ESG bonds are currently highly popular, accounting for an ever-growing share among corporate bonds. According to BofA Securities, 13.5% of all new issues were issued in compliance with ESG criteria in the first half of 2021 (17% in June, which was a new record). Whereas the share of bonds complying with ESG (i.e. economic, social, and governance) criteria has been on the rise for years, the USA has some catching up to do. But here, too, the trend is on the up, as the following analysis illustrates.

Europe still ahead, USA catching up

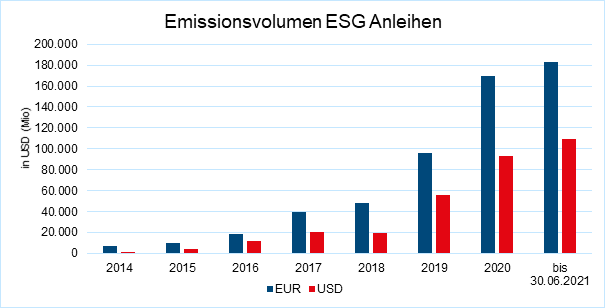

In Europe, ESG bonds worth a total of EUR 150bn (i.e. USD 180bn) were issued in the first half of 2021, i.e. more than in the entire year of 2020. According to a study by Barclays, almost a quarter of the newly issued investment grade corporate bonds in euro come with an ESG component, while that is the case for 17% in the high-yield segment. In USD, these percentage are significantly lower at 6% and 9%. That being said, the chart below highlights the fact that the volume is rising significantly in USD as well. In US dollar terms, 18% more ESG bonds were issued in the first half 2021 than in the entire year of 2020. In euro, the increase was 7%.

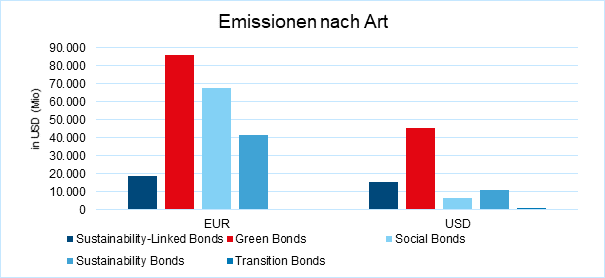

According to the Sustainable Finance Principles set by the International Capital Market Association (ICMA), there are different types of ESG bonds. Green bonds pursue environmental goals such as the reduction of carbon dioxide emissions, social bonds serve the funding of social causes such as education, and sustainability bonds combine green and social goals. Then there are sustainability-linked bonds, whose coupons often depend on whether or not certain defined ESG goals have been reached; and the newest category are transition bonds, which finance the transition to a more sustainable strategy.

Of these categories, green bonds are the most often issued one, both in euro and in US dollar. In euro, this category is closely followed by social bonds and sustainability bonds, whereas sustainability-linked bonds and transition bonds play a less significant role. In US dollar, social bonds are not really a thing yet, whereas sustainability-linked bonds are clearly on the rise both in EUR and in USD, and transition bonds are only just becoming visible.

Europe is not only pioneering the market, but there is also a lot of activity in the political and regulatory area: after ICMA, the European Commission has now also published a European Green Bond Standard which remains voluntary but is meant to lead to more transparency and comparability. It was created in the context of the Sustainable Finance Strategy and shows a clear commitment to the promotion of the funding of sustainable growth. Even the ECB now invests a part of its own funds in green bond portfolios. While there is a clear effort in the USA to protect the climate in the wake of the country leaving the Paris Climate Agreement under Donald Trump and then re-joining it under Joe Biden, it is a bit less proactive and less concrete than in Europe. The EU and the USA have the same goal of cutting net carbon emissions to zero by 2050.

Sector breakdown reveals shortcomings

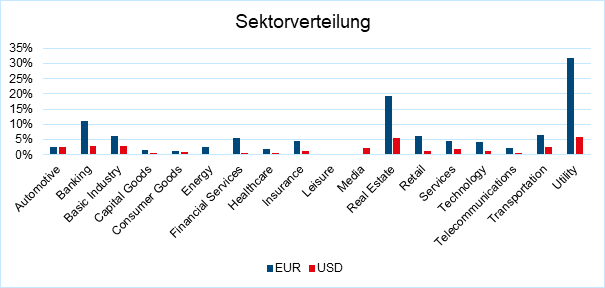

Both in Europe and the USA, the majority of ESG bonds come from only a few sectors. Utilities top the list in Europe at 32% of outstanding bonds, followed by real estate (19%) and banks (11%). Some sectors that are among the biggest greenhouse emitters have a huge gap to close: the automotive sector and the energy sector account for only 2% and 2.5%, respectively. Transportation – including railway operators, airlines, and couriers – make up only 6% of outstanding bonds at the moment.

In USD terms, the picture looks even less favourable. Here, too, utilities are slightly ahead of real estate; however, in both sectors, only 5.5% of bonds come with ESG criteria. Banks are third, and at 2.7% they are hardly much better than the automotive and the transport sector at 2.6% each. In the energy sector, a measly 0.25% of all bonds are ESG bonds.

Energy mix in the USA needs to catch up

What catches our eye immediately is the huge difference in sustainability bonds in the utilities sector between the USA and Europe. Here, too, Europe is a few steps ahead in terms of its shift away from coal and the creation of renewable energy sources. According to a study by Agora Energiewende, the share of coal in energy production in the EU halved from 2015 to 2020 to 13%, while the share of renewable energy increased to almost 40%. According to the U.S. Energy Information Administration, coal still accounts for 20% of energy production in the USA, while renewable energies also make up 20%

The new coal policy that came into effect at Erste Asset Management at the beginning of July 2021 has turned companies where coal accounts for more than 5% of sales uninvestable. As a result, 60% of all US utilities were taken out of the investment grade universe (ICE BofA US Corporate Index). Among others, this affected four of the five biggest American emitters. Far fewer European companies have been affected given the sooner move away from coal. The two biggest European utility companies, Enel and Iberdrola, for example, are pioneers in renewable energy.

Minority-owned banks

There is one special feature in terms of ESG though that does not exist in Europe. Given the debate on racism, which gained a lot of traction last year, there has been an increasing number of initiatives also in the financial sector towards more inclusion and diversity. For example, big investment banks have been trying for a while to leave a larger share of the lucrative business of bond issues to banks and investment houses that are majority-owned by minorities, women, or veterans. There have been two new issues under this scheme in the past twelve months that were exclusively managed by these firms. This can be seen as a success, given that the market is usually dominated by just a handful of large banks. Here, too, the path ahead is still long, given that these transactions account for only 2-3% of the total.

Erste Responsible Bond Global Impact

If you, too, want to invest in the increasingly global market of sustainable bonds and thus to finance sustainable growth, you may find the Erste Responsible Bond Global Impact fund interesting. This fund invests worldwide in green bonds, social bonds, sustainability bonds, and sustainability-linked bonds that are issued by states, supranational organisations, and companies. It was awarded the Austrian Ecolabel at issue (2015).

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.