All articles on the topic “Bonds”

ECB and price stability – an oxymoron?

Is the ECB reacting too late to the rising inflation? Is the massive money supply a ticking time bomb? All eyes are on the European interest rate policy.

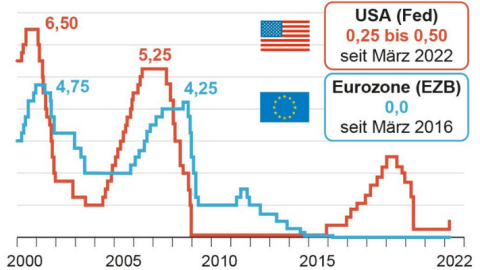

The End of Loose Monetary Policy

The US Federal Reserve is turning the interest rate screw hard and accelerating the exit from its ultra-expansive monetary policy. Will it get a grip on high inflation? And how will the economy cope with higher interest rates?

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

Do Eastern European bonds offer opportunities?

The war in Ukraine led to losses for Russian bonds. In an interview for OUR VIEW, fund manager Anton Hauser explains why government bonds from Eastern Europe offer an alternative.

Interest rate policy quo vadis? 3 monetary policy scenarios

Rising inflation and rising bond yields have recently caused uncertainty among investors. Will key interest rates in the USA be raised soon? Erste Asset Management’s Chief Economist Winzer outlines 3 scenarios for the interest rate policy of the central banks.

Advantages of supranational bonds in emerging market currencies

The most common form of supranational financial institutions are development banks, whose shareholders are usually the founding states. Investors’ exposure to bonds issued by development banks allows them to finance local infrastructure or climate projects at lower cost, which ultimately benefits the local population.

IMF and World Bank Annual Meeting, autumn 2021: emerging markets facing challenges

Fund manager Felix Dornaus attended the autumn meeting of the International Monetary Fund and the World Bank. His impressions of the outlook for emerging markets summed up here.

Green, green shades of bonds

In recent years, we have seen dynamic growth emerging. It started with green bonds, which were then complemented by social bonds, sustainability bonds (a combination of environmental and social projects), and sustainability-linked bonds.

Bond markets between strengthening economy and high liquidity

Bond funds are not always the “first choice” right now. The strong profits of listed companies and the orderly dividend payouts are currently outpacing interest income. If you are looking at performance, you have to look closely. Interview with Wolfgang Zemanek, Head of Bond Funds, Initial Asset Management.

Sustainability-linked bonds – an alternative to green bonds?

Green bonds are securities that are allocated to specific energy and environmental projects and are intended to contribute to a climate-friendly transformation of the economy. According to a study by the Climate Bonds Initiative (CBI), they reached a record level of $269. 5 billion in 2020. Sustainability-Linked Bonds represent a voluntary commitment for issuers. How exactly they work is explained in our analysis.

ESG bonds made in the USA

ESG bonds are currently on the rise and are becoming an increasingly important part of corporate bonds. According to BofA Securities, 13. 5% of all new issues with ESG criteria were already issued globally in the first half of 2021. This trend is well established in Europe and is also increasing in the USA, as the following analysis shows.

Yield curve management

In recent days, equities and other risky asset classes have come under pressure despite the fact that in the year to date the optimism about an economic recovery has been on the rise. Is that a case of “buy the rumour, sell the fact”? Had the good news already been priced into the market? Or is there another mechanism that could be driving the future development?

Emerging Markets corporate bonds: sustainability turns into a factor of success for investments

Corporate bonds from emerging markets: environmental focus and calling out companies on their sustainability efforts are turning into a success factor. Senior professional fund manager Péter Varga explains the latest trends and developments.

How are stock markets currently reacting to increases in yields?

Central bank targets for inflation may be met earlier than expected in some countries. This environment has led to an increase in government bond yields. We explain how it came about.

ECB and European Parliament get crisis programmes for 2021 on track

As the year 2020 comes to a close, the European Central Bank (ECB) and the European Parliament have put their respective programmes for the fight against the crisis on track for next year. The MEPs recently approved the approximately EUR 1.1tn Community budget for the next seven years, which includes EUR 750bn in Corona aid.

Emerging markets corporate bonds: numerous recovery candidates in case of improving corona crisis

Emerging market corporate bonds are an interesting asset class in the current low-rate environment. Péter Varga, Senior Professional Fund Manager at Erste Asset Management, answers the key questions on the current environment.

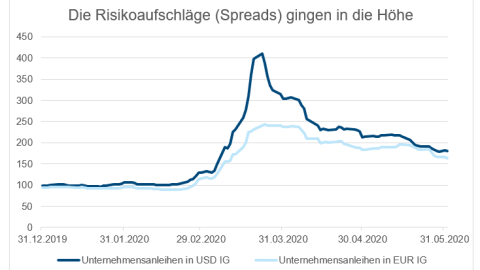

“High octane” for the portfolio

High-yield corporate bonds are currently in keen demand again, driven by the energetic steps taken by the central banks in their fight against the coronavirus crisis.

China on the way back to its former strength?

China has navigated the crisis quite well so far and that the growth rate of industrial production has picked up, too. All this in an environment where investors are looking for suitable investment opportunities. The Chinese bond market may just be what they are looking for.

India: Narendra Modi – the prime minister as crisis winner?

A year ago India was one of the fastest growing economies in the world. Today the world looks completely different because of COVID-19. But no matter how bad the conditions in India are, Prime Minister Modi’s popularity is on the rise. Could he really emerge from the crisis as a profiteer?

Balanced funds: the current investment strategy

Whether the measures taken by governments and central banks will take effect – these remain the decisive questions for the capital markets. The investment strategy of the YOU INVEST funds continues to be dominated by the pandemic and the measures taken to combat and contain the consequential losses.

ECB to buy bonds despite ruling of the German Constitutional Court

The European Central Bank (ECB) wants to stick to its bond purchases despite the recent ruling by the German constitutional court. “We will continue to do whatever is necessary to fulfill this mandate,” said ECB chief Christine Lagarde.

Problem children vs. favourite children in Latin America

Fund Manager Peter Paul Pölzl gives a detailed outlook on the loved ones and problem children among the countries in Latin America. How are China’s economy and Latin America related?

Megatrend environment & clean energy: Leveraging the right kind of companies

Mobility, renewable energy, hydrogen – There are currently many megatrends to save the environment. How can we benefit ?

“The search for yield is ongoing”

“The search for returns continues” – What were the latest developments and what are the yields like?

Fund manager Bernd Stampfl gives the answers to the most important questions.

Emerging markets corporate bond outlook 2019 + Video

What were the biggest challenges last year, and what are the opportunities in 2019? Emerging markets fund manager Péter Varga answers the most important questions.

Latin America overview: Venezuela a classic debt rescheduling candidate

Oil production, state crisis, costly restructuring: Venezuela is in crisis. What’s next? Our analysts Christian Gaier & Felix Dornaus provide the answers.

Low Return on Assets – where can savers still find decent interest rates?

Many savers are fed up with investing their saved-up capital at low interest rates. The question everyone is asking themselves now is how to earn a good yield on one’s hard-earned capital in times of low interest rates like nowadays?

Attractive yields for emerging markets bonds in local currencies

On 17 October 2018, ERSTE BOND LOCAL EMERGING celebrated its 10th anniversary – a perfect time to have a closer look at the asset class “Emerging markets bonds in local currency ”. More in our Blog.

BCA Investment Conference in Toronto: How to navigate wealth to prosperity in a late stage of the business cycle

Every year the independent investment research provider BCA organizes an outstanding event for investment professionals from all over the world to come together and have a vibrant discussion about recent challenges in financial markets.

YIELD RADAR: September 2018

Annualised real global GDP growth amounts to slightly above 3%. The composition of growth is not homogenuous. While the US economy grows strongly, the weakening loan growths puts weight on the economic activity in China. Find out more in the current yield radar.

Turkish lira – what are the reasons behind the current crisis?

The Turkish lira reflects the difficult situation Turkey is currently in. This year alone, the currency has shed more than 45% of its value to date. Interview update with Anton Hauser, Senior Fund Manager, Eastern Europe bonds.

Russian bonds should see good performance

In this interview Anton Hauser, senior fund manager at Erste Asset Management and expert for Central and East European (CEE) government bonds , talks about the difficult first half of 2018 and illustrates possible future scenarios.

A niche product with solid returns: hybrid and subordinated bonds with investment grade rating

Author: Christin Bahr, Product Management Securities Erste Group It has been half a year since the launch of the new hybrid bond fund. Reason enough for us to talk to Roman Swaton, Senior Fundmanager.

High yields and a potential turnaround make LATAM bonds an interesting investment

Autor: Christian Gaier, Head of Fixed Income Rates, Sovereigns & FX, Erste AM I would like to share my impressions from my latest investor conference in London that I attended on 16th January 2017. The conference was organized by Banco Bilbao Vizcaya Argentaria (BBVA), a leading global financial group with a strong franchise in 35 […]

2016 – a capital markets year in review

2016 was full of surprises on the stock exchanges. At the beginning of the year, economic concerns in China, the second-biggest economy in the world, triggered drastic losses on the stock exchanges. Over the year, cautious optimism gradually returned: the oil price recovered, and the stock exchanges in the emerging markets rebounded. Brexit and Donald […]

Emerging markets bonds in demand

Economic growth in the emerging markets has picked up substantially, while that in the industrialised economies has been rather stable. This has led to an increase in the growth differential in the emerging markets’ favour. Investor demand for emerging markets bonds has been on the rise in search of higher yields and interest rates.

Spotlight on: corporate bonds

ESPA RESERVE CORPORATE: 3 questions for Bernd Stampfl, fund manager.

Brazil: Hope for change stimulates bonds

Author: Felix Dornaus, Senior Fund Manager Emerging Markets Bonds Brazil tactically overweighted at the moment Most of the fundamental economic data are currently not good. In 2016, the country is in recession; for 2017, a minor growth rate of +0.7% is expected. The nominal budget deficit of 2016 is about -10%, with a primary deficit […]

Emerging Markets: Opportunities with Corporate Bonds

In an interview with Péter Varga, Senior Fund Manager Erste Asset Management, I am discussing the chances and risks with investments in emerging markets corporate bonds. Many Investors feel unsettled by the weak performance of the emerging markets. Why is this the case?

Corporate bonds with short maturities

Bond investors are faced with a difficult environment. Do corporate bonds offer the chance of a halfway decent yield? Stampfl: The statement that bond investors are faced with a difficult environment is actually an erroneous one. A balanced portfolio consisting of bonds from the peripheral countries and the core countries across all sectors would have […]

The investment segment of emerging markets corporate bonds has matured

For many institutional investors corporate bonds from emerging markets issuers have become an important instrument of portfolio diversification. Our fund management team estimates that a portfolio made up of 70% investment grade bonds and 30% high-yield bonds can yield an average 5% in the medium term. This sort of yield can hardly be achieved with […]