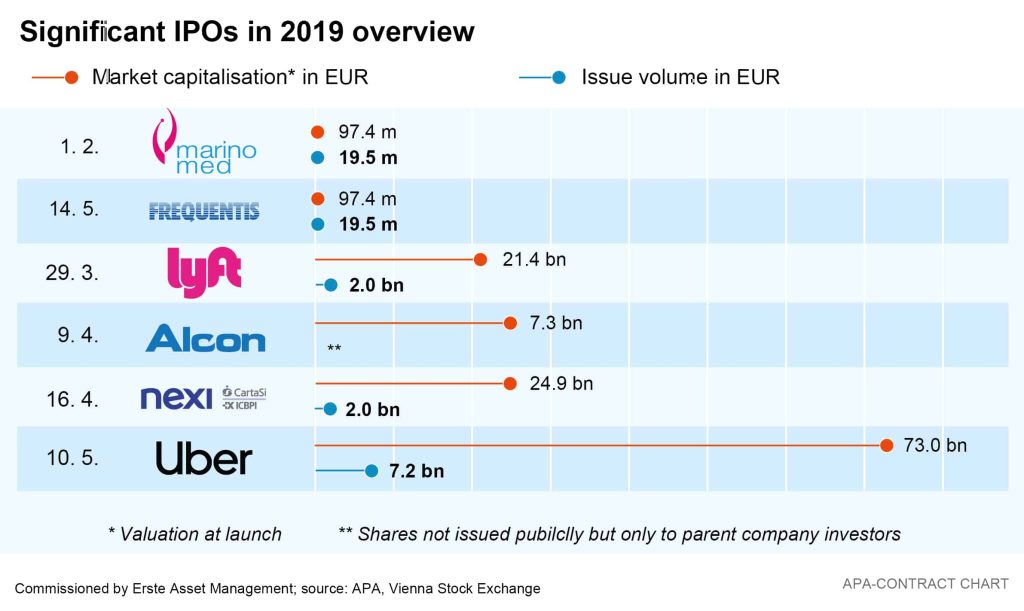

Frequentis was the second Austrian company this year to make its initial public offering (IPO) on the Vienna Stock Exchange last week. The number of IPOs by international companies for this year has been on the smaller side, with biotech company Marinomed’s IPO at the start of February being the first one in European for 2019.

According to a survey by consulting firm EY, the worldwide Q1 issue volume lay nearly 75 per cent below the figure for the same period of the previous year. One reason for this, aside from a certain aversion to risk, is that IPOs also failed due to uncommon factors: the longest government shutdown in the USA’s history, for instance, delayed the approval of IPOs.

IPOs picking up speed in Q2

However, the general conditions for IPOs improved as the first quarter progressed. Recently, big names also launched their offerings at the stock markets, raising the expectations for further IPOs.

Prominent jeans manufacturer Levi’s managed to make a spectacular comeback on Wall Street in March: on the first day of trading, the long-established company’s share prices rose by almost a third after Levi’s had been absent from the trading floor for 34 years. The US urban mobility service Lyft also caused a sensation, launching its offering at the end of March with a valuation of USD24bn on New York’s Nasdaq technology exchange. This was followed in May by the much-anticipated launch of industry leader Uber on the stock exchange, which reached a total valuation of USD73bn.

In Europe, the largest IPO to date took place in Milan, where payment processor Nexi launched its offering mid-April with a valuation of 7.3 billion euros. In Switzerland, Novartis’ medical technology subsidiary Alcon’s stock market launch caused a major stir with almost EUR25bn of market capitalization. However, its shares were not publicly offered but were issued exclusively to Novartis shareholders.

Note: Past performance is not indicative of future development.

Various new listings down the road

In Germany, prominent new entrants in individual stocks are on the horizon. The Volkswagen Group is now planning to list the Traton truck division on the stock exchange this year after all. With the approval of the supervisory board, the board of directors decided to aim for an IPO before the 2019 summer break, subject to further capital market developments, the company announced after a supervisory board meeting in the previous week.

Similarly, the Thysenkrupp steelworks and technology company is planning a partial IPO of its lucrative elevator division after a strategic realignment.

Meanwhile, the Vienna Stock Exchange’s new midmarket segment has aroused the interest of oekostrom AG. The Austrian company intends to set the course for another IPO in Vienna at its annual general meeting in June.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.