The development of world food affairs is shaped by the continuous rise in demand for animal products. Where has meat consumption increased most?

The increase in meat consumption is due to changes in dietary habits: the food revolution is happening mainly in developing countries which account for the majority of global population growth. According to the Food and Agriculture Organization (FAO), global meat production has almost quadrupled since 1965, from 84 million tonnes to 335 million tonnes.

According to data from FAO, meat consumption is up an annual 5-6%, while the consumption of dairy and poultry products rises by 3.4-3.8% per year. Historically speaking, China and Brazil account for large parts of consumption growth: the global average per capita consumption of meat increased from 30.7kg in the 1980s to 36.4kg in the 1990s. This is largely due to the strong increase in pork production in China during that period; in Brazil, meat consumption increased by 55% from 1975 to 1990.

The FAO also expects this trend to continue, because emerging countries will likely converge towards this “Western diet” that is heavy in meat consumption.

Meat production is tied to animal feed

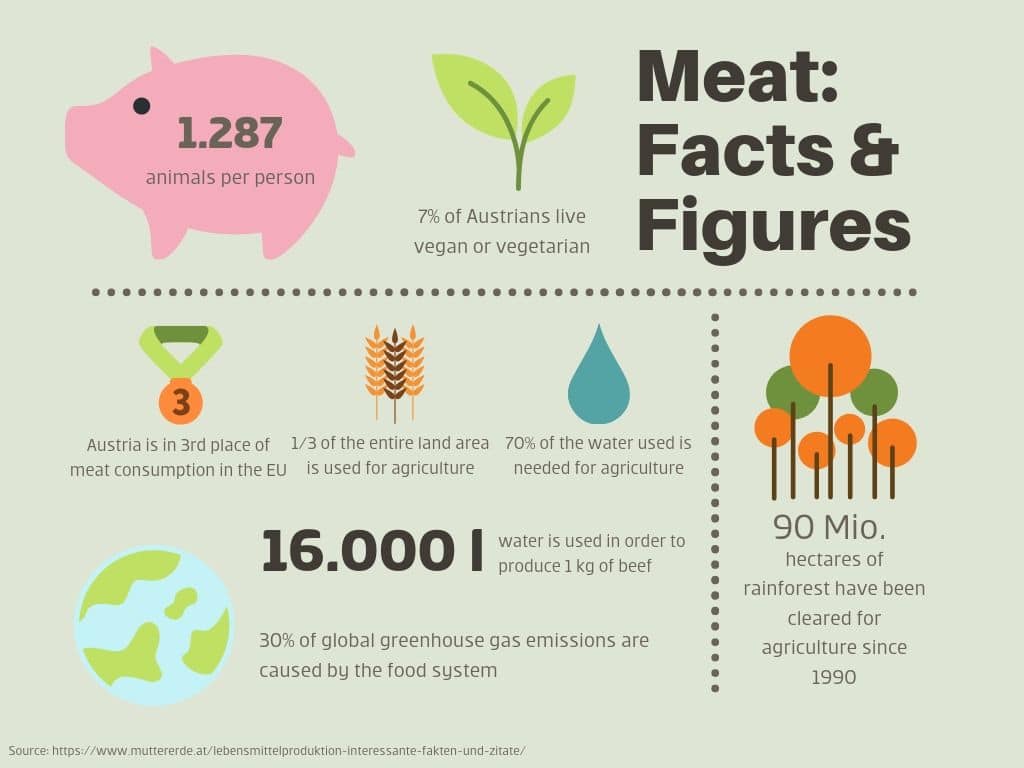

The rising demand for meat is correlated with demand for animal feed (mainly grain and oilseeds), whose cultivation also comes with negative environmental and climate effects:

- The large-scale cultivation of animal feed ousts primary forests, which are an important CO2 reservoir

- The use of chemical fertiliser is both energy- and CO2-intensive and burdens the environment, because the application on fields also affects other ecosystems such as waterways. The higher content of nutrients in the water makes these systems uninhabitable for sensitive forms of life

- Pesticides that are also used by conventional agriculture have negative effects on the environment and are suspected of carcinogenicity

Bayer AG & Monsanto Co: punitive damages

After the takeover of Monsanto by Bayer, the herbicide Roundup was faced with numerous lawsuits in the USA. This herbicide is part of the portfolio of Monsanto and has been suspected of carcinogenicity.

Bayer AG has been accused of underestimating the legal and reputational risks that came with the takeover of Monsanto and that could have a detrimental effect on the enterprise value. The international proxy advisory form ISS (International Shareholder Services) therefore suggested to express discontent with this misjudgement by refusing to discharge the Management Board from liability at this year’s AGM.

In a reaction, Bayer AG pointed out that according to the results of numerous studies a link between Roundup and carcinogenic diseases could be ruled out.

However, in the United States three verdicts have been passed to the contrary; in the most recent verdict, the plaintiff couple has been awarded more than USD 2bn, the highest amount of punitive damages to date. Punitive damages means that the fine exceeds the damage so as to have a deterrent effect. Bayer AG is confronted with about 13,000 lawsuits in the USA in connection with its glyphosate-based products.

A ban of glyphosate use has been discussed as well: in Los Angeles, it has already been introduced; the herbicide cannot be used until official healthcare bodies and environmental protection officers can ensure that the substance is harmless. A majority may be found in favour of a ban in Austria as well.

Bayer Management Board refused discharge from liability by shareholders

At the AGM held on 26 April 2019, a 56% majority voted in favour of refusing the Management Board discharge from liability, while a 66% majority voted to grant the Supervisory Board said discharge. This result has symbolic character. Much like in the case of climate-related motions in the past (Exxon Mobil, 2017), investors are making increasing use of their vote in order to address topics of sustainability that could negatively affect the enterprise value.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.