Central banks and markets are in a calibration phase. The question is how many key rate hikes are needed to confidently expect inflation to fall toward 2%.

Good economic news

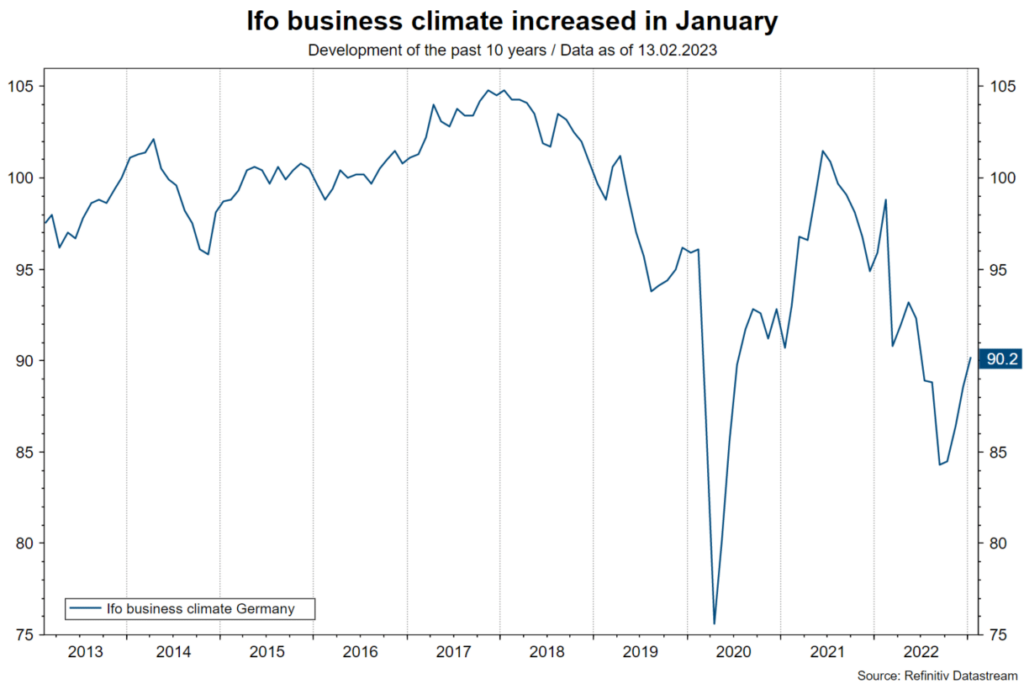

A large number of indicators of economic activity have improved in recent weeks. In the euro zone, the rise in survey-based indicators (Ifo index, purchasing managers’ indices, European Commission consumer sentiment) for the manufacturing, services and consumption sectors points to a moderate increase in real economic growth in Q1, after the economy already showed slight growth in Q4. At the same time, some segments were weak. For example, retail sales contracted 2.8% y/y in December. However, the technical recession that was widely expected until recently is not taking place. The main driving factor behind this is the sharp drop in the wholesale price of natural gas, which has now fallen below early 2022 levels.

Note: Past performance is not a reliable indicator for future performance.

In China, more and more indicators confirm the expectation for a V-shaped recovery of economic growth. Last week, the total credit figure for the month of January was above expectations.

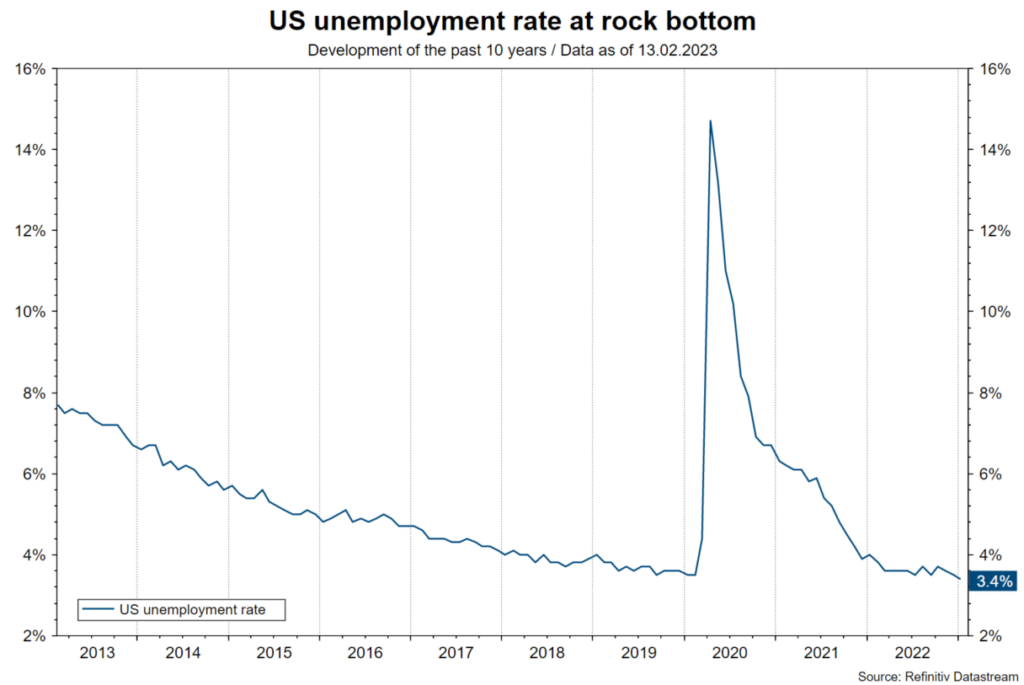

In the US, the labor market report showed an exceptionally strong increase in employment (in the non-agricultural sector). In addition, two important growth indicators due for release this week (retail sales and industrial production) are expected to grow, after contracting in the months before.

Note: Past performance is not a reliable indicator for future performance.

Bad news for the market

In an inflationary environment, however, good economic news implies additional inflationary pressure. In particular, the aforementioned US labor market had a clear negative impact in early February. In response to the release, future inflation rates priced into the market (two-year breakeven inflation rate from 2.33% to 2.75%) as well as the Fed’s future policy rates (overnight rate for July 2023 from 4.84% to 5.19%) have risen so far. The optimism of market participants for a rapid decline in inflation has given way to a scenario that describes a slower decline in inflation.

End of rapid key rate hikes

Overall, this implies a more hawkish stance of central banks with regard to inflation. At the beginning of the year, markets reacted positively to signals from central banks indicating a reduction in the extent of key rate hikes per meeting in the first half of the year. In a generally optimistic frame of mind, this was interpreted as a move away (pivot) from the hawkish stance in favor of a milder (dovish) stance. Last year, however, the focus was on raising from very low to mildly restrictive interest rate levels as quickly as possible.

High uncertainty

Since this state has (probably) been reached, a transition to a calibration phase has begun. Here, central banks emphasize that it may take a long time before the full effect of tighter monetary policy on growth and inflation is apparent.

Recession reports

Economic pessimists point out that some indicators are already pointing to increased risks of recession. Last week in the US, a Fed report (Senior Loan Officer Opinion Survey) on lending standards and credit demand pointed to further tightening and a further decline, respectively.

Immaculate falling inflation

Inflation optimists, on the other hand, believe that inflation could fall quickly without the need for restrictive monetary policy and a significant increase in the unemployment rate. (Immaculate Disinflation). This scenario describes a so-called “no landing” scenario. In this case, economic growth does not weaken (because inflation falls quickly).

Persistently high inflation

However, central banks cannot afford the luxury of being optimistic about inflation developments. Cutting interest rates too early to possibly too low levels could create a stagflation scenario like in the 1970s. In this phase of reviewing the correctness of the monetary policy stance, central banks are taking a step back in statements for future monetary policy (forward guidance). They merely emphasize that some interest rate hikes are probably still needed. At the same time, they point out to act data-dependently, i.e. to focus on the publication of economic data (backward-looking action). If it turns out that inflation remains stuck at too high levels for an uncomfortably long time (sticky inflation), key rate hikes could increase even further. In this scenario, the risk of recession increases.

The difference between immaculate disinflation and high inflation persistence is, of course, huge. Optimism for the former has fallen somewhat. The next important data point is the publication of consumer price inflation in the US for the month of January, today afternoon.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.