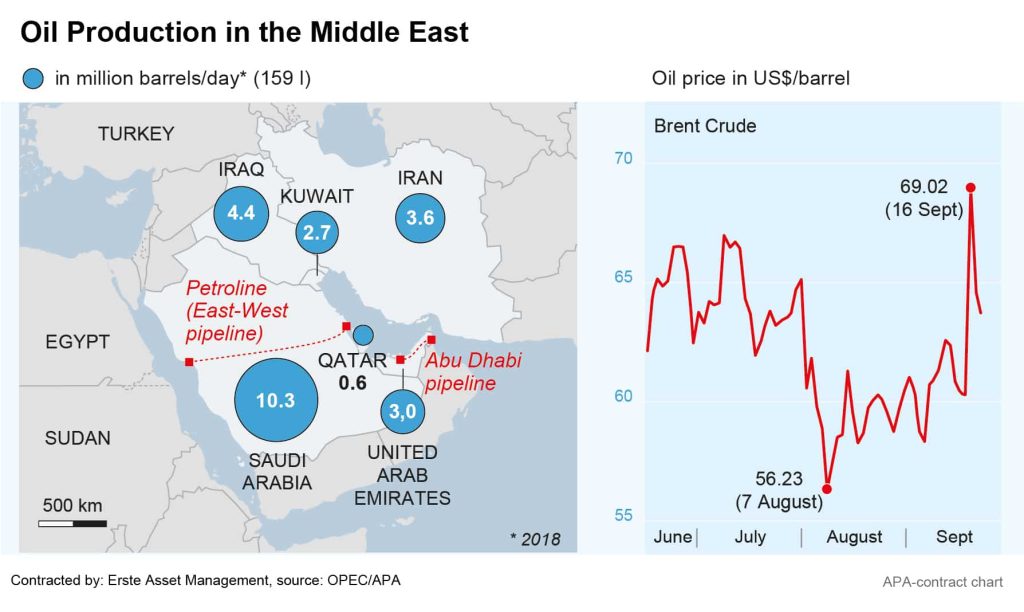

A drone attack on the refineries of Saudi Arabian oil company Aramco last week caused a stir in the oil market. At the start of the week, crude oil prices jumped to their highest levels in months. The attack, behind which the US government suspects Iran-supported Houthi rebels from Yemen, resulted in the loss of 5.7 million barrels of production, making it one of the biggest production losses of all time. The fact that oil prices nevertheless fell again quickly in the course of the week is due to several factors.

Oil market is generally well supplied

The temporary price increases can be explained by risk premiums. Saudi Arabia is regarded as one of the most stable producers: “If even a relatively simple drone attack can eliminate five per cent of the world’s supply, there will naturally be a fear of major supply shocks,” explains Erste Group commodities expert Alexander Weiss. According to Weiss, the market’s reaction has been very focused, it has not affected other sectors, and investors do not need to fundamentally revalue the oil market due to recent developments. This is mainly due to the fact that the market is currently basically very well supplied, with the International Energy Agency (IEA) even expecting a surplus supply on the oil market in the coming year.

The most important oil producing countries, which coordinate themselves in and with the Organization of Petroleum Exporting Countries (OPEC+), are trying to curb production and thus keep prices stable, but other countries are increasing their oil production further. According to IEA estimates, the demand for crude oil from the OPEC member states in the first half of 2020 will therefore lie around 1.4 million barrels below the production of the OPEC countries in August.

Oil market experts optimistic

Another reason for the limited impact following the production loss is the accumulated stocks. The USA, for example, agreed to release its strategic oil reserves should bottlenecks occur after the drone attacks on the oil plants in Saudi Arabia. This also reflects how much the United States has become more important on the oil market: In June, the USA even temporarily overtook Saudi Arabia as the world’s largest oil exporter thanks to its massive shale oil production.

According to IEA estimates, the global economic slowdown will not result in decreased demand for oil. The authorities stand by their forecasts for this and next year. As a result, global demand is expected to rise to 1.1 million barrels (1 barrel = 159 litres) per day in 2019 and 1.3 million barrels in 2020. The prerequisite for this, however, is that the trade talks between the USA and China do not fail and that the tensions regarding Iran subside.

In conclusion, Alexander Weiss sees no long-term threat to the oil supply, and the dramatic attack on Saudi Arabian production sites has not changed this: “On a geopolitical scale, we do not see any escalation at the moment. So far, everyone has kept a cool head,” Weiss sums up the situation. Last week, the oil company Saudi Aramco reported that about 40 per cent of the oil production in the attacked large plants had already resumed. Full capacity should be available again by the end of September.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.