“The Great Transformation”: This was this year’s Forum Alpbach’s overarching motto for the talks and panel discussions among the assembled top politicians, economic leaders and scientists from around the world. Partly on-site and partly online, between 18 August and 3 September a total of 4,134 participants from 62 countries discussed possible ways out of the corona pandemic crisis and global future scenarios.

The dominant topics were the energy transition and decarbonisation of the economy, Europe’s necessity to catch up in terms of digitalisation, and the requirements for labour and capital markets in a world marked by the coronavirus.

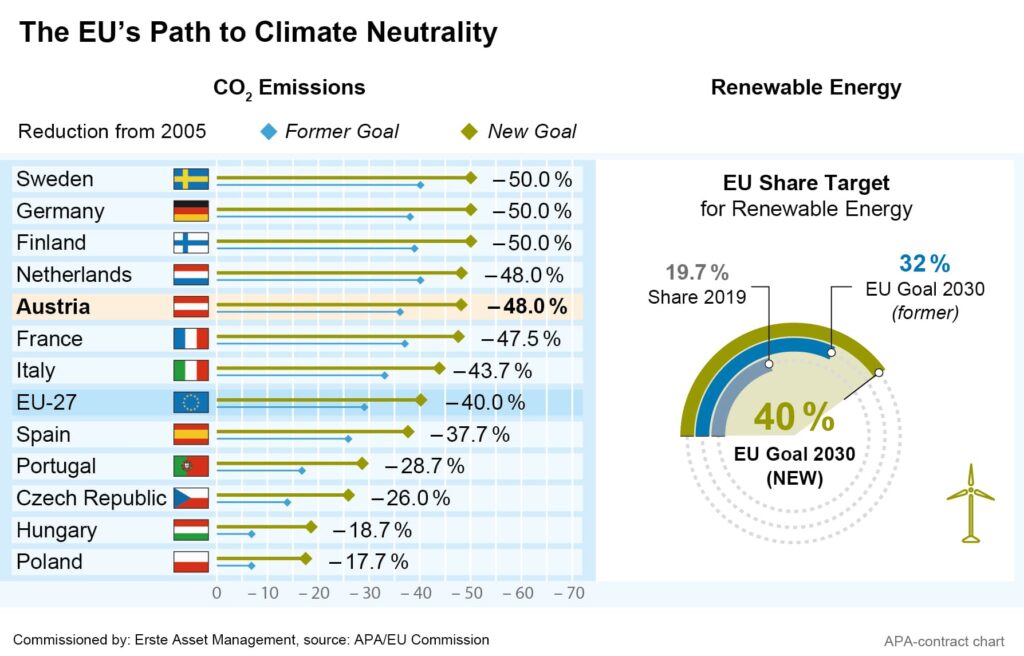

Mathias Cormann, head of the OECD, called for more comprehensive and globally coordinated measures against climate change. The reduction of greenhouse gases and aiming for general decarbonisation play a decisive role in this. Austria is still dependent on fossil fuels to 70 per cent, and the EU to about 80 per cent, said Climate Protection Minister Leonore Gewessler. The EU’s current goal is to reduce greenhouse gases to 55 per cent of 1990 levels by 2030, and to increase the share of renewable energies in the energy mix to 40 per cent. By 2050, the Union wants to be climate-neutral altogether.

However, this change requires major investments. “In order to achieve the transformation in the energy sector alone, 350 billion euros in investments are needed annually until 2030,” said EU Financial Markets Commissioner Mairead McGuiness in Alpbach. By the end of the year, the EU wants to formulate criteria delineating which investments are considered sustainable.

Capital Markets Union and Financial Education Required for Investments in Climate Goals

In this context, McGuiness also stressed the need to create an EU Capital Markets Union. A large part of the investments to meet the EU targets will have to come from the private sector, so the European financial framework needs to be rethought. “We want to create a strong Capital Markets Union that allows more money to flow into healthy companies,” she said.

This also entails strengthening capital market culture and financial education in Europe. “We need a much greater focus on financial education – starting from a very young age, similar to languages. Education is power,” McGuiness said. Only education enables people to make their own financial decisions.

One problem is that people tend to save more when times are uncertain, as they are now, explained Erste Group CEO Bernhard Spalt, and therefore financial education is needed in all areas. At school, the topic should be addressed divided among different subjects. Moreover, ideological barriers often prevent investment growth: “Politicians must create a framework in which investments can be made safely,” Spalt said, adding they should not shy away from it for ideological reasons.

For companies, too, the problem is often not liquidity, but the lack of equity, Spalt said. “The economy is ramping up again, and we are hoping for a very robust recovery. Cash is available, but companies need it as equity to start growing again.” However, many Austrian family-run businesses are afraid of a financier involved in their company interfering, Spalt regretted. Participation is not the end of business, though, the head of Erste Bank added. “it will help you grow further.”

Young business founders also often do not receive bank loans and therefore depend on a functioning capital market that is willing to take risks, said Maria Demertzis, director of the Brussels-based Bruegel think tank. Such investments should be promoted by politics and not be seen as speculation, Forum Alpbach President and former Erste Group CEO Andreas Treichl also demanded. For a start, he would be satisfied if financing from the capital market increased from around 25 to at least 35 per cent. In the US, the ratio is currently the inverse of that in Europe, with about 75 per cent of the money to companies coming from the capital market and only 25 per cent from banks, according to Treichl.

The bond market is also expected to play an increasingly important role in green investments. The Republic of Austria, for example, is to issue its first so-called “green bond”, a bond to raise capital for measures against environmental and climate damage, in the first half of 2022, Finance Minister Gernot Blümel told APA.

OeNB Governor Robert Holzmann also called for targeted infrastructure investments by the public sector to help the economy on its way to climate neutrality. This, he said, was also linked to opportunities for further development, digitalisation and innovation. “The aim is to use decarbonisation in order to leverage the technology and processes already well-developed in Austria to make it one of the leading countries in Europe regarding the implementation of such technologies,” the central banker said.

Experts See a Need for Europe to Catch up in Successful Implementation of Innovations

Compared to other countries, Europe has a certain amount of catching up to do vis-a-vis digitalisation, innovation and development. Minister of Economic Affairs Margrate Schramböck sees Europe particularly behind in the entrepreneurial implementation of innovations. Many inventions are made in Europe, but they need to be turned into successful companies through spin-offs. “What we are missing now is the transfer of basic applied sciences into companies. Austria and Europe must become stronger here,” the Minister demanded in Alpbach. In the past, she said, Europe had made mistakes here, for example by selling off telecom companies, and the related know-how with them.

Minister for Climate Action Gewessler similarly pointed out that Europe had left almost the entire photovoltaic sector to China. Europe should now use the economic opportunities it has through technological leadership in the energy transition, said Gewessler. In Austria alone, she said, there are 2,700 green energy technology companies, with growth rates of about six per cent before the pandemic.

Volkswagen Group CEO Herbert Diess expressed concern about Europe lagging behind in the digitalisation process: “We have to learn from our competitors who think differently. If we are not fast enough, we’re going to have a problem.” This lagging behind is also related to a cultural difference. In Europe, for example, data is seen as something personal, whereas in the USA and China it is seen as the basis for business models and innovations. Diess, however, attests Europe a leading role in the fight against climate change. This also opens up many opportunities for innovations and new areas of business. VW sees the fight against climate change not as a threat but as an opportunity.

The Volkswagen CEO sees a need for Europe to catch up in the field of electromobility – compared to US companies such as Tesla, but also to Chinese car manufacturers. Andreas Matthä, head of Austrian railway operator ÖBB, on the other hand, sees the increased switch to rail as the logical way to achieve the climate goals. “A switch from road to rail has an immediate effect on the climate,” Matthä explained, calling for true-cost pricing in the transport sector. Like all other European railways, he supports the EU Commission’s proposal of an emissions trading system (ETS) for transport, said Matthä, proposing that the revenues from this ETS system be at least partially earmarked for expansion and digitalisation of the railway system.

In any case, the digitalisation of workplacees around the world, which has accelerated rapidly during the lockdowns, is likely to continue. Teleworking will remain, even if not as ubiquitous as during the height of the pandemic, OECD head Cormann is convinced: “The pendulum will swing back, but not as far as before.” OeNB director Holzmann still sees major challenges ahead for the labour market. “It is important to restore the lost jobs on the labour market and, above all, to reintegrate the long-term unemployed,” said Holzmann.

Legal note:

Prognoses are no reliable indicator for future performance.