Let’s assume you are in the peculiar situation of having to participate in an Oxford-style debate where your opponent’s team is arguing that China’s growth story is over and that China is one big accident waiting to happen. Their main takeaway is that you should not invest into Chinese assets, else you will be burnt. Here’s how you present your biased case that it is in fact not over.

Before I present to you your argumentation which is mainly based on the potential that still lies uncovered and less so on hard facts and economic data, let me tell you how an Oxford-style debate usually works.

Speakers are divided into two teams and are confronted with a statement like in our case: “China’s growth story is over”. The two sides have to assume clear and opposing positions. They present alternatively in front of an audience and a Board, who will decide which side has proposed the more convincing arguments and therefore won the debate. The speeches are usually timed and consist of an introduction, an argumentative body and a conclusion. Even though the introduction and the conclusion are a very essential part, we want to focus on arguments one could use.

Trade war between China and the USA

Let’s start with the elephant in the room. Markets have been hit hard by the trade war in May, China’s growth momentum has weakened further and everyone was in suspense ahead of the G20 summit. However, the trade war cannot go on forever. Trump announced his candidacy for the next presidential elections and if he wants to sell his image as a hands-on dealmaker, he has to deliver a trade deal with China. There were three main promises during his 2016 campaign. The first one to reduce regulation and taxes was delivered. The second promise, tackling immigration and building a wall that Mexico pays for, is still in progress. Hence, Trump has urgency to deliver on the third promise of changing the terms of trade between US and China.

Even though the trade war has been broadened to a tech war and Huawei was hit hard, China also has leverage over the US with natural resources and the means to flatten the impact of the trade war. With the US/China truce and the softer stance on Huawei the talks during the G20 summit have proven to be constructive. Interestingly, the concessions have been announced by the US side and not entirely been confirmed by the Chinese. Is this a further indication that China has the upper hand and the US needs a deal real bad?

Room for monetary policy benefits growth story

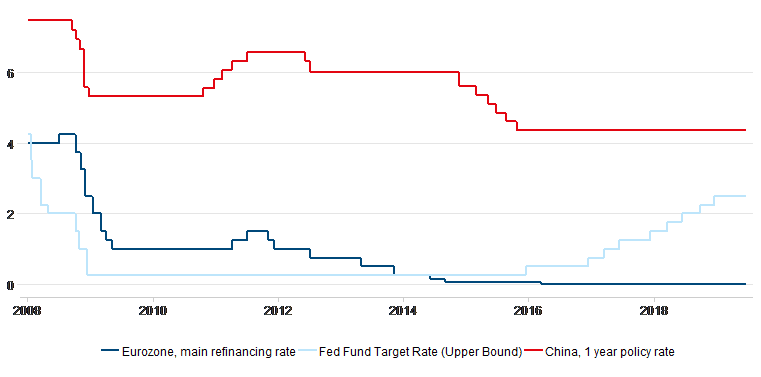

Figure 1, Source: Bloomberg

Compared to most developed countries, China has still room for monetary policy (see Figure 1). Recent fiscal measures have focused on tax cuts (cuts of 1.4% of GDP announced last year and roughly 2% of GDP announced this year), rather than infrastructure investments. Due to the high savings rates (~ 40% of disposable income compared to less than 10% in the US), the effect may not be immediate, but over the long term the tax cuts should lead to a better allocation of resources, since individual and corporates will factor in risk and reward trade-offs when investing their excess savings in the future.

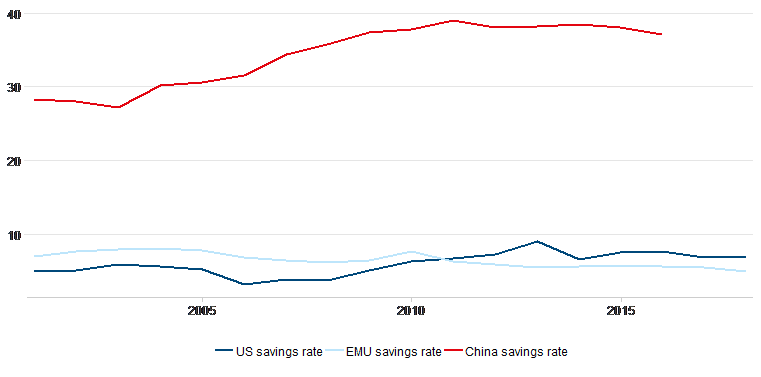

The higher savings will also put the recent credit boom into perspective. If you factor in the savings, the net credit will seem less overwhelming. Furthermore, slowing credit growth may be compensated by savings.

Figure 2, Source: Bloomberg

Political structure benefits growth story

The political structure in China also accommodates long term structural decisions. Unlike in most countries the Chinese government has the possibility to implement unpopular measures that will pay off in the long term, since they do not have to please any electorate that might disempower them. Overall, this results in a higher stability of policy decisions with a longer horizon.

This is evident in long-term projects like China 2025 and the Belt and Road Initiative (BRI) that China is pursuing. The BRI is aimed at further market integration. The infrastructure investments may lead to less dependence on the US and propel Ricardian growth similar to the effects of the European integration. If more trade will be done in Renminbi (RMB), this will also strengthen the RMBs claim to become a reserve currency and therefore decrease the vulnerability to the US’s act of weaponizing the US Dollar.

With respect to China 2025, one can observe that China is trying more and more to move up the value chain. In particular, if you consider the tech industry, one can note that China is growing more and more independent from the rest of the world. With Alibaba, Baidu and Tencet, they have companies that offer competitive alternatives to Amazon, Google and Co. Also on the electrical vehicle front, China is very well positioned, since it started quite early with subsidiaries.

Conclusion

Overall, it’s all about China’s potential for structural change. Due to the major stake of State-owned-enterprises in the Chinese economy and weak intellectual property rights, there are still a lot of inefficiencies which can be resolved. One of the main tasks, China is facing, is to strengthen the private sector and lower the dependence on export and investments by increasing private spending. It is evident that China is making a lot of efforts in that direction. The reform themes of the Communist parties of China include improving the social security with a health care and pension reform among others. Increased social security might eventually trigger a reduction in the savings rate and therefore lead to higher consumption.

The trade war should in general not only be seen as evil, but as an opportunity for further reform in China. With the pressure of the US and the slowing economic growth, China might commit to further strengthen intellectual property rights. Especially this will be good news for investors in China. Opening its economy will give China the opportunity to boost growth further through technology transfer. There are already examples of joint ventures with companies like BMW, where the foreign company has the majority stake.

The bottom line is that there is lot of potential for improvement and that one can observe that China is already making efforts to address its structural issues. Even though there is a lot of uncertainty it seems worth taking the risk. Also, with respect to China’s integration into global financial markets, one can expect a boost through the inclusion in major bond and equity benchmark indices.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.