Author's Contributions

The markets in a gold rush – overheated rally or brilliant opportunity?

Gold on the rise: Will the rally continue and what opportunities are still available for investors? Read today’s blog post to find out what is behind the development of the gold price and why shares in the gold sector might also be worth a look.

Private equity: Central Europe comes into focus

Erste AM is launching a new private equity fund of funds, Erste Diversified Private Equity II. Thomas Bobek, Head of Private Markets, talks about the investment approach and the private markets segment in an interview.

ATX surprises in 2025: why Austria’s equity market is ahead of the rest this year

While economic growth in Austria remains weak, the domestic stock market index ATX has recently climbed significantly. What is behind this strong performance?

World Environment Day: creating a positive impact with active ownership

Today’s World Environment Day focuses on environmental and climate protection under the slogan “Our Power, Our Planet.” Find out how we, as an active investor, are driving sustainable change in companies in today’s blog post.

US draft budget: “The rules of the game for renewable forms of energy are changing”

The recently published US budget draft also contains interesting passages on the future of the Inflation Reduction Act and the associated subsidies for renewable energies. In an interview, environmental equity fund manager Alexander Weiss explains what the draft means for investors and why the market reacted positively to it.

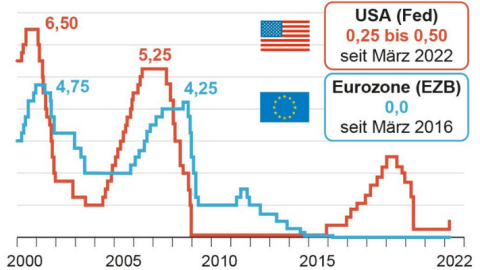

Central banks at odds: How are Fed and ECB reacting to the trade conflict?

Trump’s customs policy and the trade conflict also pose new challenges for central banks. However, while the ECB has room to cut interest rates in order to support the economy, the Fed must exercise caution in the USA. Higher tariffs also threaten to push up inflation again.

However, US President Donald Trump does not like the Fed’s course at all. His attacks on Fed Chairman Jerome Powell are fuelling concerns about the central bank’s independence. Even though Trump has recently backed down slightly, his comments are once again unsettling the markets.

Environmental stocks: How is the sector faring in the current volatile environment?

The first quarter had a few surprises in store for the markets. The US tariff announcements shook the markets to the core and caused a volatile stock market environment. The environmental technology sector was not spared either. What is the outlook for the sector? We asked fund managers Clemens Klein and Alexander Weiß in a double interview.

Get Flexible – YOU INVEST funds are starting up again

From March, the YOU INVEST funds will be gradually reorganized. With the renaming to YOU INVEST FLEXIBLE, the funds will not only have a new name but also a more flexible investment strategy and new opportunities through additional diversified sub-funds in which the funds of the YOU INVEST family can invest from the realignment onwards. You can find all the information on the changeover in today’s blog post 👉

Investment View | February 2025

What’s happening on the markets? In our Investment View, the experts of our Investment Division regularly provide insights of current market events and their opinion on the various asset classes.

The Tariff Man

Last Sunday, the US government announced new tariffs on goods from Canada, Mexico and China, only to suspend them again shortly afterwards. How might the trade conflict develop? Is the EU also threatened with new tariffs?

Pharmaceutical Companies Increase Sales, Focus on Innovation and Acquisitions

The pharmaceutical industry was able to further increase its sales in the last quarter. The biggest players in the sector are relying on acquisitions and innovations – including the increased use of AI. However, things could get more uncomfortable for pharmaceutical companies in the US market: the future US Secretary of Health and Human Services, Rober F. Kennedy Jr., is considered a critic of the industry and has already spoken out in favor of capping drug prices.

Eastern Europe: Economies expected to outperform Euro Area

Weakening growth in the eurozone has been an issue on the markets for some time now. In the Central and Eastern European countries, however, this is largely a non-issue. According to forecasts, the region is also likely to grow faster than the eurozone this year. Private consumption in particular has recently proved to be a growth driver. However, the tense situation in German industry is causing concern.

Economic outlook: soft landing with risks attached

On the stock markets, the focus is shifting back to the downside risks. Nevertheless, there are still hopes that inflation will gradually fall and that there will be no recession. But how realistic are the hopes for this “soft landing” of the economy and how can investors position themselves in the current environment?

US tech stocks: Mixed feelings after earnings figures

The shares of the major US technology companies, which had performed very well for a long time, have also fallen recently. The latest half-year figures left the market with mixed feelings: although the figures were largely as expected, there were hardly any increases in profit expectations. Nevertheless, the outlook remains positive, which for fund manager Bernhard Ruttenstorfer has several reasons.

Losses on the stock markets: an overview of the reasons and consequences

There was little to cheer about on the stock markets at the start of the week: there were significant price losses in both Europe and the USA and the Japanese Nikkei-225 recorded one of the biggest daily losses in its history. What were the reasons for Monday’s sharp sell-off, what impact could the latest events have on the markets and what will happen with the increasingly weak economy?

Microfinance: A journey through emerging Kenya

Kenya is one of the largest economies in sub-Saharan Africa and is currently the most heavily weighted country on the African continent in the ERSTE RESPONSIBLE MICROFINANCE fund. Fund manager Martin Cech therefore recently visited the country and a number of companies and microcredit borrowers.

Interview: Minimizing climate risks effectively

Companies have to deal intensively with the risks and opportunities that the climate crisis brings for their business model. These factors therefore also play a major role in our investment process. Stefanie Schock, Senior Research Analyst in our Responsible Investments team, explains how this works for the ERSTE WWF STOCK ENVIRONMENT equity fund.

Cleantech stocks: low valuations as opportunity?

Shares from the environmental sector have recently been less in the market’s favor. However, the expansion of renewable energies is continuing at a rapid pace and the AI boom could significantly boost demand for green electricity. Given the good growth prospects and the cheap valuation level, green stocks could currently be worth a look. Alexander Weiss, co-fund manager of the environmental equity funds ERSTE WWF STOCK ENVIRONEMNT and ERSTE GREEN INVEST, explains the background in an interview.

ERSTE OPPORTUNITIES MIX: the most important questions and answers

Taking advantage of short- and medium-term opportunities on the markets while at the same time focusing on long-term future trends – the new mixed fund ERSTE OPPORTUNITIES MIX makes this possible. We have summarized the most important questions and answers on the launch of the new fund.

Short-term opportunities or long-term trends – why not both?

Investing in the major trends of the future while taking advantage of short-term market opportunities – the new mixed fund ERSTE OPPORTUNITIES MIX makes this possible. Alexander Lechner, Head of Multi Asset Management, explains the concept behind the fund in an interview.

At the pulse of opportunity – new mixed fund about to launch!

Combining long-term trend themes with short and medium-term market opportunities: The new broadly diversified mixed fund ERSTE OPPORTUNITIES MIX makes this possible with its active and flexible approach.

Socially sustainable investment – how does it work?

Investing sustainably in companies with a social impact – this is possible with the ERSTE FAIR INVEST equity fund. In this interview, fund manager Bernhard Selinger explains how he finds socially sustainable companies for the portfolio and why a sustainable strategy is also good for the company’s success.

Green technologies: US elections as showstopper?

The Inflation Reduction Act has triggered billions of dollars of investment in green technologies in the USA. Are the subsidies and tax breaks for renewable energies at risk in view of the upcoming US election? Clemens Klein, fund manager of ERSTE GREEN INVEST, provides some answers.

World Water Day: the (scarce) blue gold

Droughts and water shortages are also increasing in Europe – what can be done about them? When investing, it certainly makes sense to take a close look at the water risks of companies. If you want to go one step further, you can also specifically integrate the topic of water into your portfolio.

Swimming against the tide with alternative investments

Alternative investment strategies are not comparable with traditional asset classes such as equities or bonds – this is precisely their charm. But how do these strategies work and how can investors invest in them?

Corporate bonds – Why emerging markets are worth a look

Fund manager Thomas Oposich explains in an interview what makes investments in emerging market bonds interesting and which sectors and companies he considers promising.

🍋 Dividend basics for shareholders

An increasing number of investors, when selecting shares, do not only focus on share price performance, but also on a stable, high dividend – for good reason.

Capital markets outlook 2024: good opportunities in the US election year

After a difficult market year in 2022, many asset classes performed much better this year. The outlook for the coming year 2024 is also positive – the central banks’ turnaround in interest rates has brought about a return to normality on the bond market and, with the rise in yields, is also opening up new opportunities for investors. At the same time, the ongoing geopolitical tensions in particular pose a challenge. With the improved yield opportunities for bonds, mixed funds are also coming back into focus.

FNG Label: 17 top marks for our sustainable funds

Strict criteria, a clear investment process, and many years of expertise pay off, as illustrated by our results in this year’s award of the FNG Label by Forum Nachhaltige Geldanlagen (FNG; Forum for Sustainable Investments). All 17 funds submitted by Erste Asset Management were awarded the quality label for sustainable investment funds, capturing the top rating of three stars.

The Rise of the Fallen Angels

Rating agencies assess the creditworthiness of companies and thus play an important role in the financial market. They were also in the spotlight at the beginning of the corona pandemic, with many companies being downgraded as a result of the crisis. In the meantime, the pandemic has been overcome and some of the so-called “Fallen Angels” are once again in a much better position with regard to their creditworthiness and rating.

Gold: From means of payment to safe haven

Gold has played an important role in the financial and economic system for centuries. While it initially served as a means of payment, the role of the precious metal increasingly changed over the course of history to become a crisis currency and a store of wealth in uncertain times.

Sustainable investments: fad or long-term trend?

With a view to the Ukraine war, the multiple regions of crisis or the extreme inflation, one would be forgiven for thinking that sustainability issues were taking a back seat when it came to investing. Gerold Permoser, Chief Investment Officer of Erste Asset Management, claims that this is not the case and that there is a lot of potential for investors. In a recent press talk, he and Heinz Bednar, CEO, presented five key drivers for ESG investments.

How high do key interest rates still climb?

Both the European Central Bank and the Federal Reserve in the USA raised the key interest rate by 25 basis points last week. However, both central banks signalled that the end of the cycle is near – or may even have already been reached after the recent rate hikes.

Biodiversity: interview with ecologist Franz Essl

Franz Essl is an ecologist and a recognised expert on biodiversity and the protection of species diversity. In addition, he was named Scientist of the Year 2022 by the Club of Education and Science Journalists last year. In this interview, he explains what the term biodiversity encompasses and why politics and business must finally act to stop the loss of biodiversity.

ERSTE BOND EM CORPORATE becomes sustainable: Interview with fund manager Péter Varga

ERSTE BOND EM CORPORATE becomes part of our sustainable Integration fund family. Péter Varga discusses what this sustainable change means for him as a fund manager and what it changes in his investment process.

“A mild economic downturn has already been priced in by the market”

With the ERSTE REAL ASSETS mixed fund, investors can invest in real assets – and have indeed been doing so for two years now. On the occasion of the fund’s two-year anniversary, Philip Schifferegger, fund manager of ERSTE REAL ASSETS, is taking a look at the current market situation. He also explains why the fund is well equipped for both positive and negative market phases.

Funds in focus: World Fund Day 2023

On 19 April, the Austrian financial sector once again focuses on funds. And for good reason: funds provide easy access to the investment markets and are suitable for retirement provision and investment.

Inflation: How to protect your savings

Inflation continues to make life more expensive and does not stop at the savings of Austrians. More about the future outlook and possible protection strategies.

The Credit Suisse takeover and its possible consequences

The effects of the takeover of the faltering major Swiss bank Credit Suisse by its competitor UBS are spreading far and wide. The risk of a recession has increased. Will the interest rate hikes soon be coming to an end?

Credit Suisse: Liquidity support after share price turbulence

The Swiss bank Credit Suisse came under pressure on Wednesday after uncertainty spread among investors. The experts from our Investment Division provide an overview.

Silicon Valley Bank – Impact on the Stock Markets

The turbulences surrounding the US Silicon Valley Bank (SVB) are currently keeping the markets busy. After the bank was closed last Friday, a comprehensive package of measures followed over the weekend to avoid possible consequences. In this blog post, the experts of our Investment Division explain what exactly happened and how they assess the situation.

Positive January on the markets

On the stock markets, the first month of the year was positive. The recent softer tones of the central banks give rise to hopes that interest rate hikes are slowly coming to an end. Read more about the current market assessment in our Investment Update.

Chatbot “Sustainable Investing”: The new expert on sustainability

With so much information and offers on sustainable investing, investors can easily lose track of what’s out there. Our new chatbot “Sustainable Investing” can help here and shed some light on the matter. In this article, we explain which questions the chatbot can answer and how to find it.

Thrilling decisions before Christmas

This week, the financial markets are once again in for an exciting ride: The European Central Bank and the US Federal Reserve will decide to what extent interest rates will be raised again.

From crisis manager to Nobel laureate

This year’s Nobel Prize in Economics will be awarded to three US economists for their research on banking and financial crises. Among them is Ben Bernanke, who was chair of the US Federal Reserve when the financial crisis hit in 2008 and the global economy was teetering precariously close to the brink for weeks.

YOU INVEST funds become sustainable – Questions and answers about the reorganization

Gerhard Beulig, Senior Fund Manager at Erste Asset Management, answers the most important questions about the reorganization of the YOU INVEST funds.

Toothless central banks: will the interest rate increases remain ineffective?

Rising credit rates and prices for goods and services are hampering consumer demand. Which future scenario can be expected? Interview with Péter Varga, Senior Professional Fund Manager at Erste Asset Management.

Investment update: Increased volatility on the stock markets

The financial markets started this week with high volatility. The US leading index S&P 500 suffered a loss of more than 2% since Monday, while the European index EuroStoxx 600 is almost 3% lower. What will we observe in the coming days?

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

Investment update: Some stabilization despite ongoing bombardment

Although volatility and uncertainty remain particularly high in the capital markets, there has been some stabilization and, most recently, a slight recovery in the equity markets since last week.