As global debate on suitable measures for climate protection continues, the International Energy Agency’s (IEA) annual report published in mid-November has been eagerly awaited. Among other things, it provided information on possible trends in oil demand, which in turn is a deciding factor for prices with an impact far beyond the oil industry.

Increasing demand stable until 2025

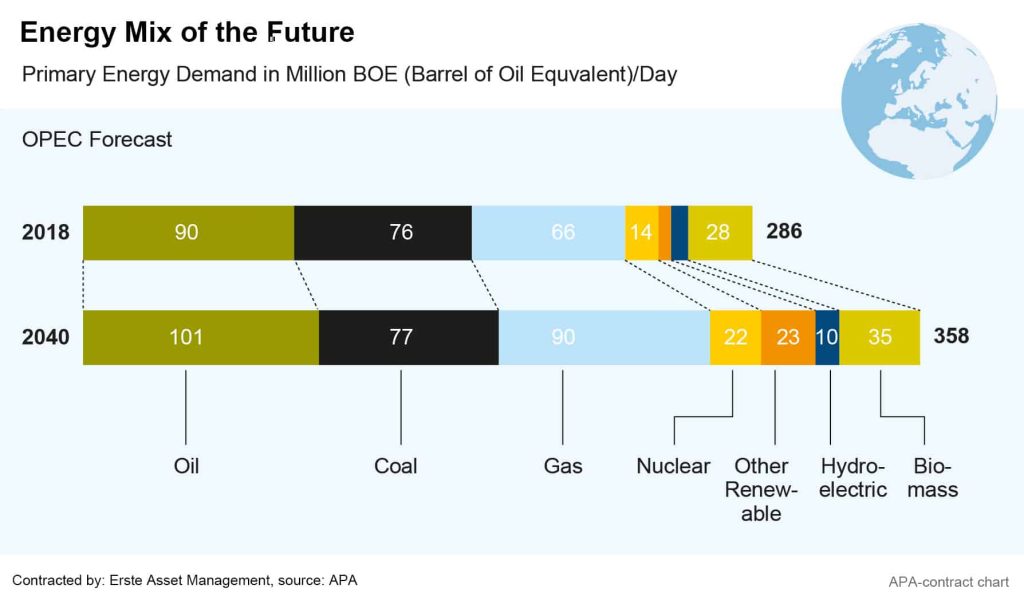

In its recent report, the IEA paints a differentiated picture of the changes to be expected as a result of efforts to curb greenhouse gas emissions. According to the report, the demand dynamics for oil will decline sharply due to the increasing number of electric cars and energy-saving vehicles. From today’s perspective, however, this development is not expected to start until the 2030s: “Demand growth will remain robust until 2025,” said IEA Executive Director Fatih Birol.

Over the next five years, the IEA expects global oil demand to rise by an average of one million barrels a day each year, with demand growth only expected to slow thereafter. From 2030 onwards, an increase of merely 100,000 barrels per day is expected, half the number compared to the IEA’s forecasts from the previous year.

In the short term, the global economic development is crucial for the demand. The Organization of Petroleum Exporting Countries’ (OPEC) monthly oil market report, published one day after the IEA’s annual report, currently estimates that global economic output will grow at a constant 3 per cent for both the current year and 2020.

Saudi Aramco: largest IPO of all time

OPEC estimates that demand for oil from its member countries will continue to decline slightly this and next year despite growing global demand. The reason for this is the increasing significance of other producing countries – most notably, the USA. On 5 December, OPEC representatives are to meet with allied states to discuss an extension of the production restrictions with which they intend to stabilise prices in the light of the latest assessments. It is generally expected that production volumes will be, if not further reduced, at least kept constant. For the largest OPEC member Saudi Arabia, the meeting comes at a particularly pivotal time: investors can now subscribe for shares in the state-owned oil company Saudi Aramco. Aramco’s market value is estimated at up to USD 2,000bn. The subscription period for shares in by far the most valuable company in the world ends just one day before the OPEC meeting. Longer-term stable prospects for the oil market are therefore likely to come in handy for the largest IPO of all time.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.