To many investors, the yield level is not the only criterion anymore when it comes to their investment decision-making process. More and more investors also want to make sure that their capital is invested in an environmentally conducive and ethically correct fashion. But how can they find such sustainable investment opportunities?

Yield plus ethics plus environmental conscience

Sustainable investment: pulling up the “right” companies and benefiting from them

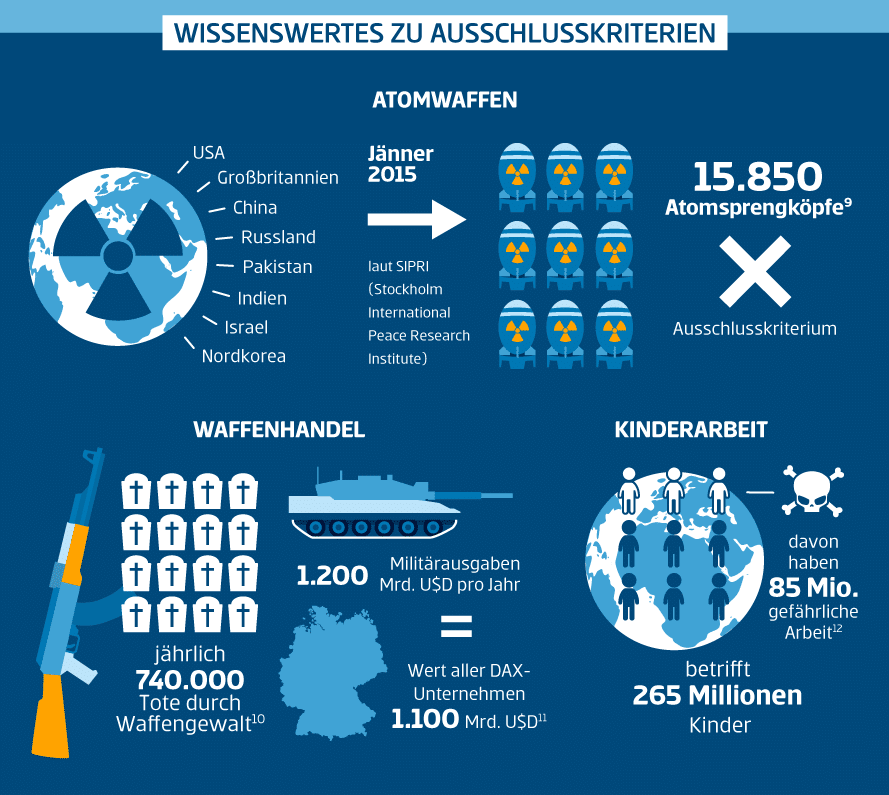

Back in the days, the most important investment criteria for investors were: safety, liquidity and yield. Nowadays, if you ask investors, another criterion has been added: sustainability. An increasing number of retail investors want to be sure that their money does not go to banned weapons, child labour, or unethical companies.

The market has recognised this trend. At EUR 280,6 bn, the total volume of sustainable investments has set a new high in Germany, Austria and Switzerland combined. Relative to the previous year, assets invested on the basis of stringent social, environmental, and governance criteria have grown by manyfold. One of the pioneers in this segment of the financial market is Austrian Erste Asset Management (Erste AM). As far back as 17 years ago, the company floated the first environmental equity fund, and since 2006 Erste AM has collaborated with the environmental organisation WWF – a collaboration that has been internationally recognised.

About:

No weapons and no child labour in investments

Things worth knowing about criteria of exclusion

“Sustainable return depends on stable, well-functioning, and solidly governed companies,” as Gerold Permoser, Chief Investment Officer of Erste AM, points out. And for issues like stability and solidity, aspects such as corporate social and environmental responsibility have become increasingly important. An environmental or financial scandal can easily get a company into dire existential straits in times of social media. Corporate management knows this. “Never before has sustainability been more important than today,” says Permoser.

Almost every company today has departments that deal with environmental protection and fairness, not the least with a view to shareholder value. Consistent investments and compliant companies are crucial to ensure that things like child labour, food speculation, the production of banned weapons, or corruption reliably end up on the index. There are some 400 sustainable funds at the moment in the German-speaking region. By investing sustainably, an investor will reap benefits in the future, can earn a lucrative yield, and also supports a compliant corporate policy.

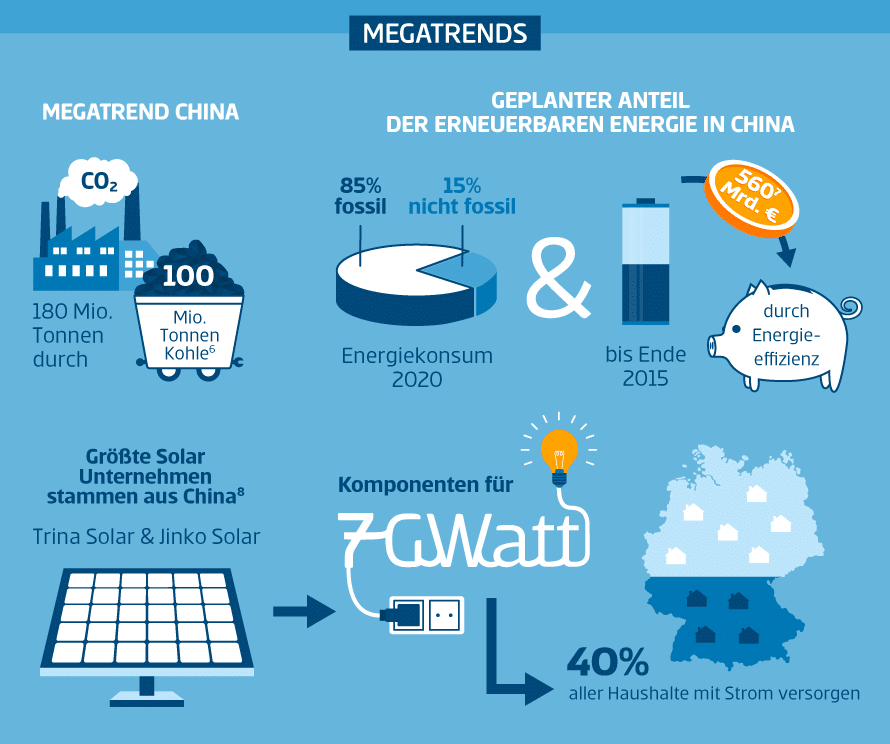

Good growth opportunities from mega trends

We are faced today with the fact that a number of mega trends, i.e. far-reaching global developments, also drive the issue of climate change, and in turn, population growth or urbanisation in growth regions. The aforementioned trends lead to an increase in energy consumption, rising demand for scarce resources, more emissions of greenhouse gases, and an increase in waste. Key technologies in the environmental field today are e.g. renewable energy (wind energy, solar), energy storage, lighting (LED), optimization of energy transport but also electric cars.

“At the end of the day, companies that offer solutions to these developments will be benefiting from above-average growth opportunities for years. Everything starts with socially responsible investments,” as Permoser concludes.

INFO:

With sustainable assets under management of EUR 5.3bn, Erste AM is a pioneer in the areas of ethics and sustainability: the first public sustainable fund was issued as early as 2001.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.