Latest Posts

ERSTE FUTURE INVEST: Megatrends cannot be stopped

Interview with fund manager Bernhard Selinger on the development of the fund ERSTE FUTURE INVEST.

Upward trend at the beginning of the week – Update from the Investment Division

At the beginning of the week stock markets continue the upward trend of the previous week and the WTI oil price falls in double digits to a multi-year low. What will we see this week?

Corona and the oil market

The oil market won’t escape the corona virus unscathed either. Within only two weeks, oil recorded its best and its worst day of the millennium so far.

Stock market rally– Update from the Investment Division

What has occurred since yesterday ? Markets Stock markets continued to rally yesterday. Europe was up slightly by 0.65%. USA clearly in positive territory at approx. 3%. Asia is slightly in negative territory as of this morning. The oil price fell back down to USD 20.30 (WTI). Gold remained strong at USD 1720 per ounce. […]

Easter weekend with a difference – Update from the Investment Division

What has occurred since last Friday ? This Easter weekend was quite different compared to other Easter weekends of the past. Even if our countries will be on the forefront to loosen the lock-down over the next months not much could be felt from any resurrection yet. At least the OPEC-countries and their allies including […]

Erste Asset Management excludes oil companies

Austrian sustainability pioneer withdraws early from the oil sector in all sustainable funds with eco-labels. What are the reasons?

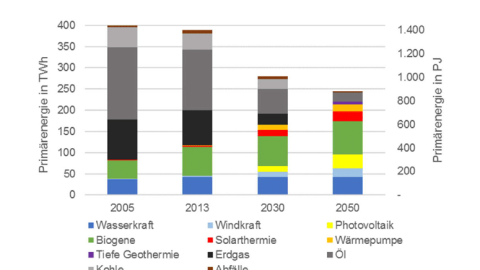

Electricity & Energy – facts & figures

*ESG stands for Environmental, Social and Governance“ – These are the three broad categories according to which companies are examined in sustainable investment. Disclaimer: Forecasts are not a reliable indicator for future developments.

Ørsted AS: Best Practice and Environmental Leader

According to our evaluation, the Danish Ørsted AS is among the leading companies in the environmental sector, which results from a radical transformation of the business model that the company has gone through in the recent decade. Whereas ten years ago the company produced 85% of its energy from fossil fuels and only 15% from […]

Time is running out

Many of the companies in the utilities sector have so far failed to implement a comprehensive decarbonisation strategy. Utilities sector: assessment & engagement According to the analysis by our partner MSCI, less than half of the companies in this sector[1] have set themselves goals such as the ones required for the containment of climate warming […]

Energy and phasing-out of coal-based electricity

The topic of energy and electricity provides an excellent background to have a closer look at the issue of energy transition. The prevalent energy mix, which is still very much geared towards fossil fuels, is in the process of transition, as also pointed out by Erste AM’s research partners. The comeback of coal? The current […]

Green bonds for clean energy

Green bonds are bonds whose issue proceeds are exclusively used to finance existing or new projects with environmental benefits. Long tradition In 2007, the European Investment Bank (EIB) issued the first green bond and called it “Climate Awareness Bond”. While during the first years this young market segment was largely driven by supranational issuers and […]

Divesting oil – personal preface included

When I think back to my first school outing to the refinery in Schwechat (Lower Austria), the first thing that comes to mind are the excellent wiener sausages at the canteen. The highly complex processes involved in the refinement of crude oil, on the other hand, are hard to digest even for an adult. Divesting […]

Reduction in Covid-19 deaths – Update from the Investment Division

What has occurred over the weekend ? On Friday and also over the weekend some movement happened in the talks between Russia and Saudi Arabia about possible oil production cuts. After the last talks of OPEC+ about a month ago ended without an agreement between those two countries Saudi Arabia increased the oil production unilaterally. […]

Dow Jones: A brief history of the crisis

As the world’s best-known stock index, the Dow Jones Industrial index provides an overview of the most serious crises from the perspective of the financial markets. History shows that a deep fall does not necessarily mean a long dry spell.

Increasing oil price – Update from the Investment Division

Yesterday the rise in oil prices was particularly noteworthy in the markets. What do rising oil prices mean for the global economy?

Our update from the Investment Division.

Lehman Brothers and Coronavirus -A (Preliminary) Tale of Two Crises

The Lehman Brothers crash in 2008, like the current corona virus crisis, had a massive impact on the stock markets. We look back and compare the two.

Positive summary of last week – Update from the Investment Division

What has occurred over the weekend? Equity markets had a good week. The US-equity index S&P 500 gained + 10,3%. Also the European markets gained significantly. The EuroStoxx 50 gained 7,5%. A bit negative were the losses on Friday (S&P 500 – 3,4%, EuroStoxx 50 – 4,2%). Volatility in the markets remained on a higher […]

For 3 day win streak – Update from the Investment Division

What has occurred since yesterday ? Global equity markets closed yesterday the third day in a row with strong gains. The US leading equity index increased by 6,2%. The European exchanges could see gains of 1% to 3%. The credit risk margins für High Yield Corporate Bonds decreased again considerably. Also on the markets where […]

“Mr. Market” two positive days in a row – Update from the Investment Division

What has occurred since yesterday ? Two positive days in a row on the American stock markets. Something we saw the last time on 11. + 12.2020. Mr. Market was in a good mood over the last two days. After the US-American equity index S&P500 gained almost 9% on Tuesday it increased also yesterday by […]

Bull movement – Update from the Investment Division

What has occurred since yesterday ? Bull movement. Prices of risky asset classes, e.g. equity increased. Of course the question remains if it is just a short, technical upward spurt or a stable base. The reason for the better mood in the market is the agreement in the USA on a USD 2000 billion stimulus […]

What is helicopter money?

While traditional monetary policy measures are also employed, the focus has recently shifted to a concept that has always been the subject of debate: helicopter money.

Father of value investing – Update from the Investment Division

What has occurred since yesterday ? Benjamin Graham focused on fundamental equity analysis and became widely known as the “father of value investing”. Equity should only be purchased at a discount to its fundamental value. In his book “The Intelligent Investor” Graham creates a character called Mr. Market, a fellow who turns up every day […]

Coronacession

The world is in a state of emergency, with the corona pandemic constituting a global health, economic, and financial crisis. The term “Coronacession” has been created as a chimaera of corona and recession. The central question is how deep the emergency runs and how long it will last. The speed of the development is breath-taking. […]

Restaurants & petrol stations: how do support measures for the economy work?

We’ve repeatedly reported on monetary and fiscal policy measures in recent weeks. Today we want to show the effect of economic stimulus packages with simple examples.

The ordinary becomes special – Update from the Investment Division

What has occurred since yesterday ? Sometimes the ordinary becomes something special. To prove the validity of this heuristic, we will use the database of our Bloomberg terminal once again. On the 24,060 trading days of the leading US index S&P500 since 1928, the average daily change has been +0.02%. In contrast, for almost a […]

Rollercoaster ride continues – Update from the Investment Division

Rollercoaster ride continues. What has occurred since yesterday? And what will we be observing in the coming days? Update from the Investment Division

Historic decline in US equity markets – Update from the Investment Division

What has occurred since yesterday (17.3.2020)? Yesterday´s update started with the advantages of the Bloomberg terminals and also today we used the huge data base. Yesterday we reported on the ten days where the American equity index S&P500 had its largest losses on the same day. These ten days occurred in six different years: 1929, […]

Is China back to work?

When do people in China return to work and how quickly will the economy recover from the coronavirus shock? Our senior fund manager Jenny Teng analyzes the current situation.

Living in volatile times – Coronavirus

The update of our Investment Division What has occurred since yesterday In his address to the National Union of South African Students in Capetown 1966 in regards to the US-American civil rights movement Robert F. Kennedy said the following: „There is a Chinese curse that says: “May he live in interesting times” If we want […]

20th anniversary of the dot-com bubble: The return of tech stocks

20 years later: The high point of the “dot-com bubble” is approaching. Stock markets and technology stocks plummeted at the time but investors were still able to make a small fortune. We take a look at the return of technology stocks.

Distortions on the financial market

The distortions on the financial market continue, and the prices of risky asset classes such as equities and corporate bonds with low credit quality are falling. Market prices have increasingly come to reflect a global recession.

Coronavirus: US rate cut and now what?

The corona virus leaves traces in financial market policy. The US Federal Reserve cut interest rates surprisingly early on Tuesday. Erste AM chief economist Gerhard Winzer explains this measure in our interview.

Coronavirus: The economic effects of epidemics and pandemics

What are the economic effects of an epidemic or pandemic? Our Experts went through relevant studies in order to be able to give a well-founded assessment. The results are surprising.

Erste Asset Management integrates sustainability in funds and on corporate level

Erste Asset Management expands on its pioneering role in the area of ethics and environmental issues. The company is taking the next step by making sustainable criteria an integral part of a large number of its investment decisions.

Coronavirus starting to affect global corporations

Coronavirus: The spread of the virus is the defining issue in the financial markets. Global corporations such as Apple, Adidas and AT&S are also suffering the economic consequences.

Turbulent start of the year for oil

Oil prices came under pressure at the beginning of the year. The consequences of the coronavirus in China were cited as the main reason for the fall in prices.

How does the struggle for a stable oil price continue?

First virtual chart analyst – bot learns to “look at” charts

The intuition of an experienced chart analyst contributes significantly to a correct forecast. With the help of around one million charts of shares, Erste AM trained the world’s first virtual chart analyst.

Coronavirus: epidemic in China disrupts recovery scenario

Coronavirus: The economy is increasingly affected by the virus crisis. Will China’s economy be able to withstand the pressure despite resistance? Analysis by Erste AM chief economist Gerhard Winzer.

Problem children vs. favourite children in Latin America

Fund Manager Peter Paul Pölzl gives a detailed outlook on the loved ones and problem children among the countries in Latin America. How are China’s economy and Latin America related?

Climate change and other challenges front and center at the WEF

At the World Economic Forum in Davos, topics from business, politics and science were discussed. However, climate protection received the most attention. How is the global economy doing?

And what is the outlook for 2020?

US banks report good and bad developments in the financial sector

The reporting season with the largest US banks started on Wall Street last week. Their results give a good impression of how the previous year went and what trends can be identified for this year.

Russian equities: attractive valuations and high dividend yield

After the strong stock market year 2019, the chances are good for further price gains on the Moscow stock exchange. The extremely low valuation of the shares and the high payout rates make Russian shares one of the most attractive stock market segments. Read more in the interview with ERSTE STOCK RUSSIA fund manager Alexandre Dimitrov.

2019 stock market review

Our 2019 stock market review: for investors around the world, 2019 was by and large a continuation of the previous year: the trade dispute between the US and China and the back and forth over Brexit remained the dominant topics.

Frankincense, myrrh, or gold? Have you found the right Christmas present yet?

The gifts of the three Magi to the new-born Christ Child are well known. Even back then, gold was of high value due to its scarceness and was regarded as a special kind of paying one’s respects to someone. Frankincense and myrrh have since then lost some of their appeal as gifts, but it is […]

Gold: the most sustainable commodity in the world?

Guest commentary by expert Ronald-Peter Stöferle The public is still being fed the narrative of gold being a dirty metal. Gold is considered environmentally reproachable because open-pit mining requires enormous volumes of rock to be moved; and in rare cases, mercury is used in the process. Gold is also regarded as soiled in terms of […]

All that glitters is not gold

To extract gold, copper, nickel, tungsten and other metallic raw materials, entire ecosystems are destroyed. Guest author Georg Scattolin from the WWF, on environmental threats in the extraction of raw materials.

Tiffany as exemplary company in the field of sustainability

The takeover by LVMH raised the media profile of Tiffany last week substantially. Not only financial aspects, but also the sustainability strategy make the company attractive. Tiffany has gone through an impressive development in terms of sustainability. The company has co-financed or implemented numerous projects to facilitate a better and more environmentally friendly production of […]

Gold with traces of rust

Hardly anyone can escape the fascination of gold. But, what is the economic function of gold, and how does it perform socially and environmentally?

Bargains, sales and dividends: Hopeful signs for US retail investors

Thanksgiving, Black Friday and Cyber Monday are considered to be the weeks with the highest retail sales. How can investors benefit from the US Christmas business?

Positive bottom line for our funds in 2019

Only a few weeks left and then 2019 is history. Thanks to booming stock exchanges and yet another increase in bond prices. Investors can look back on a pleasing balance sheet.