The semiconductor industry is considered one of the biggest beneficiaries of the AI boom. Investors therefore kept a close eye on the sector’s figures for the first three months of 2025. One thing became clear: the expansion of AI infrastructure continues to deliver good results for most chip companies – but the sword of Damocles in the form of impending US tariffs is still hanging over industry giants such as Nvidia & Co. Read more in today’s blog post.

All articles on the topic “Markets and opinions”

Turbulent start of the year for oil

Oil prices came under pressure at the beginning of the year. The consequences of the coronavirus in China were cited as the main reason for the fall in prices.

How does the struggle for a stable oil price continue?

First virtual chart analyst – bot learns to “look at” charts

The intuition of an experienced chart analyst contributes significantly to a correct forecast. With the help of around one million charts of shares, Erste AM trained the world’s first virtual chart analyst.

Coronavirus: epidemic in China disrupts recovery scenario

Coronavirus: The economy is increasingly affected by the virus crisis. Will China’s economy be able to withstand the pressure despite resistance? Analysis by Erste AM chief economist Gerhard Winzer.

Problem children vs. favourite children in Latin America

Fund Manager Peter Paul Pölzl gives a detailed outlook on the loved ones and problem children among the countries in Latin America. How are China’s economy and Latin America related?

Climate change and other challenges front and center at the WEF

At the World Economic Forum in Davos, topics from business, politics and science were discussed. However, climate protection received the most attention. How is the global economy doing?

And what is the outlook for 2020?

US banks report good and bad developments in the financial sector

The reporting season with the largest US banks started on Wall Street last week. Their results give a good impression of how the previous year went and what trends can be identified for this year.

Russian equities: attractive valuations and high dividend yield

After the strong stock market year 2019, the chances are good for further price gains on the Moscow stock exchange. The extremely low valuation of the shares and the high payout rates make Russian shares one of the most attractive stock market segments. Read more in the interview with ERSTE STOCK RUSSIA fund manager Alexandre Dimitrov.

2019 stock market review

Our 2019 stock market review: for investors around the world, 2019 was by and large a continuation of the previous year: the trade dispute between the US and China and the back and forth over Brexit remained the dominant topics.

Bargains, sales and dividends: Hopeful signs for US retail investors

Thanksgiving, Black Friday and Cyber Monday are considered to be the weeks with the highest retail sales. How can investors benefit from the US Christmas business?

Positive bottom line for our funds in 2019

Only a few weeks left and then 2019 is history. Thanks to booming stock exchanges and yet another increase in bond prices. Investors can look back on a pleasing balance sheet.

Demand in the oil market will not lose momentum until 2030

Against the background of the initial public offering of Saudi Aramco, the international energy agency predicts a robust demand for oil by 2025. Thereafter demand-dynamics will decline sharply due to increase in energy-efficient vehicles.

Artificial Intelligence as investment in the future

Artificial intelligence opens up new opportunities to invest. Which developments and companies are most interesting? And how is the best way to do it?

A recovering global economy?

The recovery of the world economy has become more likely: First AM chief economist Gerhard Winzer gives an outlook on whether the trend reversal is done.

FT Nordic Investor Outlook – Agile Investment in Uncertain Markets

The FT Nordic Investor Outlook 2019 was dedicated to the topic „Agile Investment in Uncertain Markets“. High caliber speakers were discussing China, ESG and Brexit.

Turkish economy caught between recovery and conflicts

The Turkish invasion in northern Syria and the conflict surrounding it with the USA put the lira under renewed pressure, raising concerns about the Turkish economy’s recovery.

Megatrend environment & clean energy: Leveraging the right kind of companies

Mobility, renewable energy, hydrogen – There are currently many megatrends to save the environment. How can we benefit ?

Just how golden is the Czech economy’s golden age?

Although the current phase of the czech economy is not utterly perfect, it can be called a golden age. What is behind all of this ?

Megatrend healthcare: medical care and costs as challenge

Healthcare has never been so important as it is today. Which changed living and consumption habits will influence our future the most?

No long-term consequences after brief panic in oil market

In the previous week crude oil prices have been the highest since 1991. How is the struggle for stable prices on the oil market going? First AM resource expert Alexander Weiss explains the current situation.

IFA: Smartphone manufacturers pin their hopes on new standard

New smartphones will dominate the international radio exhibition in Berlin until the middle of this week. What does the current market look like & what does that mean for technology stocks?

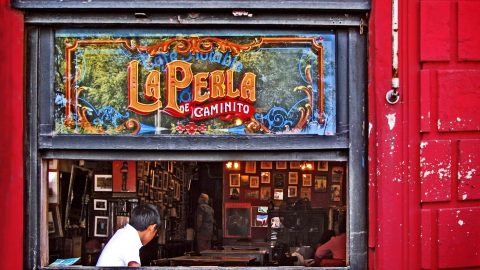

ARGENTINA CRIES (again) – Status Quo and Quo Vadis

The developments surrounding the election in Argentina & presidential challenger Alberto Fernandez are currently frightening investors. Are we looking at a “default”? Our fund manager Felix Dornaus analyzes the situation.

Weak growth and risks

The recent confrontation between the USA and China in the areas of trade and currency management triggered temporary losses for risky asset classes such as equities. Are the negative implications of an ongoing USA-China conflict strong enough to set off a decline or even a recession?

Looming hard Brexit pushes Pound further down

The hard brexit is described as the most economically unfavorable outcome. First effects can be seen with the Pound.

The Moon Landing – 50 years on: Are private companies taking over the space industry?

Adjusted for inflation, the moon landing cost far more than USD 100 bn by today’s standards. Nowadays the influence of private companies is skyrocketing. They are not just suppliers, but market leaders for many aspects.

“In 2040, 60% of all new cars will be electric” – Interview with equity fund manager

Equity fund manager Clemens Klein is interviewed about promising new environmental technologies and explains what investing in renewable forms of energy can do to help the environment.

Capital market outlook – expansive central banks fuelling risk appetite among investors

At the beginning of July, important stock market indices reached new all time highs. How will economic growth continue & in which asset classes does Erste Asset Management see the best investment opportunities?

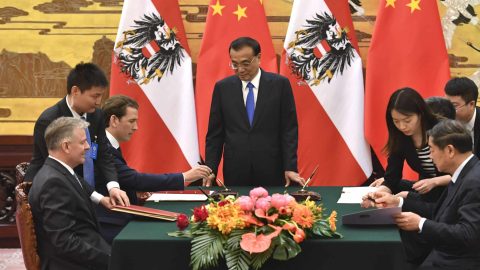

Arguments for a continuation of China’s growth story

Why the trade war with the US does not mean the end of the development story and what speaks for the continuation of China’s growth story.

Outlook for the second half of 2019

Many asset classes recorded significant gains. At the same time, the falling tendency of numerous economic indicators has suggested a slowdown in GDP growth. How do these two go together?

Mercosur – EU: Largest free trade zone in the world

After 20 years of negotiation the EU and the South American trade bloc Mercosur announced the formation of the world’s largest free trade zone. The agreement is controversial.

Fund manager-Interview: Turkey after the victory of the opposition in Istanbul

After the victory of opposition politician Ekrem Imamoglu in the mayoral elections in Istanbul, hope is spreading. Alexandre Dimitrov, fund manager of ESPA STOCK ISTANBUL, explains Turkey’s chances for an economic turnaround.

Can India step out from under China’s shadow?

India has been one of the fastest growing economies in the world for several years. Can it step out of China’s shadow or will it stay only a contender?

India-election: Government strengthened for upcoming challenges

In May, the general election in India brought a clear victory for former PM Modi. The Indian stock market increased almost continuously. Can the strong economic growth continue? More in our blog!

“Charts don’t tell the future. They tell stories”

The US and Europe are the two most important equity markets worldwide. In our article, we present 6 charts that show the difference between the European and US stock markets.

USA urges Japan to sign trade agreement quickly

Japan is currently on several levels in the spell of US President Donald Trump’s trade policy. Will there be a free trade agreement soon and what would such an agreement mean for the Japanese economy?

Technology share rally: USA head and shoulders above the rest

After a strong setback in December 2018, technology stocks made a brilliant comeback in the first four months of this year. ESPA STOCK TECHNO fund manager Bernhard Ruttenstorfer explains the reasons for the new price appreciation, from which the technology sector benefits and what must be considered when investing.

Country report – Croatia

Croatia has finally received the long-awaited investment grade rating. What’s next? Our senior fund manager Ivana Kunstek answers the most important questions.

IPOs in demand again

During the first quarter conditions for a stock market debut have improved. Recently big names have also increased expectations for further IPOs.

Transformation process in China

China accounts for just under 16% of world gross domestic product, making it the second largest economy in the world. Can this success story be continued – what speaks for and what against it?

What is it about dividends on stocks?

When share prices rise on the stock markets, investors are happy. How do dividend stocks work and what’s in it? In our blog post we give an overview of the main features of dividends.

Rivalry USA – China dominating the markets

The trade war between China and the USA reaches a new stage. With the announcement by US President Trump threatening to raise the penalty for Chinese imports to 25 percent, the fronts seem hardened. Will there be an early resolution of the trade dispute and what does a further escalation mean for the global economy?

Earnings Season: US stock markets climb to record levels after unexpectedly good figures

A US stock exchange peaked in the reporting season last week. In any case the first quarter was already doing exceptionally well. Whether and how long this pace can be maintained is questionable. Will the current phase on the US stock exchanges soon be nearing its end?

IMF Spring Meeting: Emerging Markets – What’s next?

The IMF Spring Meetings of the International Monetary Fund in Washington hosts events for emerging market investors. Our senior fund manager Felix Dornaus was there & reports on his most important impressions.

European banks: equity issues and lessons from the financial crisis

What has the financial crisis shown us and what lessons have policy makers learned about “too big to fail”? The Deutsche Bank Commerzbank merger offers a lot of conversation points.

Turkey after the local elections

The local elections in Turkey had been built up by President Erdogan to be a test of his policies. What do the results mean for Turkey’s economy?

Stable prospects for Central and Eastern Europe

The countries of Central, Eastern and Southeastern Europe are among the most important economic growth markets for Europe. How are the prospects for next year?

“The search for yield is ongoing”

“The search for returns continues” – What were the latest developments and what are the yields like?

Fund manager Bernd Stampfl gives the answers to the most important questions.

Continuing struggle for stable oil prices

Current situation on the oil market – in the previous week oil prices have been rising for four months.

There is currently a surge but how is the struggle for stable oil prices going? Interested ? Read on here.

Emerging markets corporate bond outlook 2019 + Video

What were the biggest challenges last year, and what are the opportunities in 2019? Emerging markets fund manager Péter Varga answers the most important questions.

USA still going strong

The US economy has developed very solidly since the financial crisis. The current expansion could soon become the longest in US history.

Currently the US remains strong but the key question is: Will it continue? Read on here!

Stabilization or downturn?

The majority of economic indicators point to a slowdown in global real economic growth.

How will this dichotomy between the market and the economic environment be resolved and will there be a stabilization?