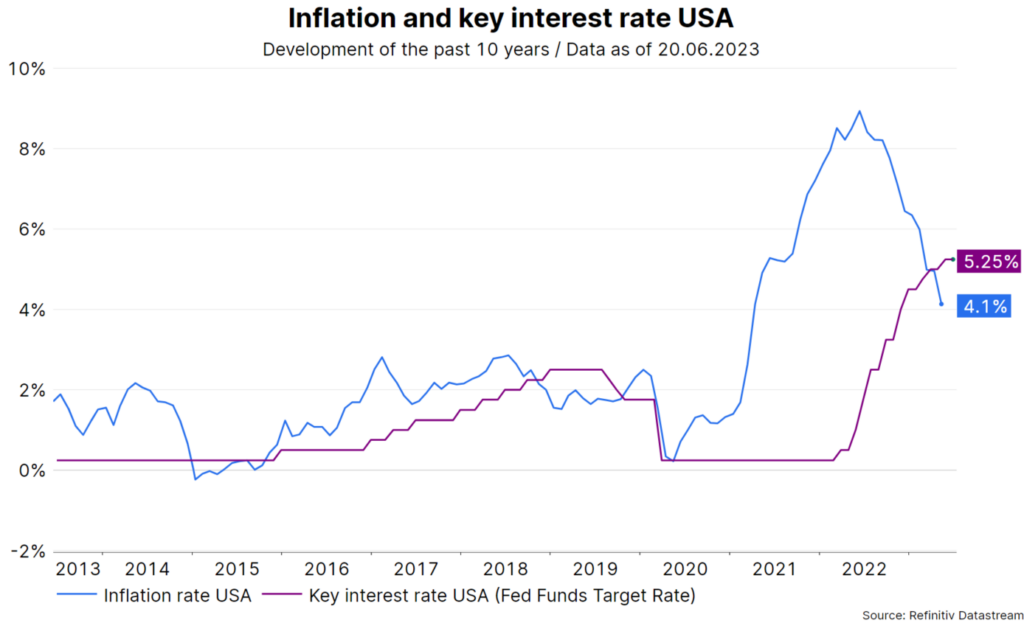

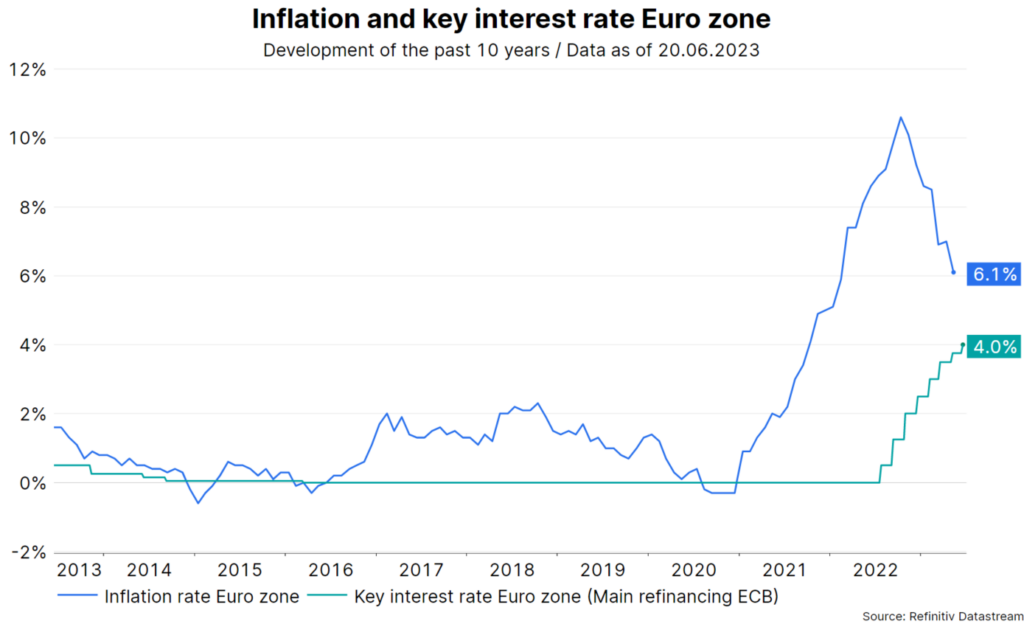

After the big inflation and interest rate shock, both central banks and markets have been trying to get their bearings for several months. Since mid-May, the future key-lending rates priced into the market have risen again. The market thus expects monetary policy to remain restrictive, with the determining factor being the dynamics in inflation. Although inflation rates are falling, they are doing so more slowly than expected.

Last week, the central banks in the USA and the Eurozone raised their inflation expectations. Accordingly, further key-lending rate hikes were also announced. At least there are some signs of a further decline in inflation.

No interest rate move in the US

The world’s most important central bank, the Fed, left the range for the effective key-lending rate (i.e. Fed funds rate) unchanged at 5% – 5.25% last Wednesday, despite raising Q4 inflation expectations for 2023 to 3.9% year-on-year. The March estimate for the so-called core PCE deflator had still been at 3.6% for Q4.

Even though the Fed funds rate remained unchanged this time, the central bank hinted at several rate hikes for the future. On average, the meeting participants expect a rate of 5.6% for the end of 2023, up from previously 5.1%.

Rate hikes temporally stretched out

There is a strategy behind this. The more the Fed funds rate approaches a sufficiently restrictive level, the more cautious the central bank becomes with interest rate hikes. The idea is to keep the risk of excessive rate hikes, which would unnecessarily trigger a recession, as low as possible.

After the Fed has reduced the extent of interest rate hikes per meeting in recent months, the path of interest rate hikes is now being stretched out over time. The Fed will now refrain from raising key-lending rates at each meeting. This gives the central bank more time to better assess the effect of past rate hikes and their monetary policy on growth and inflation.

After all, in the month of May, core inflation in the service sector (total excluding food, energy, and housing costs) fell to a low of 0.16% month-on-month. In addition, consumer inflation expectations have declined significantly in two surveys by the New York Fed and the University of Michigan. This also reduces the probability of inflation persistence, i.e. inflation remaining at a very high level.

Three criteria for the ECB’s approach

In contrast to the Fed, the European Central Bank raised key-lending rates further by 0.25 percentage points. The main refinancing rate is now 4.00%. The ECB bases its strategy for fighting inflation on three criteria:

- How far above the central bank’s inflation target of 2% is the inflation forecast?

The central bank has raised its expectation for consumer price inflation excluding energy and food, i.e. the core rate, for 2025 from 2.2% in March to 2.3%. This is a clearly hawkish signal – more rate hikes are needed. - The underlying inflation process

Core inflation continued to fall in May but was still much too high at 5.3% year-on-year. At least core inflation is falling at monthly intervals. - The effect of the previous key-lending rate hikes on inflation

Little is yet evident here, which is probably only natural. The influence of monetary policy on inflation is subject to considerable uncertainty, both in terms of strength and duration. With regard to the ECB meeting in July, a key-lending rate hike is in any case very likely, according to ECB President Christine Lagarde.

Bank of England also expects further interest rate increase

The Bank of England is also expected to raise key-lending rates in the United Kingdom this week. Market prices reflect a hike from 4.5% to 4.75%. The driving factor behind this is the very tight labour market. Unemployment is low, employment growth is outpacing weak economic growth, and wage growth is inconsistent with the 2% inflation target because productivity is subdued.

Conclusion: soft or hard landing?

With regard to the assessment of the level at which the cycle of interest rate hikes implemented by central banks will terminate, we are still in an upward revision process. Inflation is falling, but only slowly so. Currently, the working assumption is that the Fed, the ECB, and the Bank of England will all raise their respective key-lending rates by at least another 0.5 percentage points (to 5.75%, 4.5% and 5%, respectively).

In the past, restrictive monetary policies would usually trigger a recession (a so-called hard landing). Hopes for a soft landing are fuelled by falling inflation rates and economic indicators that point to low economic growth but no recession. The next important data in this context will be the preliminary purchasing managers’ indices for the month of June for the major developed economies on 23 June.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.