Latest Posts

An extraordinary half year

The first half of the year on the financial markets was characterized by price declines in equities and bonds, rising inflation, and the war in Ukraine. What developments does Erste Asset Management expect for the second half of the year?

Fund savings plan: Why it pays off to persevere

The bears have gained the upper hand on the stock markets. How investors and savers can overcome this phase and why perseverance could pay off right now.

Central Banks Attempt to Prevent Inflationary Spiral

Since the beginning of the year, the bond markets have been in a bear market. What are the implications for the economy? Erste Asset Management Chief Economist Gerhard Winzer analyzes three models in relation to the development of inflation and their implications.

Travel Industry Expects Strong Summer Season After Two Years of Crisis

For companies in the tourism and travel industry, this could mean a return to profitability despite staff shortages and higher fuel prices.

Increasing growth risks

Inflation, the war in Ukraine and monetary policy are driving the markets and stoking fears of an impending recession. Initial economic indicators also point to gloomy growth prospects.

Toothless central banks: will the interest rate increases remain ineffective?

Rising credit rates and prices for goods and services are hampering consumer demand. Which future scenario can be expected? Interview with Péter Varga, Senior Professional Fund Manager at Erste Asset Management.

Way Out Recession?

The prices of risk asset classes are subject to downward pressure. Is an inflation spiral likely to occur? Will the increase in key interest rates trigger a recession?

High inflation rates increase downside risks

Inflation rates continue to rise, prompting central banks to accelerate rate hikes. Which models for the future inflation development are conceivable? Erste Asset Management Chief Economist Winzer analyzes which scenarios are imaginable in the future.

Despite high inflation, U.S. Treasury Secretary Yellen sees little risk of recession

Sentiment among U.S. consumers has fallen to a record low due to high inflation. How does this data affect the economy? Is a recession looming? Are solid corporate results being ignored?

Austria goes green

The first green bond of the Republic of Austria was issued on 24 May 2022 and is meeting with high demand. The majority of the proceeds will go towards clean and sustainable transport, e.g. the expansion of the railway network. In which other areas will the Green Bond invest?

The return of the yield was short and painful

Due to the rapid rise in yields, almost all types of bonds have suffered significant price losses since the beginning of the year. But now you have the chance to take advantage of the higher yield level. Find out the best way to do this in today’s blog.

World Economic Forum in Davos Sees World at Turning Point After Pandemic-Induced Break

The World Economic Forum in Davos, Switzerland, focused on the topics of the Ukraine war, inflation, supply chain problems, food shortages and climate change. How do top politicians and leading economists assess the situation?

Alternative investments defy market losses

The losses of equities, bonds and gold since the beginning of April have put the limelight on the asset class of alternative investments. What are the characteristics of such an asset? Can this slow the downturn? And how can you invest?

Growth fears

Inflation has been the underlying factor in economy for some time. A recovery of GDP on a pre-pandemic level should be reached soon. The probability of a growth phase has increased. What further developments are expected?

Hawkish and bearish

Expectations of key interest rate hikes have been the most important driving factor for the capital markets since the beginning of the year. The Federal Reserve Chairman reiterated the Fed’s hawkish and bearish stance. How will the financial environment change in the second half of the year?

China’s Strict Zero-Covid Strategy Is Slowing Down Economic Recovery

China’s economy is on a downward slide: exports and freight traffic are at their lowest level since the beginning of the pandemic. Investors are turning their backs on the country. Has the bottom now been reached?

ECB and price stability – an oxymoron?

Is the ECB reacting too late to the rising inflation? Is the massive money supply a ticking time bomb? All eyes are on the European interest rate policy.

Tightening of financial condition

The global economy has been confronted with two stagflationary events in the last two years: the Covid-19 pandemic and the war in Ukraine. What factors are influencing the uncertainty in the markets? Erste Asset Management Chief Economist Winzer analyzes which scenarios are conceivable in the future.

The End of Loose Monetary Policy

The US Federal Reserve is turning the interest rate screw hard and accelerating the exit from its ultra-expansive monetary policy. Will it get a grip on high inflation? And how will the economy cope with higher interest rates?

And this year’s Nobel Peace Prize goes to …?

The European taxonomy created uniform criteria for sustainable investments. Nuclear power was also classified as green under certain conditions. Read the ESGenius Letter on the topic of “Green nuclear power?”.

Saving multiple crises the right way

Companies and their stakeholders are needed to achieve the goal of an effective, science-based climate strategy with a sustainably oriented financial market that drives this transformation.

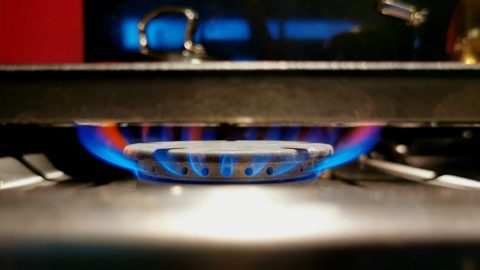

Our ESG partners’ view on nuclear energy and sustainability

The EU Commission announced that certain activities involving nuclear power and natural gas will be included in the EU taxonomy. Small Modular Reactors are seen as an investment opportunity. How are energy suppliers and the financial sector dealing with this?

Investment update: Increased volatility on the stock markets

The financial markets started this week with high volatility. The US leading index S&P 500 suffered a loss of more than 2% since Monday, while the European index EuroStoxx 600 is almost 3% lower. What will we observe in the coming days?

Streaming Industry Shake-Up: Pioneer Netflix Losing Customers for the First Time

After the Netflix share price crash: Are the golden days for streaming providers like Netflix and Amazon over? What new plans could inspire investors?

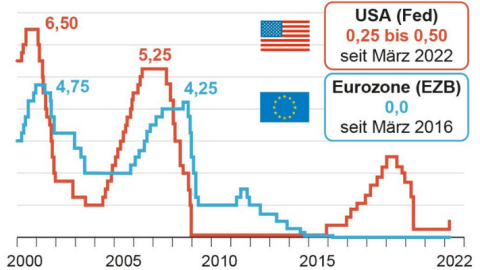

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

France Presidential Elections: Second Voting Round between Macron and Le Pen

A tight race is shaping up in the run-off election for the French presidency in a fortnight. What concerns both candidates is the preservation of purchasing power and the high prices for oil and natural gas. How will the financial markets react to the election result?

The hour of the hawks

In the US, interest rate hikes to a level of 3% by the end of 2023 have become likely. When will the European Central Bank follow? Erste Asset Management Chief Economist Gerhard Winzer analyses the interest rate policies of the central banks.

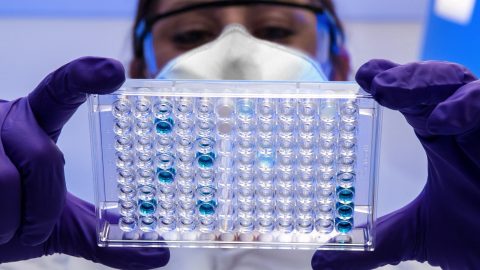

Massive Investments to Solve Chip Industry’s Supply Bottlenecks as Demand Soars Further

The increased demand for semiconductors continues to cause supply bottlenecks. This is why the EU wants to boost Europe’s share of the global market in semiconductor production. In particular, computers and mobile phones as well as consumer electronics are in demand.

The invasion of Ukraine by Russia and its massive effects

Within two years, the global economy has been confronted by two negative events or, indeed, shocks: the Covid pandemic was the first one, having not only killed six million people globally at this point, but having also caused an unprecedented slump in the global economy and the subsequent recovery. The second one, i.e. the invasion of Ukraine by Russia, is of a geopolitical nature and has triggered a commodity price shock.

Water risks in investment – more than just a drop in the bucket?

Drinking water is one of the earth’s limited resources. Water shortage can entail a variety of implications. On the occasion of World Water Day, Walter Hatak, Head of Responsible Investments at Erste Asset Management, analyzes the risks of water consumption.

Do Eastern European bonds offer opportunities?

The war in Ukraine led to losses for Russian bonds. In an interview for OUR VIEW, fund manager Anton Hauser explains why government bonds from Eastern Europe offer an alternative.

Investment update: Some stabilization despite ongoing bombardment

Although volatility and uncertainty remain particularly high in the capital markets, there has been some stabilization and, most recently, a slight recovery in the equity markets since last week.

Soaring Oil Prices may Accelerate Phase-Out of Fossil Fuels

After the oil price climbed to its highest level since 2008 in the previous week, the countries want to end their dependence on Russian oil and natural gas supplies.

Two stagflationary shocks: pandemic and war in Ukraine

The global economy was confronted with two negative developments within two years: the Covid-19 pandemic and the Ukraine war. Erste Asset Management’s Chief Economist Winzer analyzes the stagflationary state of the economy.

Interview: What do the sanctions imposed on Russia mean for our funds?

What are the effects of the sanctions imposed on Russia on our funds? Interview with Alexandre Dimitrov, Senior Fund Manager with more than 20 years of experience and special field of expertise: equity markets Russia and CEE.

Investment Update: First steps to interest rate hikes and volatility in the stock markets

Stocks posted significant gains on Wednesday after U.S. Federal Reserve Chairman Jerome Powell signaled that the central bank would begin raising interest rates this month. Stock markets interpreted this as a positive signal in the sense that the threat to growth posed by the war in Ukraine did not justify a change of course in monetary policy at the moment.

The impact of the war in Ukraine

We want to highlight the possible impact of the war in Ukraine on investment decisions. In short, the conflict reinforces already existing trends. In addition, the global recovery scenario is still holding, but recession risks in Europe have increased.

Ukraine conflict: sanctions against Russia

Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

Military conflict Russia-Ukraine

Russia launched a military invasion of Ukraine on Thursday. The financial markets are reacting with price declines, a rise in the price of crude oil, a fall in the Russian ruble and price rises in credit-sensitive government bonds. We provide an assessment of the current market situation.

Escalation of the conflict between Russia and Ukraine: are the markets at risk?

The Russia/Ukraine conflict is keeping the markets in suspense. Everything is possible – from continued diplomacy in order to contain the escalation to harder sanctions in case of a more comprehensive invasion. The volatility on the financial markets will remain high.

Transition to EVs is the Automotive Industry’s Hope for Beating Chip Crisis

The automotive industry is slowly recovering from the shortage of semiconductors in 2020 and 2021. The European car manufacturers recently presented more positive figures. The switch to electromobility is now in full swing.

Interest rate policy quo vadis? 3 monetary policy scenarios

Rising inflation and rising bond yields have recently caused uncertainty among investors. Will key interest rates in the USA be raised soon? Erste Asset Management’s Chief Economist Winzer outlines 3 scenarios for the interest rate policy of the central banks.

The crisis in Ukraine

The risk of an escalation of the geopolitical conflict between Russia, Ukraine and NATO has risen further in recent days.

Despite correction: long-term upward trend of biotech companies intact

Biotechnology shares have seen better times. Despite the most recent corrections, hopes for growth in the biotechnology sector remain very high. We spoke to Harald Kober, fund manager of ERSTE STOCK BIOTEC, about the latest developments.

Turbulent Week for Tech Giant Shares

US technology stocks have been subject to high fluctuations recently. Facebook reported significant share price losses. In contrast, Apple, Alphabet, Microsoft and Amazon delivered solid figures. The technology sector should continue to grow in the future.

Erste Asset Management achieves record result in 2021

Erste Asset Management was yet again ranked first among the Austrian investment companies last year. Assets under management in Austria had increased by 16.6% y/y to EUR 47.7bn as of 31 December 2021.

Stock markets off to a bumpy start in 2022

Inflation has risen sharply and the first interest rate hikes are expected from the Federal Reserve in the USA. What impact could this have on stocks?

Investing – a long term story

We have seen some extraordinary years speaking about equity and multi asset performance. Interest rates were low, volatility – representing the average daily price changes – was comparably low. What is the situation today?

Gas and Oil Prices Continue to Soar

Energy prices are going through the roof at the moment. The causes are both political and economic. Shares in the energy and commodities sector offer potential for further price increases.

10 theses for 2022

Waves of infections will continue to influence economic activity and the markets. What will happen in China, what are the inflation risks and will it be volatile? Our chief economist Gerhard Winzer has drawn up 10 theses for the year 2022.