Alternative forms of investments such as microfinance funds have become more popular with investors in recent years, complementing equities, bonds, real estate, precious metals, and commodities.

Such funds invest in microloans that help people in emerging markets to secure their subsistence. At the same time, they pay a yield, as Martin Cech, fund manager of ERSTE RESPONSIBLE MICROFINANCE, explains.

What is microfinance?

Muhammad Yunus, founder of Grameen Bank, had the idea of microfinance as early as in the 1970s. He received the Nobel Peace Prize for his concept of microloans in 2006. Microfinance means “banking for the unbankable person”.

The money goes to people who have no credit rating but a business idea. These ideas can come from any area, e.g. crafts, agriculture, tourism, or services. In many cases, microfinance clients have more than one business pillar, so to speak. Microfinance is no donation; it supports the fight against poverty.

It gives people the chance of a better life while at the same time facilitating a stable yield for investors. The ERSTE RESPONSIBLE MICROFINANCE fund does both: it makes the world a slightly better place with microfinance while earning money.

A fund for investors who want to do good

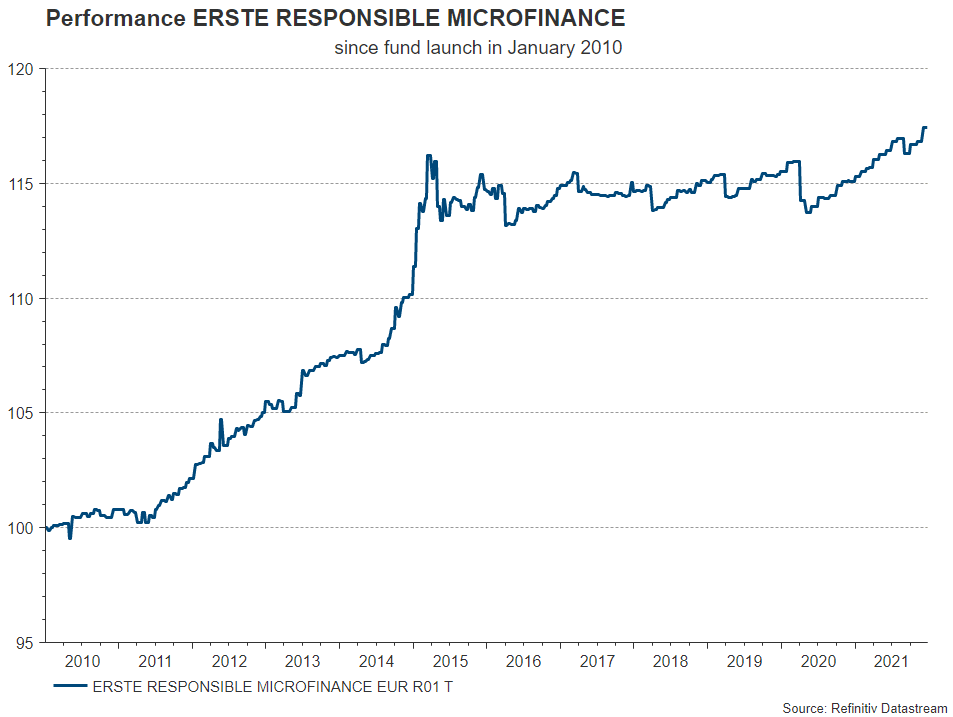

The umbrella fund ERSTE RESPONSIBLE MICROFINANCE was launched by Erste Asset Management in January 2021 and has been the only microfinance fund according to the Austrian Investment Fund Act.

Since its launch, it has achieved a cumulative performance of +24.98% (as of 30 November 2021; source: FMP), i.e. +1.89% per year. The fund has achieved positive monthly performances throughout 2021.

In the past 36 months, the volatility has been only slightly above 1%. As a result of this attractive relationship of yield vs. volatility, the fund has repeatedly received the Österreichischer Dachfonds Award (Austrian Umbrella Fund Award) of Geld-Magazin, most recently in 2021, when it was declared the winner in its category (1st place in the one-year ranking, and 2nd place in the five-year ranking).

As impact fund that is meant to achieve a directly positive, sustainable impact, the fund is classed according to the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector.

Low correlation with equities and bonds

It is worth bearing in mind that the performance of the fund has a very low correlation to large investment categories such as equities or bonds.

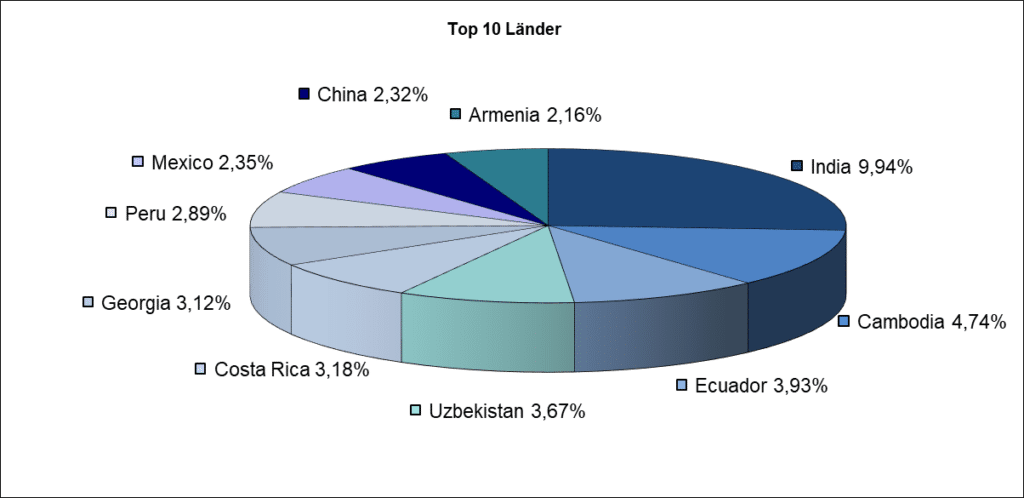

This is due to global diversification (ERSTE RESPONSIBLE MICROFINANCE invests across 90 countries and more than 470 institutes in total) and to the fact that the business of typical microfinance clients and the capital markets have only a limited number of points of contact.

That being said, the microfinance market, too, is subject to external forces. In spring of 2020, the market corrected in the wake of the outbreak of the Covid-19 pandemic.

Many recipients of microloans lost their livelihood overnight. Some microfinance institutes (MFIs) had to form provisions for their loans. Moratoriums were being granted as it was (and is) in the interest of MFIs to continue and expand the long-standing business relationships with their microfinance clients.

“The money goes to people who have no credit rating but a business idea. These ideas can come from any area, e.g. crafts, agriculture, tourism, or services. In many cases, microfinance clients have more than one business pillar, so to speak. Microfinance is no donation; it supports the fight against poverty.”

Fund Manager Martin Cech (left).

© Phot: Erste AM

Global pandemic as disruptive factor

In 2021, the dynamic development continued on the global microfinance market, although the ongoing Covid-19 pandemic remains a burden on a global scale.

The biggest regions are South and Southeast Asia (21.4%), followed by Central Asia (17.2%), Central America (13.0%), and South America (12.1%).

Sub-Saharan Africa accounts for 5.6%. Investments in MFIs account for about 5.2%, supporting the momentum of the fund. Rural borrowers in the fund make up 46%. It is the fund management team’s goal to keep this ratio of rural vs. urban borrowers balanced.

Maybe this will curtail rural flight? Another positive aspect: at 61%, women tend to account for a large part of the recipients of microloans.

Downside: limited liquidity

Investors should bear in mind that microfinance is considered an alternative investment and as such has only limited liquidity. This is due to the fact that the fund invests largely in credit to microfinance institutes that are not exchanged-traded.

Breakdown of the top-10 country weights in the fund

SUMMARY:

Microfinance is an investment class that is still not particularly well known. It supports people setting up a business and provides investors with a regular yield that is uncorrelated to equities or bonds. ERSTE RESPONSIBLE MICROFINANCE offers the chance to invest in microloans. The aforementioned notices about limited liquidity should be borne in mind.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.