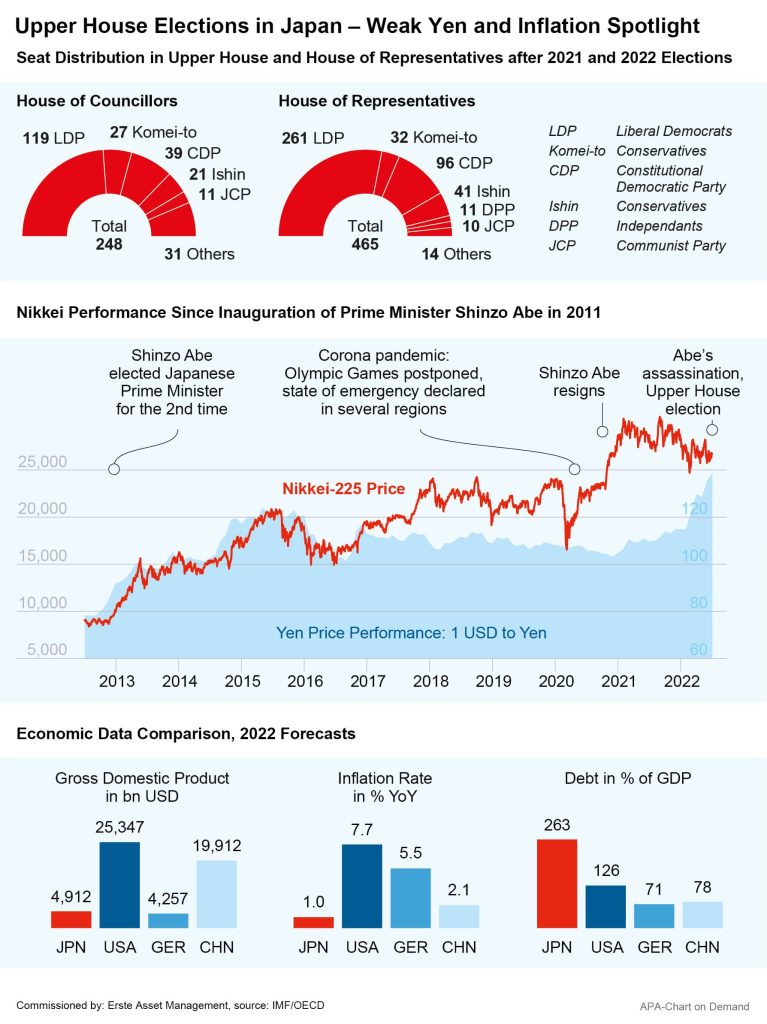

Japan’s ruling Liberal Democratic Party (LDP) of Prime Minister Fumio Kishida won a resounding victory in last week’s upper house election. Voters thus opted for stability in a difficult environment two days after the fatal assassination of former party and government leader Shinzo Abe. The LPD won 63 of the 125 seats in the upper house, securing a comfortable majority even without its coalition partner Komeito. In the lower house, the other chamber of parliament, the two parties already hold a majority.

This gives Kishida a solid majority to tackle the country’s current challenges, one of them being a new record of 110,000 daily COVID-19 infections reported on Saturday. Japan also continues to struggle with the economic consequences of the Ukraine war, rising food and energy prices and a tightening security situation in the face of Russia’s and China’s power ambitions.

Observers now keenly wait to see whether Kishida will continue the course set by former LPD chairman Shinzo Abe. Abe made his mark on the country during his record term in office from 2012 to 2020 and is considered the architect of modern Japan. Besides his economic policy doctrine, christened Abenomics, a change in security policy orientation was considered Abe’s greatest concern. Japan’s constitution is a legacy of the Second World War and prescribes a purely defensive security policy for the country. Abe had the constitution reinterpreted to strengthen the country’s role, but he did not succeed in changing it.

Government Plans to Double Military Spending

However, growing fears of an expansionist China and Russia’s war against Ukraine have changed the mood in the country. Kishida could now realise Abe’s life goal and turn Japan’s defence forces into a strong military with a constitutional amendment. Before the election, the LPD already held out the prospect of doubling the defence budget from one to two per cent of the gross domestic product. This would also allow Kishida to secure the support of the hardliners in his party and possibly give him a free hand for economic policy reforms.

Abe had stimulated the economy from 2012 onwards with a combination of extremely loose monetary policy and debt-financed government investment and structural reforms. Japan’s central bank kept interest rates down as part of a strict zero-interest rate policy. Particularly huge bond purchases played an important role in controlling the yield curve in the market. This stimulated investments and also enabled the financing of large government debts. In the meantime, the central bank already holds more than 50 per cent of outstanding government bonds and is the absolute largest lender to its own country.

With the flood of money in the form of bond purchases and low interest rates, Abe also wanted to fight the deflation running rampant for decades. The effect of this policy on the Japanese yen was also quite desirable for many years: low interest rates help lower the yen’s exchange rate, which in turn helps the strongly export-oriented Japanese economy. A weak yen also makes it easier to repay government debt.

Abenomics Under Scrutiny

However, in the meantime the general conditions have changed. Japan is the most indebted industrial nation. Rising food and energy prices are increasingly causing problems for Japanese consumers, but wages and salaries have been stagnating for many years. The result is a decline in real wages. While other nations’ central banks have already started to raise their interest rates in the fight against inflation, the Bank of Japan continued to maintain its low interest rate policy. The interest rate differential is thus widening and putting additional pressure on the already weak yen.

The currency’s weakness, which was desired for a long time, is now increasingly becoming a problem and is further fuelling inflation. Only a few days ago, the yen fell further, while the dollar rose to over 138 yen for the first time since 1998. Japan’s finance minister and his US counterpart Janet Yellen have recently warned that the yen’s weakness could attract speculators and further increase the currency’s volatility.

A Change in Monetary Policy Could Be Imminent

In this changed environment, however, Kishida could now move away from the long-standing doctrine of Abenomics. Much depends on the upcoming appointment of a new central bank governor in April, as Abe’s chosen central bank governor Haruhiko Kuroda needs to be replaced. A new central bank governor could also mean a reboot of the Bank of Japan’s monetary policy orientation.

In view of rising energy prices, Kishida also wants to radically change course in energy policy. In 2012, Japan decided to phase out nuclear energy following the nuclear disaster in Fukushima. Kishida’s government now wants to put reactors that have been shut down back into operation and increase the share of nuclear energy in the energy mix to 20 to 22 per cent. The population is likely to back him in this. The recent heat wave triggered concerns about Japan’s power supply stability and also led to a rethinking of nuclear power use.

Japanese stock market: opportunities after price losses in the 1st half of the year

In the wake of the lockdowns in neighboring China, the global interest rate turnaround and increasing economic concerns, the prices of Japanese equities also fell in the 1st half of the year. Compared with other indices, the price declines were not as severe: the NIKKEI 225, for example, lost 8.4 percent from January to the end of June, while the technology-heavy U.S. NASDAQ 100 lost around 30 percent in the same period. One of the reasons for the relative strength of the stock market was the loose monetary policy of the central bank outlined above and the extremely weak yen.

The mood of investors has probably improved since the beginning of July. The weak currency is good for export-oriented companies like Sony and Nintendo, which can bring their game consoles to consumers worldwide at lower cost. Whether the stock market will reward this competitive advantage in the longer term remains to be seen.

ERSTE RESPONSIBLE STOCK JAPAN – Japanese stocks sustainable

The lower stock prices compared to the beginning of the year are an opportunity to buy into the Japanese stock market at a lower entry price. The ERSTE RESPONSIBLE STOCK JAPAN fund offers the opportunity to invest broadly diversified in a portfolio of more than 120 selected sustainable stocks in the “Land of the Rising Sun”. In addition to the opportunities, the development of the Corona situation with possible further lockdowns in China and other Asian countries should be kept in mind when making personal investment decisions.

ERSTE RESPONSIBLE STOCK JAPAN – Opportunities and risks at a glance:

Advantages for the investor

- Broad diversification in Japanese companies even with low capital investment.

- Opportunities for attractive value growth.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital growth.

Risks to be considered

- The fund price may fluctuate strongly (high volatility).

- Due to the investment in foreign currency, especially in Japanese Yen, the unit value may be affected by changes in exchange rates.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK JAPAN as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK JAPAN, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK JAPAN as described in the Fund Documents.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.