Latest Posts

Transition Phase

So far this year, high inflation rates have been the driving factor on the financial markets. This could now change, as Chief Economist Gerhard Winzer writes. Disappointingly weak indicators of economic activity could now increasingly come into focus.

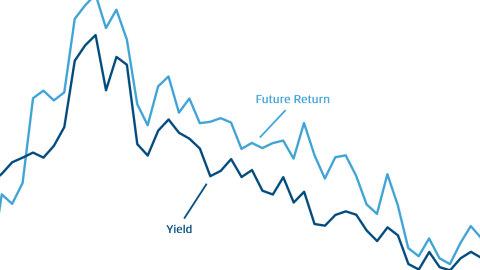

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

One month is not yet a trend

The rise in inflation in the USA was recently lower than expected, which led to a significantly brighter mood on the markets. However, a favourable inflation report is not yet a trend, as Chief Economist Gerhard Winzer emphasises.

Technology stocks in the verge of a comeback?

Due to fears of recession, rising inflation and interest rates, US technology stocks have come under pressure in 2022. The prospect of falling inflation, fueled by recent data from the US, could put them back on track for growth. We explore the question of whether tech stocks are on the verge of a comeback.

Review and outlook: “2022 turned out to be a tough year for equities”

On the stock markets, the year 2022 was characterized by high uncertainties and volatility. Tamás Menyhárt, senior fund manager at Erste Asset Management and equity expert, therefore draws an initial summary of the stock market year and ventures an outlook for the coming months on the markets.

Reduction in the pace of key interest rate increases

More and more central banks are signalling a reduction in the pace at which they are raising key interest rates. However, as Chief Economist Gerhard Winzer explains, this does not necessarily mean that central banks are softening their focus on fighting inflation. Rather, a pause in the rate hike cycle would require a change in inflation dynamics.

Outlook: Development of the neutral real interest rate

This year brought a turning point in the monetary policy of the major central banks. The crucial question is whether this turning point is cyclical or structural. It is therefore worth taking a look at the neutral interest rate, as this captures structural macroeconomic changes.

Bearish Stock Markets After Third-Term Re-Election of Chinese Head Of State Xi Jingping

Hands off Chinese equities? The confirmation of another term in office for China’s state and party leader Xi Jinping triggered a plunge in share prices on the Hong Kong and Shanghai stock exchanges. Equities Technology in particular came under pressure. What happens now?

Club of Rome: “The biggest problem of our time is our inability to distinguish fiction from fact”

In 1972, the Club of Rome published its first analysis of the “Limits to Growth”. Fifty years later, the non-profit organisation asks in a book whether green growth is possible at all.

Strong US dollar increases pressure on Japan’s central bank

The soaring US dollar is causing problems in countries outside the USA. In Japan, the Yen has weakened considerably recently because, unlike the other central banks, the Bank of Japan is sticking to its ultra-loose monetary policy. Against this backdrop, the meeting of the Japanese central bank next Friday will be more in focus than usual.

Dividend strategy: falling prices may still come with opportunities

Corrections on the markets are often painful, as previous price gains are reduced or the investment even slips into the loss zone. However, price declines can also offer opportunities. Our expert Johann Griener presents a possible entry strategy for the dividend share segment.

Is now the right time to invest in equities?

Global equity markets have been under pressure for several months. The short recovery phase in the summer did not last long. What are the reasons for the bear market and when could be a good time to enter?

Emerging Markets Credit Conference – a sentiment snapshot among investors

The mood among investors in the bond sector in emerging markets is mixed, as this year’s Emerging Markets Credit Conference held by US investment bank J.P. Morgan showed. Thomas Oposich, Senior Fund Manager, reports on the conference and his impressions.

Inflation rates (still) too high

The inflation problem continues to preoccupy the central banks. They are likely to maintain their basic restrictive stance until inflation rates have convincingly embarked on a downward trend.

Economy and interest rates in the context of global risks

What do global risks and rising interest rates mean for the economy? We talked to

Prof. Dr. Ernest Gnan, Secretary General of SUERF – The European Money and Finance Forum and former Head of the Economic Analysis Department of the Oesterreichische Nationalbank.

The “Squirrel Principle” – get through winter on dividends

Dividend shares provide regular profit distributions even in difficult times on the stock market. This makes them particularly interesting in the current market environment.

Fed remains on course

The latest US labor market data suggest that the Fed will remain on its course of more restrictive monetary policy. “As long as job growth remains strong and unemployment and participation rates remain low, the Fed will maintain its basic restrictive stance”, writes Head Economist Gerhard Winzer in his market commentary.

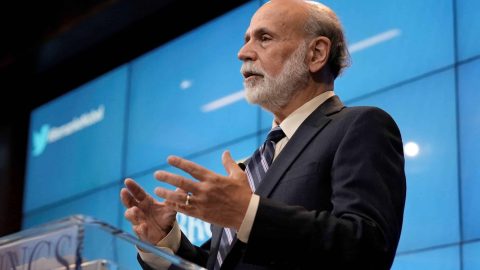

From crisis manager to Nobel laureate

This year’s Nobel Prize in Economics will be awarded to three US economists for their research on banking and financial crises. Among them is Ben Bernanke, who was chair of the US Federal Reserve when the financial crisis hit in 2008 and the global economy was teetering precariously close to the brink for weeks.

OPEC Cuts Oil Production by 2m Barrels per Day, Sparking Criticism From the West

Last Wednesday, the countries of the OPEC+ oil alliance decided on a comprehensive reduction in oil production. As early as November, 2 million barrels less per day will be produced. Many countries fear a rise in oil prices.

Good nerves and stamina required

The mood on the capital markets has deteriorated further over the last months. In a comprehensive market update, Gerald Stadlbauer, Head of Discretionary Portfolio Management at Erste Asset Management, explains why stamina is needed in the current situation.

Excessive Pessimism?

The unexpectedly high inflation rates draw even wider circles. In view of the pessimistic mood, the question arises whether the negative environment is already being reflected by market prices.

What happens to equities when interest rates rise?

So far, the year 2022 has brought significant price losses on the stock markets. Inflation and rising interest rates are often cited as the reason. But why is that the case?

Italy after the parliamentary elections: a path beset by obstacles

Italy has voted: The party “Fratelli d’Italia” around top candidate Giorgia Meloni was the election winner. The center-right alliance together with the parties “Lega” and “Forza Italia” achieved an absolute majority. What consequences could the election results have for the country, its economy and cooperation with the European Union?

Rapid and synchronous key rate hikes

Central banks are responding to high inflation by raising key interest rates. Further key rate hikes are likely this week as well.

New UK Prime Minister and New King During Turbulent Times

The death of Queen Elizabeth II, her succession by Charles III and the appointment of the new prime minister, Liz Truss, mark a change of era in Great Britain. The government’s focus is on the fight against inflation and high energy prices.

Monetary tightening even as growth slows further?

Last week, three major central banks have raised their key interest rates further. By nature, however, it is not easy to find the right key interest rate level – especially in the current environment.

European Forum Alpbach Ends on a Positive Note Despite Ukraine War and Climate Crisis

The 77th edition of the European Forum Alpbach recently came to an end. This year, the symposium was held under the central motto “The New Europe”, with topics such as climate protection or security policy on the agenda.

420 years – The birth of the stock exchange

On August 31, 1602, stock exchange history was written in Amsterdam. 420 years later, Michiel van der Werf, Senior Fund Manager at Erste Asset Management, looks back on the birth of stock exchange trading.

The Meme Stocks Are Back: Bed Bath & Beyond in the Spotlight After Price Rollercoaster

The meme stocks are back. Most recently, the shares of Bed Bath & Beyond in particular have been in the spotlight with a veritable roller coaster ride. What is behind this phenomenon?

For some time valid: Elevated recession risks and restrictive monetary policy

The central banks want to achieve their long-term inflation target of 2%. In order to achieve this goal, they have raised key interest rates and are implementing a restrictive monetary policy. The higher key interest rates will weaken economic growth and also the labour market. Whether this can be achieved without a recession or whether there will be a “soft landing” is currently the subject of heated debate.

Cyber-Roundup 2022: Tesla shareholders demand action on social issues

At the beginning of August, this year’s Tesla Annual General Meeting took place under the name “Cyber Roundup”. The number of shareholder proposals on environmental and social issues reached a new maximum this year.

ERSTE FAIR INVEST – “S” moving to centre stage

About a year ago, the social impact fund ERSTE FAIR INVEST was launched. Reason enough to take a closer look at the fund, which focuses on the “S” in ESG. In addition, fund manager Bernhard Selinger explains in an interview what the term “fair” actually means.

Are Defensive Weapons Social?

The war in Ukraine is also a watershed in terms of European defense policy. In view of the EU’s planned social taxonomy, the question now arises as to what extent the defense industry’s contribution to national security and peace can be considered sustainable.

From the EU Taxonomy to the EU Social Taxonomy?

The EU’s possible social taxonomy could create uniform framework conditions for socially sustainable investments. However, due to the different definitions, the development of such a taxonomy is likely to be difficult.

Practical techniques to analyze social factors in ESG research

So far, there is a lack of uniform standards for socially responsible investments. However, alternative techniques and sources of information can provide insight into the social performance of companies.

What does the “S” in ESG stand for?

As a sustainable investor, Erste Asset Management has been dealing with social indicators in the evaluation of companies and countries for more than ten years. But how are these social aspects addressed and what do they mean?

ESG investments – “S” is for sexy?

Human rights, child labor, arms production, … – the range of social issues in the ESG universe is long. Besides environmental and governance aspects, social issues are becoming increasingly important when it comes to sustainable investment. A possible EU social taxonomy could bring new standards for sustainable investments and thus bring the “S” in ESG even more into focus.

Jackson Hole – Focus on Monetary Policy

This week, the highly acclaimed Jackson Hole Economic Symposium will take place. Fed Chairman Jerome Powell’s speech will be the center of attention.

“Green Rush” – The Inflation Reduction Act

The Inflation Reduction Act recently passed by the US Senate is intended to get the USA back on track in terms of climate protection. By 2030, 369 billion US dollars are to flow into renewable energies through various channels.

Very tight labor market in the USA

Many economic indicators point to weakening economic momentum. Meanwhile, the US labor market continues to be very robust, which recently mitigated the immediate risks of recession in the United States.

OPEC+ Agrees Minimal Increase in Production Volumes

Hopes were pinned on a significantly higher increase to put the brakes on the soaring oil prices. At present, it is mainly the oil companies that are benefiting from this, as they recently reported record profits.

Croatia entering Eurozone – Farewell to Kuna

Croatia’s entry into the euro area is a done deal. Ivana Kunstek, Senior Fund Manager at Erste Asset Management Croatia, talks about her home country’s path into the eurozone.

The Euro – a Snapshot

For more than 20 years, the euro has been the instrument of payment for around 340 million people. What is the current state of our currency and what opportunities and challenges does the euro face?

Energy commodities and inflation – where are we going?

Prices for energy and food have risen significantly, putting a strain on consumers’ wallets. If the Russia-Ukraine war does not ease, the situation may deteriorate even further.

Recession Risks

Ahead of the upcoming interest rate decision by the Federal Reserve, a number of economic indicators point to increasing risks of growth or recession. There are also uncertainties regarding the further development of inflation and the effectiveness of monetary policy measures.

WIIW Forecast Sees Eastern European EU Countries Well-Equiped to Handle Consequences of War and Inflation

For this year, experts at the Vienna Institute for International Economic Studies (WIIW) expect economic growth of 3.3% on average for the EU members in Central, Eastern and Southeastern Europe.

Mega interest rate hikes indirectly increase purchasing power

Gerhard Winzer, Chief Economist at Erste Asset Management, provides an overview of recent economic developments and explains, among other things, what structural problems the euro is facing.

Japan Faces Possible Monetary Policy Change Following Upper House Election

Prime Minister Fumio Kishida’s ruling LPD won a resounding victory in the upper house election. With a solid majority, Kishida could now initiate reforms in security and energy policy. In addition, the extremely loose monetary policy that has been in place for years is being put to the test.

YOU INVEST funds become sustainable – Questions and answers about the reorganization

Gerhard Beulig, Senior Fund Manager at Erste Asset Management, answers the most important questions about the reorganization of the YOU INVEST funds.

Mixed outlook for the second half of the year

Ahead of the upcoming reporting season, several negative factors dominate the markets. Tamás Menyhárt, Senior Fund Manager at Erste Asset Management, sums up the stock market year so far and shares his views on the further development.