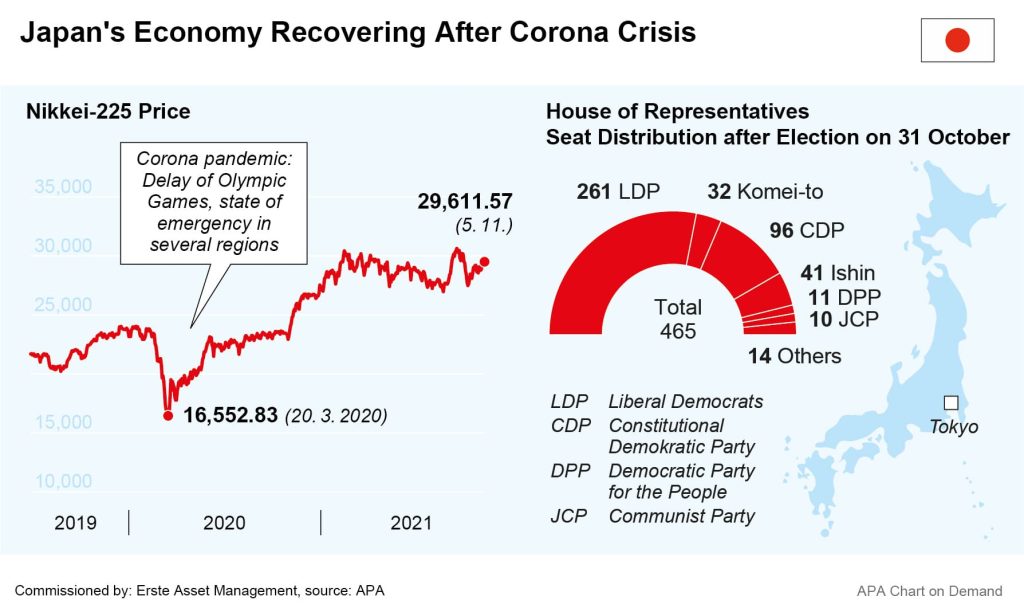

In Japan’s parliamentary elections, Prime Minister Fumio Kishida’s ruling LDP recently gained a surprisingly comfortable majority. The party gained the 261 seats needed for an „absolute stable majority“ of the 465 total seats in the Shūgiin, the Japanese House of Representatives. Together with its smaller coalition partner Komeito, the party even holds 291 seats, allowing the government to control the chairmanship of all committees and comfortably push legislation through the House of Representatives.

The election results were received positively on the Tokyo stock exchange. Investors are hoping for economic stimulus programmes and a continuation of the expansionary monetary policy under the new government. The Nikkei index rose 2.6 per cent the day after the election, trading almost as high as in September, when it had intermittently risen to its highest level since 1990.

64-year-old Kishida had come to power in the party just before the election, having been elected prime minister by parliament in early October after his largely hapless predecessor, Yoshihide Suga, threw in the towel after just one year. Suga had come under criticism for his Corona policy and had lost a lot of popularity. Kishida then called a new election to obtain a mandate from the people for a government under his leadership.

Although the former banker has the image of having little charisma, he also stands for continuity and the continuation of his his party’s right wing’s traditional policies. Before his election, Kishida had promised a new beginning as well as massive corona pandemic aid for the economy. On the day after the election, Kishida again focused his program on economic recovery from the effects of the coronavirus pandemic, but also on combating climate change and a stronger deterrent defense policy against China.

Stimulus Package to Counter Effects of Corona Pandemic and “New Capitalism”

In mid-November, Kishida announced a comprehensive package to boost the economy, particularly including investment in environmentally friendly energy, and a special budget for the end of the year. He also held out the prospect of aid for the tourism industry. However, he also signaled that Japan would have to generally consider the ability of attacking enemy bases as an option to counter foreign nations’ defense technologies, which puts a drastic increase in the defense budget on the agenda.

Kishida also proclaimed a “New Capitalism”. Under this catchphrase, he wants to significantly increase the salaries of the Japanese in order to improve the financial situation of the poorer population and the middle class. Details of this plan are not yet known, but it is expected that Kishida will rely on an expansionary fiscal policy and measures to redistribute wealth. The party’s right-wing had scrapped these plans before the election, but with the absolute majority he has won, Kishida now has a better chance.

Further plans include starting up nuclear power plants again. Since the Fukushima nuclear disaster in 2011, only one-third of the 33 operational reactors are still on the grid. However, in view of the Fukushima meltdown, which led to the shutdown of nuclear power plants, many Japanese are critical of a return to nuclear energy.

Hopes are high for the newly elected government’s economic stimulus program, as the pandemic, supply shortages, production disruptions in Asia and slower growth in China have hit Japan’s heavily export-dependent economy hard. Most Japanese car manufacturers, for example, saw their global output decline in September because of shortages of memory chips and other components. The supply shortages are also reflected in economic statistics. According to government data, Japan’s industry shrank by 5.4 per cent in September compared to the previous month. This is the third consecutive decline.

Central Bank Likely to Continue Expansionary Zero Interest Rate Policy for Now

The Bank of Japan (BoJ) also recently lowered its economic growth forecast for Japan. The central bank expects gross domestic product (GDP) to grow by 3.4 per cent in the fiscal year ending on 31 March With this in mind, the central bank also confirmed its loose monetary policy in support of the economy at the end of October. With this interest rate decision, the short-term interest rate target was left at minus 0.1 per cent and the target yield for ten-year government bonds at zero per cent.

Unlike in other industrialized countries, there are no rising inflation rates in Japan that would require a departure from the low interest rate policy. While other central banks in Europe and the US therefore may raise interest rates this year or next to keep rising inflation in check, Japan has the opposite problem: the Bank of Japan has been fighting falling wages and prices for years and has been trying to fuel inflation with securities purchases. But the BoJ expects inflation to remain below its 2 per cent target for at least two more years, which means that an end to its loose monetary policy is not in sight for the time being.

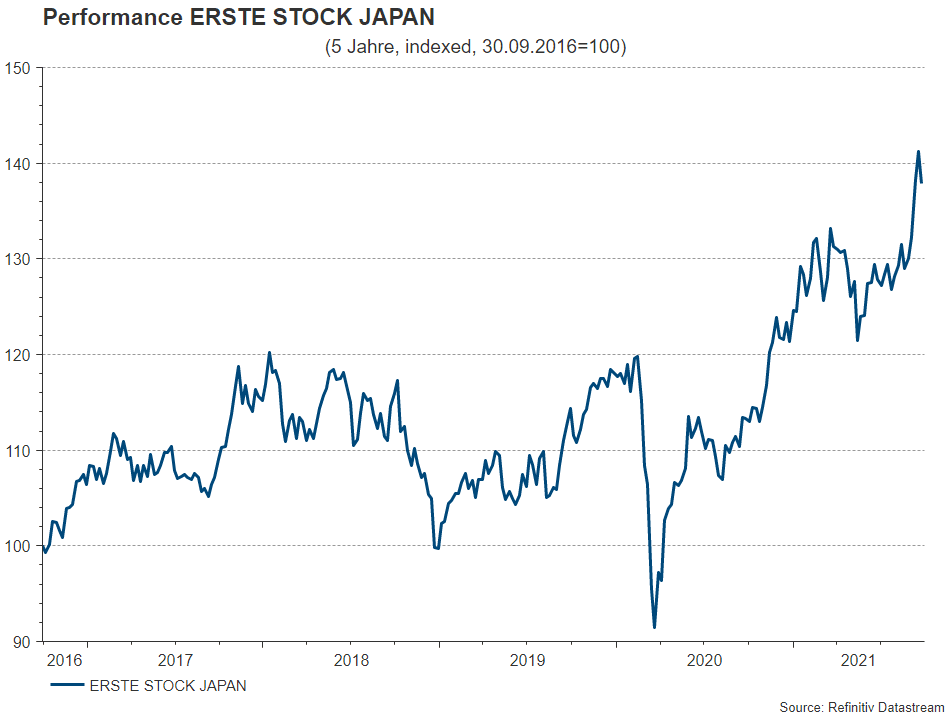

ERSTE STOCK JAPAN: Shares in the Land of the Rising Sun

With ERSTE STOCK JAPAN, investors can invest in a selection of attractive stocks on the Tokyo Stock Exchange. These include, for example, stocks such as the electronics giant Sony Group, the globally active pharmaceutical company Daiichi-Sankyo or the largest Japanese chemical company Shi-Etsu Chemical. In the past 5 years, the fund achieved a performance of 7.1% p.a.. (see chart, data as of 30.9.2021, source OeKB).

CONCLUSION: The parliamentary elections in Japan confirmed Prime Minister Fumio Kishida’s pro-business course. Will the stock market gain new momentum? With the ERSTE STOCK JAPAN you can invest in a selection of attractive Japanese equities.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.