The financial markets are facing high uncertainty on several levels. This concerns inflation, economic growth, monetary policy and geopolitics both in the short term (this year) and in the long term. The markets are trying to deal with this uncertainty.

The hope that there will be no further increase in commodity prices due to the absence of quantity restrictions on commodities (export restrictions on the part of Russia and / or import restrictions on the part of the West) has led to price increases in equities and a narrowing of credit spreads in recent days. If the economic impact of the war in Ukraine does not upset the economic expansion, the pressure on central banks to raise key interest rates to higher levels sooner and faster will increase. At the same time, however, the risk of a failure of the peace talks and further sanctions remains considerable.

Pressure on central banks increases

From a market perspective, the most important event in the past few days was the further increase in expectations of a key interest rate hike in the USA (mini interest rate shock). In the meantime, a key interest rate of just under 2.5% has been priced in for December 2022 and an interest rate of just under 3% for December 2023. The decisive factor was a speech by Fed Chairman Powell entitled “Restoring Price Stability”. Little was new in terms of content, but the tone was even more hawkish than the Federal Open Market Committee press conference a few days earlier. The speech described the labour market as very strong and inflation as far too high. The answer to three self-asked questions was clearly “hawkish”, i.e. focused on achieving the inflation target in a hawkish tone.

- What will be the impact of the Ukraine war? Answer: No particular concern discernible.

- How likely is it that monetary policy can lower inflation without triggering a recession? Answer: The Fed will do its best to successfully meet this challenge. The economy is very strong and well positioned to cope with tighter monetary policy.

- What will it take to restore price stability? Answer: If it is appropriate to raise the policy rate by more than 25 basis points (25 basis points = 0.25 percentage points) at one or more meetings, we will do so. And if we conclude that we need to adopt a restrictive stance (above a neutral policy rate level), we will do that too.

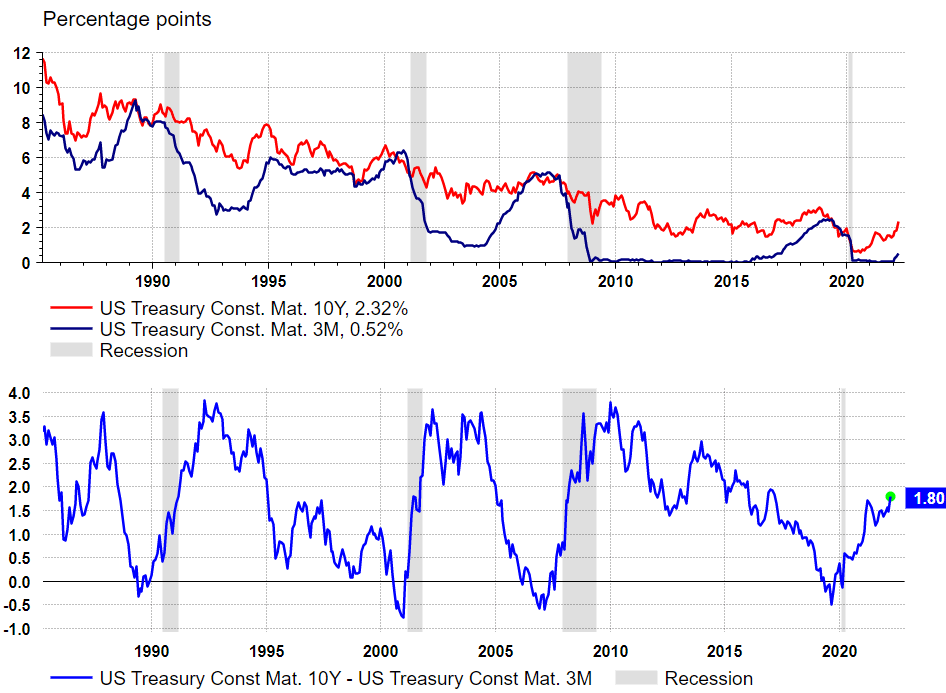

US-Bond yields (3M, 10Y constant maturity; – 10 years)

Source: Refinitiv Datastream/Fathom Consulting as of 31/03/2022

Inflation higher than expected

Inflation rates in February were in many cases higher than expected (OECD area: 7.7% yoy). Energy prices recorded the strongest increase. Food price inflation was equally remarkable. It is worth noting that core inflation (excluding food and energy) was also strong. High core inflation rates are an important argument for central banks in advanced economies to bring forward or accelerate the cycle of interest rate hikes. With the war in Ukraine, commodity prices have risen further. Mainly because of this, the first inflation reports for March show further increases in inflation (Germany: 2.5% monthly / 7.6% annual). Inflation rates could continue to climb in the coming months. This is also indicated by the preliminary Purchasing Managers’ Index for March: Companies’ selling prices continued to rise in March. Consumers’ inflation expectations are also on the rise. The risk of secondary round effects is greater the lower the unemployment rate (low at 5.3% in the OECD area) and the stronger the economy is growing (the less the economy is affected by the war in Ukraine).

Purchasing managers’ indices remain robust

On a positive note, the preliminary Purchasing Managers’ Indices for the advanced economies for the month of March showed only a comparatively small impact of the war in Ukraine on activity. Moreover, the strong increase in the purchasing managers’ index for the service sector since January can be attributed to the diminishing negative influence of the omicron variant. From a central bank perspective, this reduces the concern of triggering a recession with key interest rate hikes.

The expectation and sentiment indicators, on the other hand, point to a clear deterioration. In the aggregate purchasing managers’ report, the component “future production” shows a clear decline. On the business side, the sharp decline in the expectations component of the IFO-report in Germany in March stands out. The value has approached the pandemic low of April 2020. Similarly, consumer sentiment in the Eurozone is only just above the pandemic low according to the European Commission’s March report. These reports point to downside economic risks that are greater in Europe and the Eurozone, respectively, than in the US.

Conclusion:

In the US, swift rate hikes to levels of 2.5% by the end of 2022 and 3% by the end of 2023 have become likely. In March, the Fed already raised the key interest rate for the first time by 0.25 percentage points to 0.5% (upper band for the key interest rate). At the next two central bank meetings, the key interest rates could even be raised by half a percentage point each. Although the European Central Bank will only proceed moderately because wage growth is significantly lower in the Eurozone and economic risks are greater, an exit from the negative interest rate policy this year is likely. The key interest rate for the deposit facility is currently at minus 0.5%. By the end of 2022, this rate could be raised to zero percent.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.