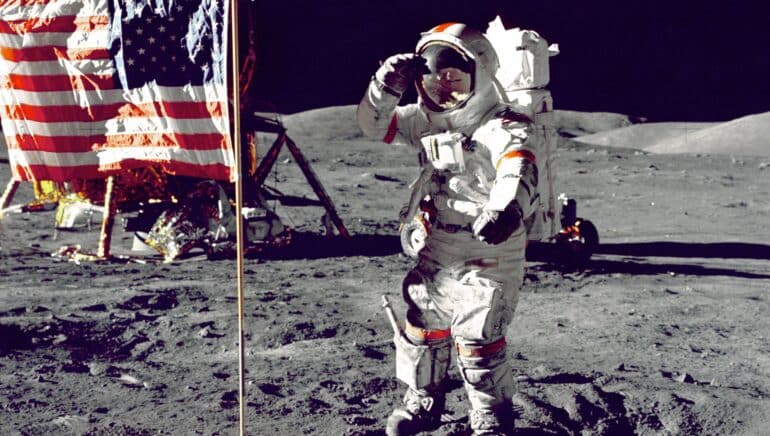

50 years ago, on 20 July 1969, Neil Armstrong and Edwin Aldrin were the first humans to set foot on the moon. The Apollo space program, launched during the Cold War, was not a commercial project, but rather politically motivated, demonstrating the USA’s determination to win the race to the moon against the Soviet Union after the defeat in the race to the Earth’s orbit. Adjusted for inflation, the “big step for mankind” cost far more than USD 100 bn by today’s standards; however, the indirect profitability for the private sector can hardly be overstated. Many of the innovations of the Lunar Landing Program found their way into the private sector and have become an indispensable part of everyday life, from microchips to wireless drills.

Since 1972, no human has been on the lunar surface, but the space industry has changed dramatically. Even in the 1960s, NASA relied on private suppliers such as Boeing, but at the time space programs were primarily run by government agencies. Today, private companies play an important role in the space business, as suppliers of space vehicles and ground equipment, as carriers of payloads into space, or as satellite operators and users.

SpaceX competes for rocket launches with NASA and ESA

Tesla CEO Elon Musk’s emerging space enterprise SpaceX provides space travel on a large-scale, focusing on mass production and recyclability in its rocket design, thereby competing with public agencies such as ESA as carriers of payloads into space. The company is now the market leader for satellite launches, continuously transporting weather or communications satellites into space and providing supply flights to the International Space Station (ISS).

Other companies are also currently attempting to enter this attractive market. In July, iSpace was the first private Chinese space company to launch a rocket into orbit. Private companies are also reaching for the stars in Europe. State-owned Swiss arms and aviation group Ruag is currently planning acquisitions worth CHF 500m to expand its space division and intends to go public in 2021 or 2022.

Space industry valued at USD 360 bn total

According to the Cologne Institute for Economic Research, the entire space industry was worth around USD 360 bn in 2018. Of this amount, 125 billion dollars were spent on ground-based equipment. At 102 billion, the transmission of TV, radio or broadband signals is the most important commercial service. Government activities and manned space flight currently amount to just under 83 billion and are thus only the third most important segment.

But this could change soon. US President Donald Trump wants US astronauts to first return to the moon in 2024, after which the next goal is Mars. Other countries, such as China or India, and even private companies, are now also targeting the moon. In early May, Amazon boss Jeff Bezos detailed his commercial ambitions regarding the Earth’s satellite: the Blue Moon landing device, which is being developed by his company Blue Origin, is to be Bezos’ contribution to the collaboration with the US space agency NASA in the new race to the moon. For the European Space Agency ESA, rocket manufacturer ArianeGroup and German company PTScientists are currently working on plans for an unmanned landing on the moon before 2025.

Legal note:

Prognoses are no reliable indicator for future performance.