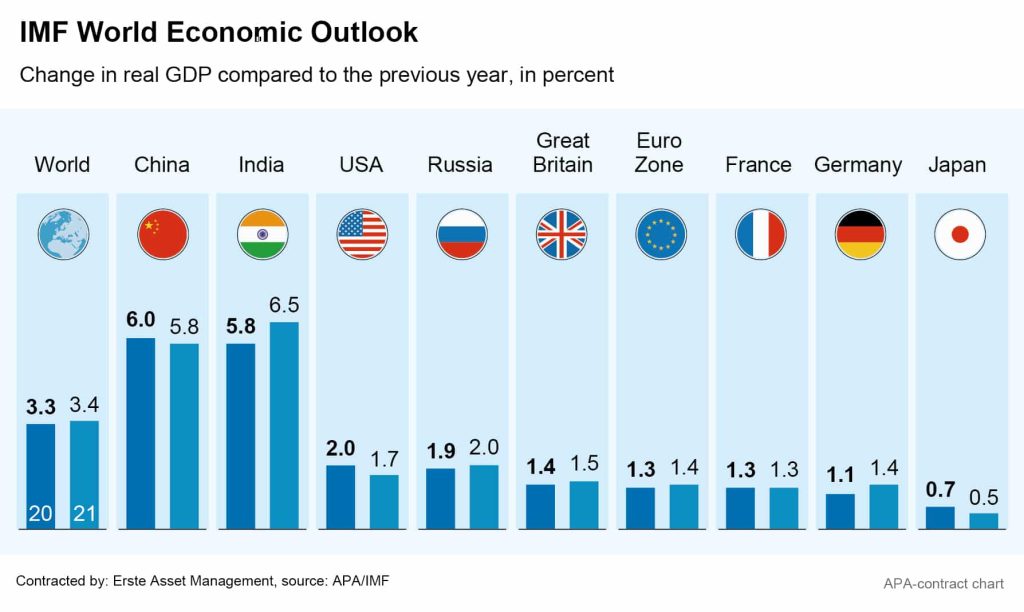

At the traditional World Economic Forum (WEF) held from 21 to 24 January in the Swiss ski resort of Davos, climate change and mitigation measures received the most attention. But the approximately 3,000 high-ranking representatives from business, politics and science also discussed other pressing issues such as trade conflicts and a fairer tax system. At the beginning of the meeting, the International Monetary Fund (IMF) presented its new global economy forecasts.

IMF expects a return to more growth

According to the IMF, global growth will be picking up slightly in 2020. According to the IMF experts, the global economy is expected to grow by 3.3 per cent this year compared with 2.9 per cent in 2019. However, expectations have been slightly lowered compared to the forecast made in October 2019, at which point the IMF was expecting 3.4 percent growth for 2020. For 2021, the IMF revised its forecast to 3.4 percent from initially 3.6 percent. The slightly lowered estimates are mainly due to the weaker development in India, a major emerging market that, however, is currently suffering from severe political unrest. Meanwhile, new tensions regarding trading between the USA and the European Union also pose a risk for IMF chief economist Gita Gopinath.

Climate change topics beyond Greta vs. Trump

Against this backdrop, EU Commission President Ursula von der Leyen said in Davos that the EU Commission would not shy away from tariffs and other import barriers if international trading partners’ production methods remained less environmentally friendly than European companies.

In addition, managers of large financial groups used the WEF to emphasize the economic importance of climate-friendly business models. Bank of America CEO Brian Moynihan, for example, advocated “sustainable business models that address long-term social goals”. Investment management company Blackrock announced plans to give priority to green investments: “We must note that climate risks are also investment risks,” said Vice Chairman Philipp Hildebrand. Investment advisors from Mercer already reported “pressure” to offer sustainable investments. The head of Europe’s largest insurance group, Allianz, in turn called for a discussion about appropriate measures to phase out coal. Overall, the impression felt was that corporations are trying to see a silver lining in the necessary cuts: “Sustainability is one of our greatest business opportunities, because it’s about how to operate the physical world in a way that maintains value in the long term,” Accenture Germany CEO Frank Riemensperger summarized the sentiments.

OECD hoping for tax reforms before 2020

Apart from climate issues, the need to improve the global tax system was also a major topic of discussion. The Organisation for Economic Cooperation and Development (OECD) hopes to agree concrete figures by July at the latest, so that new tax regulations can be implemented in the latter half of the year. Under the umbrella of the OECD, countries are working on a global minimum tax for corporations and a new form of taxation for internet companies.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.