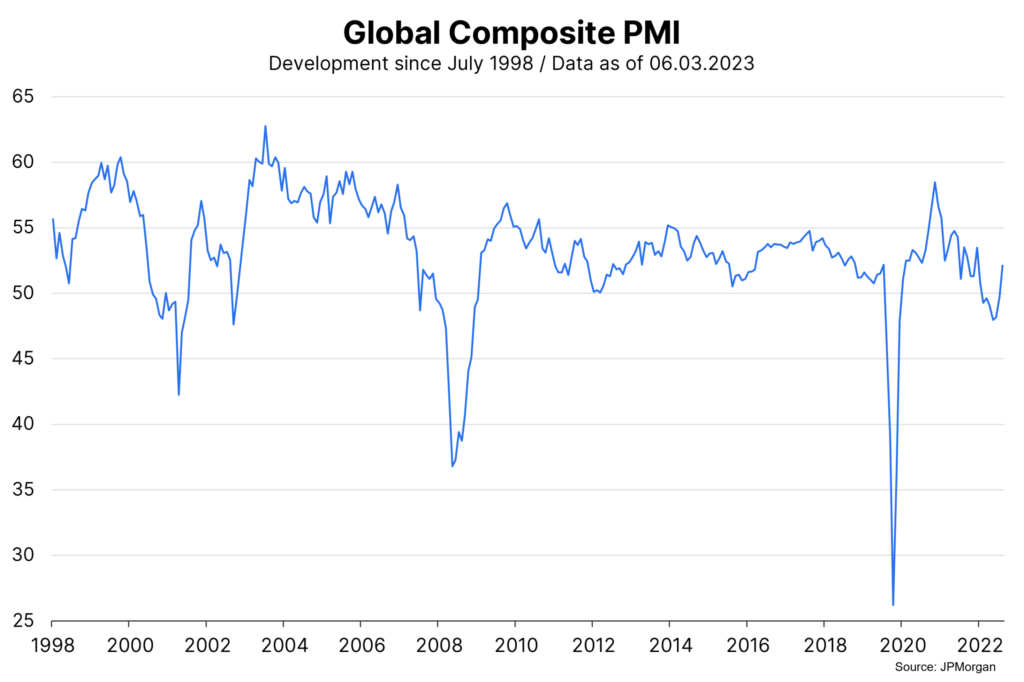

The indications for an increase in global real economic growth have increased in recent days. With the global purchasing managers index, one of the most important survey-based economic reports has been published. The overall number showed an increase for the third consecutive month for the month of February, with the increase accelerating.

If this positive economic data were taking place in a low inflation environment, it would be unqualified good news. However, inflation reports have been published at the same time, further dampening hopes for a rapid decline in inflation without additional key rate hikes.

Trend growth

With a value of 52.1, the Purchasing Managers’ Index (PMI) points to global growth around potential (2.5% quarterly growth annualized). The rising trend (positive momentum), the improvement in new orders as well as the expectations component even point to higher growth for the coming months.

Broad-based increase

Also impressive is that both manufacturing and services participated in the increase. Thus, global manufacturing may have grown in the first quarter after contracting in the fourth quarter. The larger increase in the services PMI suggests that there is still pent-up demand toward the end of the pandemic. The strong increase in the overall number was driven in good part by the strong increase in the PMI in China. This confirmed the expectation for a V-shaped (rapid) recovery after the abandonment of the zero tolerance policy toward new infections. Overall, however, most countries showed an increase.

Solid labor market

This improvement in economic indicators is taking place while unemployment rates are very low. In the Eurozone, the unemployment rate in January was only 6.7% (a very low value). Next Friday, the unemployment rate in the USA is expected to be 3.4% in the month of February (also very low). Regarding employment (Nonfarm Payrolls), an increase of 215,000 is expected. The previous month was super strong at over 500,000. The increase in the employment component of the Purchasing Managers Report for the second month in a row points to a continued firm labor market.

High inflation

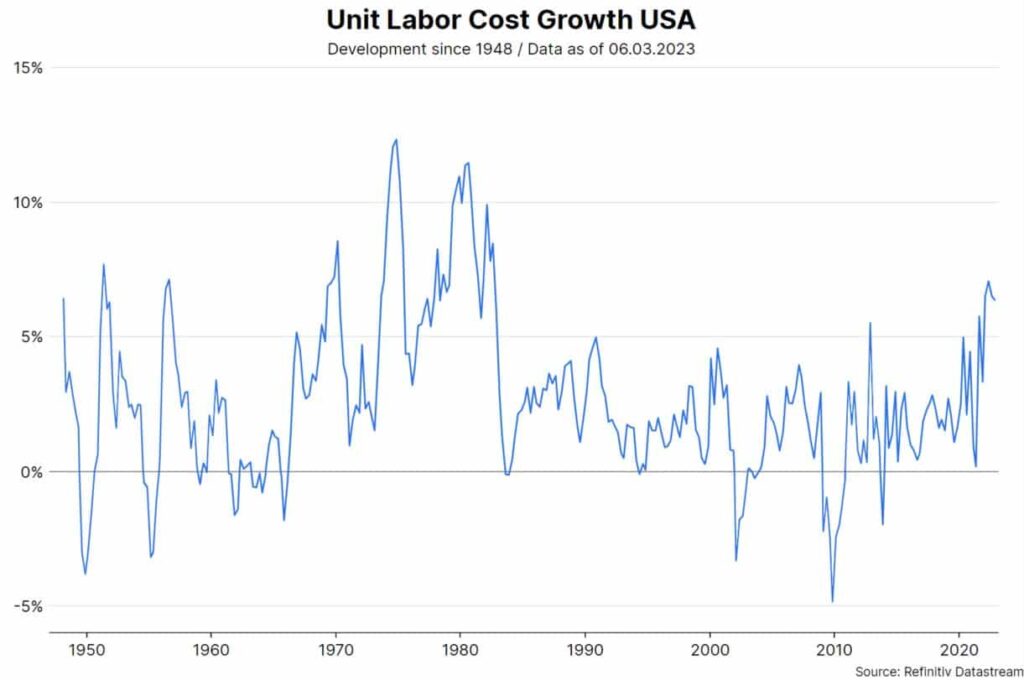

On the inflation side, however, there is disappointing news. In the U.S., the second estimate of unit labor cost growth for the fourth quarter of 2022 was revised sharply upward (first estimate: 4.3% y/y, second estimate: 6.5%). All components involved were moved in the “wrong” direction. Output down (0.7% y/y), hours worked up (2.6%), hourly wages up (4.4%). Unit labor cost growth has a significant impact on consumer price inflation.

In the eurozone, the flash estimate for consumer price inflation in the month of February showed a surprisingly strong increase of 0.7% month-on-month and 8.5% year-on-year. The core rate (excluding the volatile food and energy components) was also high at 0.7% y/y and 5.6% y/y. In addition, in the global purchasing managers’ index, selling prices did not continue the falling trend in February.

Important secondary condition

The rising economic indicators are only conditionally positive: The important condition is that inflation falls quickly. However, the most recently published inflation indicators point in the opposite direction (persistence). This has reduced the scope for central banks to pause in order to better assess the effect of key rate hikes on growth and inflation. A key interest rate in the USA of 6% (upper band) and of 4% (lower band) in the euro zone has become more likely. In this environment, Fed Chairman Jerome Powell’s speeches to two congressional committees today Tuesday and tomorrow Wednesday will be closely watched.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.