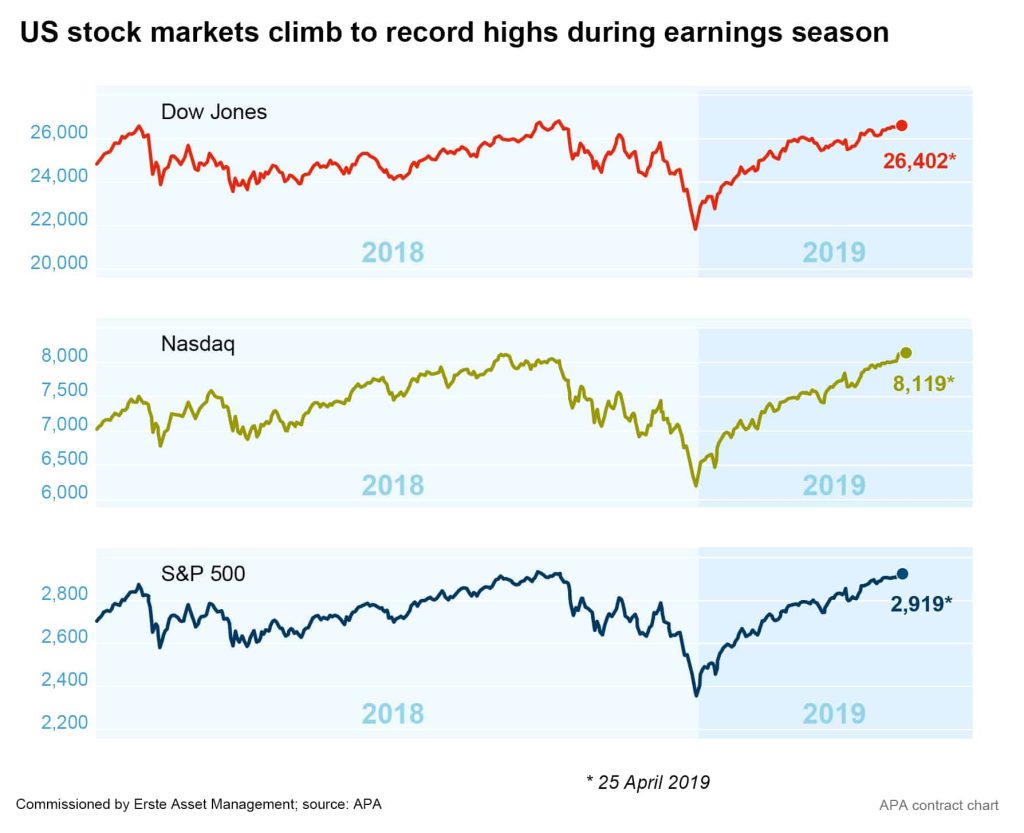

Earnings Season: US stock markets climb to record levels after unexpectedly good figures

In the US stock markets, earnings season reached its peak in the previous week. A number of major players have already published their results for Q1. In the run-up, disappointing quarterly results with profit declines had been feared; however, most of these proved to be unfounded, and, in fact, numerous companies even exceeded analysts’ expectations. In New York, the S&P 500 and the Nasdaq Composite responded with new highs both during the day and at close.

Pleasant surprises in various industries

By the middle of the week, 129 companies had already presented their results. According to news agency Reuters quoting data from financial data provider Refinitiv, more than 75 per cent exceeded expectations, including, among others, the operators of the social networks Twitter and Facebook as well as toy group Hasbro. Technology corporation United Technologies and arms manufacturer Lockheed Martin also pleased investors with positive figures and have already raised their profit expectations for the whole year. Established IT company Microsoft attracted attention in particular with its figures for the first quarter of the year: owing to its flourishing cloud service business, Microsoft increased its revenue in the first three months of 2019 by 14 per cent to USD30.57bn, with profit increasing by 19 per cent to around USD8.8bn. In this manner, positive surprises in the quarterly figures were found across various industries and sectors.

Note: Past performance is not indicative of future development.

Good reasons for disappointing figures

Analysts noted that, considering the positive environment the current results create, disappointing figures would weigh more heavily. However, specific reasons rather than general economic concern caused some companies to fall short of expectations – Boeing being one of those. For the time being, the aircraft manufacturer retracted all forecasts for the year as a whole, mainly because of the uncertainty caused by the launch bans on its 737-Max models following two crashes. Construction machinery giant Caterpillar was unable to present convincing revenue figures, in this case, the company reported, because of weak sales in Asia and the Pacific. However, the construction machinery group may be able to look forward to positive developments in the trade dispute and a subsequent pick-up of sales.

Expectations for stock market before possible trading agreement

Since the markets’ heavy index losses in the final quarter of the previous year, negotiations between the USA and China have made significant progress. For many investors, an agreement in the trade conflict seems only a matter of time and is regarded as the next important milestone for the stock markets. Furthermore, the Federal Reserve’s restraint in the current year has had a positive effect on the stock market, and, finally, analysts’ profit expectations have improved significantly since the beginning of April and as earnings season gained momentum.

Conclusion: Company results in the USA are surprisingly positive and the stock markets are rewarding this with share price increases.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.