The semiconductor industry is considered one of the biggest beneficiaries of the AI boom. Investors therefore kept a close eye on the sector’s figures for the first three months of 2025. One thing became clear: the expansion of AI infrastructure continues to deliver good results for most chip companies – but the sword of Damocles in the form of impending US tariffs is still hanging over industry giants such as Nvidia & Co. Read more in today’s blog post.

All articles on the topic “Markets and opinions”

Calibration

Central banks and markets are in a calibration phase. The question is how many key rate hikes are needed to be able to confidently expect inflation to fall in the direction of 2%. Particular attention is therefore once again being paid to the US inflation data, which will be published today, Tuesday.

Metaverse – just a dream or long-term investment opportunity?

Besides artificial intelligence, the Metaverse continues to be one of the big future topics in the tech industry. Our expert Harald Egger gives an insight into what the metaverse actually is and what possible areas of application there are.

Microfinance defies international capital markets in 2022

The microfinance market also faced a variety of challenges in 2022. Despite the difficult environment, however, the global market continued to grow dynamically. The ERSTE RESPONSIBLE MICROFINANCE also developed positively in the previous year compared with the global equity and bond markets.

Positive January on the markets

On the stock markets, the first month of the year was positive. The recent softer tones of the central banks give rise to hopes that interest rate hikes are slowly coming to an end. Read more about the current market assessment in our Investment Update.

China Aiming for Fast Economic Recovery After End Of Covid Restrictions

After the lifting of the Corona restrictions, mighty China is back on track for growth. Also the global economy is benefiting from this. In any case, the Shanghai and Hong Kong stock exchanges started the “Year of the Rabbit” on a positive note.

“Environmental themes offer potential for long-term growth phase“

Forbes Magazine ranked Clemens Klein, fund manager of ERSTE WWF STOCK ENVIRONMENT, as one of the top ten fund managers of the German-speaking region. In our interview, he talks about the investment strategy and philosophy of the fund.

Party Crashers

Improved growth prospects for China and Europe and hopes of a sustained decline in inflation have supported the markets since the beginning of the year. However, sharp central bank rhetoric and weak growth indicators in the USA could prove to be spoilers.

Attractive yields: Why corporate bonds are worth a look

Corporate bond yields are now back at attractive levels. In his article, senior fund manager Hannes Kusstatscher explains what this means and how the situation on the bond market could develop.

Tug of war

At present, indicators on inflation and economic activity are competing to determine which of the two categories is more important for the financial market. Read more in the current market commentary by Chief Economist Gerhard Winzer.

After a Difficult Year, the Tech Industry Returns to the CES Industry Trade Show

After a three-year pandemic break, the technology industry returned to the renowned electronics trade show CES in Las Vegas. The dominant topics were artificial intelligence and virtual reality. However, extensive staff reduction programs at major tech companies also made headlines recently.

How to invest in corporate bond funds

Yields on corporate bonds in both the investment grade and high-yield segments have risen significantly in recent months. This means that there are currently interesting entry levels again.

Our expert Johann Griener explains in his blogpost how to take advantage of this opportunity with a corporate bond fund.

Upbeat markets at the beginning of the year

Despite uncertainties, the stock and bond markets got off to a friendly start in the new year. In the USA, economic data recently surprised on the upside. Is the situation better than the mood?

New Power – Green Hydrogen

Technological advantages and cost reductions have dramatically changed the environment for green hydrogen production. Our fund managers Clemens Klein and Alexander Weiss report on their journey to an exciting company in this industry.

How a bond fund “works”

Interest rates are back, which means that investing in bonds and bond funds again offers opportunities for attractive returns. Our expert Johann Griener explains how a bond fund works and what you should bear in mind when investing.

Ten topics for 2023

The previous year was marked by unexpectedly high inflation and rapid key interest rate hikes – but what will the new year bring?

In his article, Chief Economist Gerhard Winzer presents ten topics that could be particularly relevant for the financial markets in 2023.

Market commentary: What will the new year 2023 bring?

In the past year, numerous trouble spots preoccupied the markets. In his market commentary, Gerald Stadlbauer, Head of Discretionary Portfolio Management, gives an outlook on what 2023 might bring.

Interest rates are back

After many years of low interest rates, the tide has turned in recent months. This is also creating some opportunities on the bond market again, as our expert Johann Griener explains in his article.

Stock Exchanges Carefully Optimistic for 2023 After Year of Losses

The turn of the year marked the end of a difficult and lossy year on the stock markets. After two years of Corona pandemic, 2022 was dominated by Russia’s invasion of Ukraine, with many stock exchanges suffering double-digit losses.

The forthcoming steepening of the term structure of interest rates: An investment case

How the yield curve of a bond looks depends on several factors. In his article, fund manager Tolgahan Memişoğlu explains what this means and why yield curves could become steeper again in the future.

Hawkish holidays from the Bank of Japan

Last week, the Japanese central bank made the last major monetary policy decision of 2022, bringing an eventful year to an end – also from a central bank perspective.

Ukraine war: Exclusive interview with ORF correspondent Christian Wehrschütz

Hardly any journalist like Christian Wehrschütz has been dealing so intensively with the background of the Ukraine war for years. In an exclusive interview, the ORF correspondent gave us insights into daily life in the midst of a war. He does not currently see a solution to the conflict in the near future.

Energy of the Future

There is no perfect solution to solve our energy problems in the long term, explains Walter Hatak, Head of Responsible Investments. But instead of burying our heads in the sand, we should be able to choose the best possible alternative, take the future into account in our planning, and learn from past mistakes.

Inflation Reduction Act: what’s next?

The Inflation Reduction Act is designed to get the US back on track in terms of climate protection. What will the law achieve and who could benefit from it? Senior Research Analyst Stefanie Schock addresses these questions in her article.

ERSTE GREEN INVEST – with a tailwind towards energy transition

With the energy transition and the necessary ecologisation of the economy, “green technologies” are likely to remain one of the megatrends of the coming years. The ERSTE GREEN INVEST impact fund invests in precisely those companies whose business models could benefit from this megatrend.

Hydrogen – a colour theory

Hydrogen has great potential as a carbon-free fuel, electricity storage or energy carrier and could play an important role in the energy transition. But not all hydrogen is the same, as Senior ESG Researcher Alexander Osojnik explains. There are certain differences depending on how it is produced, which makes the topic of hydrogen almost a color theory.

Thrilling decisions before Christmas

This week, the financial markets are once again in for an exciting ride: The European Central Bank and the US Federal Reserve will decide to what extent interest rates will be raised again.

Successful launch of private equity fund of funds in difficult market environment

In June, Erste Asset Management announced the first closing of its private equity fund of funds, “Erste Diversified Private Equity I” at EUR 80mn. In an interview, Thomas Bobek, Head of Private Equity Management, is very satisfied with the successful start of the fund.

High uncertainty reduces potential for asset price increases

The environment for the financial markets remains highly uncertain. The further development of inflation and economic growth is not sufficiently foreseeable. This points to continued high fluctuations in asset prices.

Ceteris Paribus

The indications that the inflation peak will be exceeded are growing. If the relationship between inflation surprises (upside) and asset prices (downside) were to hold, that would be, all other things being equal, good news for the financial market.

Retailers hopeful for Black Friday and Cyber Week

On Black Friday and Cyber Monday, many retailers traditionally draw shoppers with discounts and special offers. In view of high inflation and rising interest rates and their potential impact, the financial markets are looking particularly eagerly to the two big holiday shopping days this year.

Transition Phase

So far this year, high inflation rates have been the driving factor on the financial markets. This could now change, as Chief Economist Gerhard Winzer writes. Disappointingly weak indicators of economic activity could now increasingly come into focus.

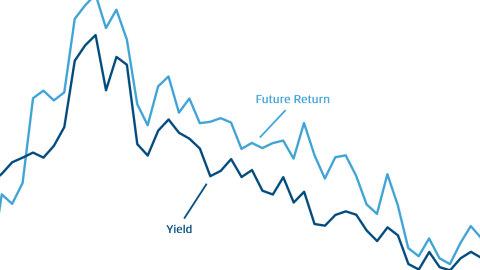

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

One month is not yet a trend

The rise in inflation in the USA was recently lower than expected, which led to a significantly brighter mood on the markets. However, a favourable inflation report is not yet a trend, as Chief Economist Gerhard Winzer emphasises.

Technology stocks in the verge of a comeback?

Due to fears of recession, rising inflation and interest rates, US technology stocks have come under pressure in 2022. The prospect of falling inflation, fueled by recent data from the US, could put them back on track for growth. We explore the question of whether tech stocks are on the verge of a comeback.

Review and outlook: “2022 turned out to be a tough year for equities”

On the stock markets, the year 2022 was characterized by high uncertainties and volatility. Tamás Menyhárt, senior fund manager at Erste Asset Management and equity expert, therefore draws an initial summary of the stock market year and ventures an outlook for the coming months on the markets.

Reduction in the pace of key interest rate increases

More and more central banks are signalling a reduction in the pace at which they are raising key interest rates. However, as Chief Economist Gerhard Winzer explains, this does not necessarily mean that central banks are softening their focus on fighting inflation. Rather, a pause in the rate hike cycle would require a change in inflation dynamics.

Outlook: Development of the neutral real interest rate

This year brought a turning point in the monetary policy of the major central banks. The crucial question is whether this turning point is cyclical or structural. It is therefore worth taking a look at the neutral interest rate, as this captures structural macroeconomic changes.

Bearish Stock Markets After Third-Term Re-Election of Chinese Head Of State Xi Jingping

Hands off Chinese equities? The confirmation of another term in office for China’s state and party leader Xi Jinping triggered a plunge in share prices on the Hong Kong and Shanghai stock exchanges. Equities Technology in particular came under pressure. What happens now?

Strong US dollar increases pressure on Japan’s central bank

The soaring US dollar is causing problems in countries outside the USA. In Japan, the Yen has weakened considerably recently because, unlike the other central banks, the Bank of Japan is sticking to its ultra-loose monetary policy. Against this backdrop, the meeting of the Japanese central bank next Friday will be more in focus than usual.

Dividend strategy: falling prices may still come with opportunities

Corrections on the markets are often painful, as previous price gains are reduced or the investment even slips into the loss zone. However, price declines can also offer opportunities. Our expert Johann Griener presents a possible entry strategy for the dividend share segment.

Is now the right time to invest in equities?

Global equity markets have been under pressure for several months. The short recovery phase in the summer did not last long. What are the reasons for the bear market and when could be a good time to enter?

Emerging Markets Credit Conference – a sentiment snapshot among investors

The mood among investors in the bond sector in emerging markets is mixed, as this year’s Emerging Markets Credit Conference held by US investment bank J.P. Morgan showed. Thomas Oposich, Senior Fund Manager, reports on the conference and his impressions.

Inflation rates (still) too high

The inflation problem continues to preoccupy the central banks. They are likely to maintain their basic restrictive stance until inflation rates have convincingly embarked on a downward trend.

Economy and interest rates in the context of global risks

What do global risks and rising interest rates mean for the economy? We talked to

Prof. Dr. Ernest Gnan, Secretary General of SUERF – The European Money and Finance Forum and former Head of the Economic Analysis Department of the Oesterreichische Nationalbank.

The “Squirrel Principle” – get through winter on dividends

Dividend shares provide regular profit distributions even in difficult times on the stock market. This makes them particularly interesting in the current market environment.

Fed remains on course

The latest US labor market data suggest that the Fed will remain on its course of more restrictive monetary policy. “As long as job growth remains strong and unemployment and participation rates remain low, the Fed will maintain its basic restrictive stance”, writes Head Economist Gerhard Winzer in his market commentary.

OPEC Cuts Oil Production by 2m Barrels per Day, Sparking Criticism From the West

Last Wednesday, the countries of the OPEC+ oil alliance decided on a comprehensive reduction in oil production. As early as November, 2 million barrels less per day will be produced. Many countries fear a rise in oil prices.

Good nerves and stamina required

The mood on the capital markets has deteriorated further over the last months. In a comprehensive market update, Gerald Stadlbauer, Head of Discretionary Portfolio Management at Erste Asset Management, explains why stamina is needed in the current situation.

Excessive Pessimism?

The unexpectedly high inflation rates draw even wider circles. In view of the pessimistic mood, the question arises whether the negative environment is already being reflected by market prices.

What happens to equities when interest rates rise?

So far, the year 2022 has brought significant price losses on the stock markets. Inflation and rising interest rates are often cited as the reason. But why is that the case?