline or even a recession?

Looming hard Brexit pushes Pound further down

The hard brexit is described as the most economically unfavorable outcome. First effects can be seen with the Pound.

The Moon Landing – 50 years on: Are private companies taking over the space industry?

Adjusted for inflation, the moon landing cost far more than USD 100 bn by today’s standards. Nowadays the influence of private companies is skyrocketing. They are not just suppliers, but market leaders for many aspects.

“In 2040, 60% of all new cars will be electric” – Interview with equity fund manager

Equity fund manager Clemens Klein is interviewed about promising new environmental technologies and explains what investing in renewable forms of energy can do to help the environment.

Capital market outlook – expansive central banks fuelling risk appetite among investors

At the beginning of July, important stock market indices reached new all time highs. How will economic growth continue & in which asset classes does Erste Asset Management see the best investment opportunities?

Arguments for a continuation of China’s growth story

Why the trade war with the US does not mean the end of the development story and what speaks for the continuation of China’s growth story.

Meat production: Perspective of a sustainable investor

Sustainable investors and informed customers are essential in order to decrease the negative impact of meat production on the environment.

Outlook for the second half of 2019

Many asset classes recorded significant gains. At the same time, the falling tendency of numerous economic indicators has suggested a slowdown in GDP growth. How do these two go together?

Mobile hen houses and high-tech: the AUGA Group

High water consumption, pollution of soils and destruction: These are just some of the criticisms of conventional agriculture. The AUGA Group shows that it can be done differently!

Revolution on a plate

For many Austrians meat is simply one of them. But the enjoyable change spares both the wallet and the environment. WWF guest author Helene Glatter-Götz gives tips for a sustainable and balanced diet.

Searching for the hair in the (chicken)soup

ESG analysts look beyond traditional key ratios like cash flow and growth rates. They take a closer look and take into account the social and environmental aspects of a company.

Meat as a driver of climate change

Cattle-breeding on a global scale is very harmful to the environment. The usage of water in draught areas is one of the biggest problems. But are substitute products the answer to limiting emissions from meat production?

Pesticides, Animal Feed and Meat Consumption – The Food Revolution

The last article in our dossier on “Meat”: What role do animal feed and pesticides play for the environment and the climate?

The king is dead, long live the king

The king is dead, long live the king. Time for our former Head of SRI Gerold Permoser to draw a summary and write a final ESG review.

Meat consumption and how it is connected to antibiotics in beef (Editorial)

“I just wanted to tell you, your cow Elsa is dead.” An old sketch as an excuse to bring up bad news. What this has to do with meat consumption and antibiotics, you will read in our new post.

Mercosur – EU: Largest free trade zone in the world

After 20 years of negotiation the EU and the South American trade bloc Mercosur announced the formation of the world’s largest free trade zone. The agreement is controversial.

Fund manager-Interview: Turkey after the victory of the opposition in Istanbul

After the victory of opposition politician Ekrem Imamoglu in the mayoral elections in Istanbul, hope is spreading. Alexandre Dimitrov, fund manager of ESPA STOCK ISTANBUL, explains Turkey’s chances for an economic turnaround.

Can India step out from under China’s shadow?

India has been one of the fastest growing economies in the world for several years. Can it step out of China’s shadow or will it stay only a contender?

India-election: Government strengthened for upcoming challenges

In May, the general election in India brought a clear victory for former PM Modi. The Indian stock market increased almost continuously. Can the strong economic growth continue? More in our blog!

“Charts don’t tell the future. They tell stories”

The US and Europe are the two most important equity markets worldwide. In our article, we present 6 charts that show the difference between the European and US stock markets.

USA urges Japan to sign trade agreement quickly

Japan is currently on several levels in the spell of US President Donald Trump’s trade policy. Will there be a free trade agreement soon and what would such an agreement mean for the Japanese economy?

Investment horizon – phrase or mathematics?

Under the search term “investment horizon” there are numerous definitions on the internet. What does the term “investment horizon” actually mean? In our blog post we give an overview of the most important features of the investment horizon.

Technology share rally: USA head and shoulders above the rest

After a strong setback in December 2018, technology stocks made a brilliant comeback in the first four months of this year. ESPA STOCK TECHNO fund manager Bernhard Ruttenstorfer explains the reasons for the new price appreciation, from which the technology sector benefits and what must be considered when investing.

Country report – Croatia

Croatia has finally received the long-awaited investment grade rating. What’s next? Our senior fund manager Ivana Kunstek answers the most important questions.

IPOs in demand again

During the first quarter conditions for a stock market debut have improved. Recently big names have also increased expectations for further IPOs.

Transformation process in China

China accounts for just under 16% of world gross domestic product, making it the second largest economy in the world. Can this success story be continued – what speaks for and what against it?

What is it about dividends on stocks?

When share prices rise on the stock markets, investors are happy. How do dividend stocks work and what’s in it? In our blog post we give an overview of the main features of dividends.

Rivalry USA – China dominating the markets

The trade war between China and the USA reaches a new stage. With the announcement by US President Trump threatening to raise the penalty for Chinese imports to 25 percent, the fronts seem hardened. Will there be an early resolution of the trade dispute and what does a further escalation mean for the global economy?

Earnings Season: US stock markets climb to record levels after unexpectedly good figures

A US stock exchange peaked in the reporting season last week. In any case the first quarter was already doing exceptionally well. Whether and how long this pace can be maintained is questionable. Will the current phase on the US stock exchanges soon be nearing its end?

IMF Spring Meeting: Emerging Markets – What’s next?

The IMF Spring Meetings of the International Monetary Fund in Washington hosts events for emerging market investors. Our senior fund manager Felix Dornaus was there & reports on his most important impressions.