In the first quarter of 2023, the global economy grew strongly. The indicators for the second quarter are mixed, but suggest trend growth. At the same time, the inflation indicators are still too high. For the central banks, this implies the pursuit of a restrictive monetary policy regime. In the past, this policy has caused a recession. Although there are already some negative growth indicators, the cause of the recession fears lies mainly in the statistical relationship between key interest rate hikes and a subsequent recession.

Strong global growth in the first quarter

After the high growth of gross domestic product in China (10.8%), growth around trend is expected this week for the USA (2.0%) and the Eurozone (0.8%). The expected growth in South Korea is below trend at 0.8%.

The figures refer to growth at quarterly intervals extrapolated to the year, i.e. actual growth times four. Overall, global real economic growth in the first quarter could be annualized at around 4%, with growth in the developed economies being around 1.8%.

Monthly indicators net positive

Although the high-frequency monthly growth indicators are mixed, they point to trend growth for the second quarter. On the positive side, the preliminary purchasing manager indices for the major developed economies for the month of April stand out. These have continued to rise in the USA, the Eurozone, the UK and Australia.

A common feature of the country indicators is that the dynamics are located in the service sector. The manufacturing sector remains weak, even though the manufacturing purchasing manager index has risen in Japan and the USA.

Leading indicators of recession

There is a reason why the timing of a recession is rarely properly predicted. In a recession, economic data usually does not deteriorate gradually, but in a surprising and sharp way. The unemployment rate is rapidly increasing by several percentage points.

Attempts are being made to identify a recession with so-called leading indicators, but with modest success. However, they can be used to identify the general risk of a recession. The US indicators that are currently giving the biggest warning signs are the inverted yield curve – due to the restrictive interest rate policy, the short-running ones are above the long-term yields – the falling Leading Index of the Conference Board, the rising trend of applications for unemployment benefits and the tightening of lending standards until January 2023. For the latter, most analysts are expect a further tightening.

Uncomfortable high inflation

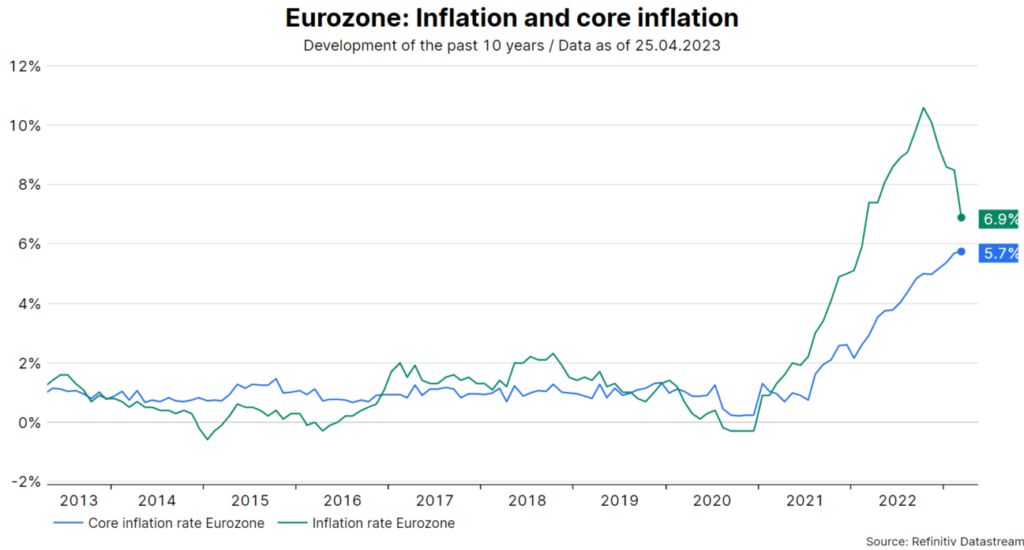

The growth risk is significantly influenced by the development of inflation. If inflation falls quickly, the central bank can lower the key interest rates. This would also reduce the risk of growth. However, the inflation indicators are still uncomfortably high. Last week, consumer prices in the UK for the month of March rose by 0.8% on a monthly basis to 10.1% at an annual rate. In the Eurozone, the headline index shows a falling trend at an annual rate (6.9% in March after 8.8% in February), but the core rate (total number excluding energy and food) shows an upward trend (5.7% after 5.6%).

Note: Past performance is not a reliable indicator of future performance.

Key indicator growth in labor costs

This week, probably the most important inflation indicator is the labor cost index in the USA for the first quarter. The expectation amounts to an increase of 1.1% at a quarterly basis. Extrapolated to the year (increase by four), this means a high wage inflation of 4.4%, which is not in line with the central bank’s inflation target of 2% because productivity growth is low. In the long term, the development of unit labor costs calculated from wage growth minus productivity growth is the best determinant for inflation. In the fourth quarter of 2022, growth was still 3.2% (annualized).

Conclusion: Low Volatility, but downward risks remain

Conclusion: The central banks will continue to pursue a restrictive monetary policy because the inflation indicators are too high. Although the growth indicators are good to strong, there are therefore increased risks of recession. However, the assessment for the time of a deterioration is traditionally fraught with considerable uncertainty.

At the same time, stock prices have risen since the outbreak of the banking crisis in the USA at the beginning of March and future fluctuations (volatility) priced in the stock market have fallen. This can be explained with the good growth indicators, the fallen expectations for the future key interest rates and the lower stress indicators for the financial market with a pessimistic attitude of investors at the same time. However, the downward risks remain.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.