Last week brought good, bad and inflation-fighting news, all from the US. The labor market was a little less tight in February, but turbulence surrounding a US bank have led to a flight to the safe haven (US government bonds). Mid-week, the chairman of the US Federal Reserve hinted at the possibility of faster rate hikes to higher levels.

Closure of Silicon Valley Bank

Last Friday, Silicon Valley Bank (SVB) was closed by the Federal Deposit Insurance Corporation (FDIC). The bank specializes in startups in the technology sector. More and more customers withdrew their deposits. To service the outflows, bonds were sold. However, the bonds were accounted for with unrealized book losses. Realizing the price losses had led to additional funding needs that no one wanted to cover.

Note: Past performance is not a reliable indicator for future performance. The Silicon Valley Bank is listed on the NASDAQ as “SVB Financial Group”.

Present value and duration

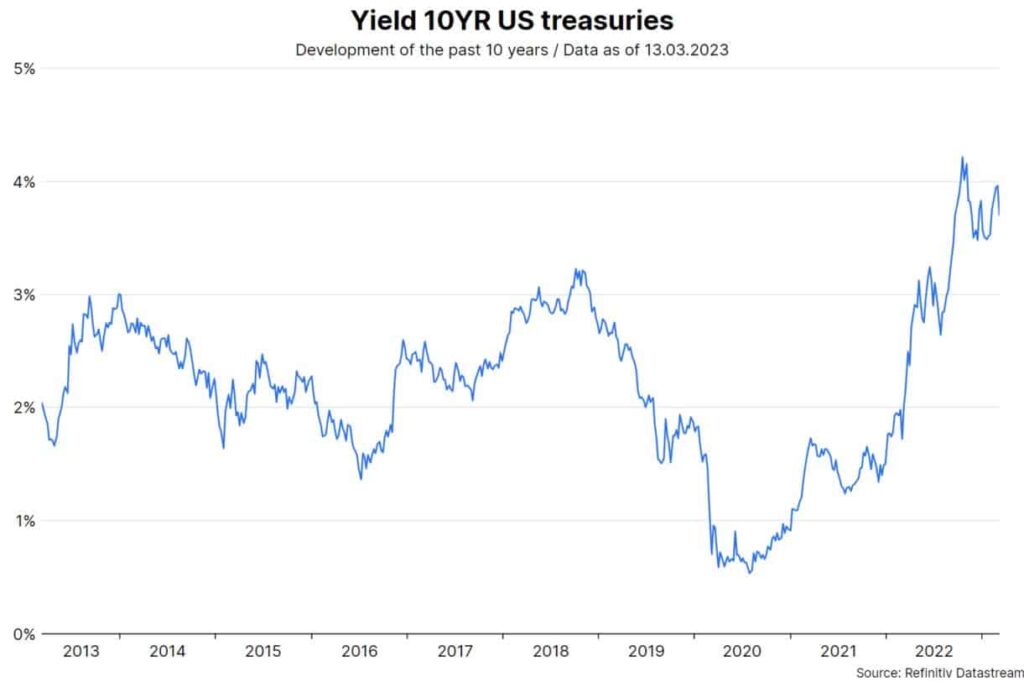

SVB’s deposits have grown strongly in recent years. These were invested in bonds (government and mortgage bonds). However, the sharp rise in yields last year led to unrealized book losses. This is where the present value model comes into play. When the coupon payments on existing bonds are valued at the higher yields on new bonds, the price (present value) of the existing bonds falls.

Note: Past performance is not a reliable indicator for future performance.

As long as the bonds could have been held to maturity, this was not a problem. It is worth noting that the interest rate sensitivity (duration) of the bond portfolio actually increased last year. The higher the interest rate sensitivity, the higher the price decline per percentage point increase in interest rates. Other managers shortened the interest rate risk (duration) last year.

Conflicting goals

In principle, a central bank has three functions:

- low inflation

- full employment and

- financial market stability.

Because inflation has been high for some time, monetary policy is designed to be restrictive. Key interest rates are being raised and bonds on the central bank’s balance sheet are being sold (quantitative tightening). This jeopardizes the other two objectives. To quote from a recent working paper, “there is no post-1950 precedent for a sizable central-bank-induced disinflation that does not entail substantial economic sacrifice or recession.“ (Managing Disinflation, Cecchetti at al, February 2023). In addition, rapid increases in policy rates increase the risk of liquidity crises. Last year, UK pension funds slid into one.

Decisive measures to avoid consequential damage

The closure of SVB has led to concerns of possible spillover effects. First, there are fears that other banks could also slide into a liquidity crisis. Second, there are concerns that numerous startup companies might not get their deposits. Treasury Secretary Janet Yellen and the Federal Reserve are resolutely countering these concerns with a number of measures adopted over the weekend:

- The US Federal Reserve offers loans to banks with a maturity of up to one year under a new program (Bank Term Funding Program – BTFP). The bonds serving as collateral are valued at their nominal value (not at current lower prices). This would allow banks to obtain liquidity without having to realize the book losses on bonds.

- The Treasury secures this lending from the Exchange Stabilization Fund to the tune of $25 billion.

- The terms of the discount window will be aligned with the BTFP. Here, collateralized loans will be made available to banks under three programs (Primary, Secondary and Seasonal Credit).

- All deposits are to be protected for customers (both those of secured and unsecured).

- The SVB subsidiary in the UK will be sold to HSBC.

Medium-term inflation risks stay

Previously, the head of the US Federal Reserve, Powell had made strong inflation-fighting statements in two speeches to subcommittees of the U.S. Congress. The key phrase was, “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” On the positive side, last Friday’s labor market report for the month of February showed another increase in the participation rate. While the labor market remains exceptionally tight, there is improvement. In addition, average hourly wages increased by only 0.2% month-over-month (4.6% year-over-year).

Next Tuesday, the release of consumer price inflation for the month of February will receive a lot of attention. The core rate (total excluding food and energy) is expected to rise a high 0.4% month-on-month. The annualized figure is 4.8% (0.4% times 12 months). Even though inflation remains far too high and evidence of inflation persistence has increased: As long as the impact of SVB is unclear, it is difficult to imagine a particularly restrictive monetary policy (acceleration of the rate hike cycle). However, this increases medium-term inflation risks.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.