The semiconductor industry is considered one of the biggest beneficiaries of the AI boom. Investors therefore kept a close eye on the sector’s figures for the first three months of 2025. One thing became clear: the expansion of AI infrastructure continues to deliver good results for most chip companies – but the sword of Damocles in the form of impending US tariffs is still hanging over industry giants such as Nvidia & Co. Read more in today’s blog post.

All articles on the topic “Markets and opinions”

Italy after the parliamentary elections: a path beset by obstacles

Italy has voted: The party “Fratelli d’Italia” around top candidate Giorgia Meloni was the election winner. The center-right alliance together with the parties “Lega” and “Forza Italia” achieved an absolute majority. What consequences could the election results have for the country, its economy and cooperation with the European Union?

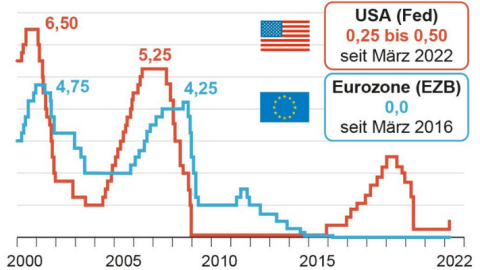

Rapid and synchronous key rate hikes

Central banks are responding to high inflation by raising key interest rates. Further key rate hikes are likely this week as well.

New UK Prime Minister and New King During Turbulent Times

The death of Queen Elizabeth II, her succession by Charles III and the appointment of the new prime minister, Liz Truss, mark a change of era in Great Britain. The government’s focus is on the fight against inflation and high energy prices.

Monetary tightening even as growth slows further?

Last week, three major central banks have raised their key interest rates further. By nature, however, it is not easy to find the right key interest rate level – especially in the current environment.

European Forum Alpbach Ends on a Positive Note Despite Ukraine War and Climate Crisis

The 77th edition of the European Forum Alpbach recently came to an end. This year, the symposium was held under the central motto “The New Europe”, with topics such as climate protection or security policy on the agenda.

420 years – The birth of the stock exchange

On August 31, 1602, stock exchange history was written in Amsterdam. 420 years later, Michiel van der Werf, Senior Fund Manager at Erste Asset Management, looks back on the birth of stock exchange trading.

The Meme Stocks Are Back: Bed Bath & Beyond in the Spotlight After Price Rollercoaster

The meme stocks are back. Most recently, the shares of Bed Bath & Beyond in particular have been in the spotlight with a veritable roller coaster ride. What is behind this phenomenon?

For some time valid: Elevated recession risks and restrictive monetary policy

The central banks want to achieve their long-term inflation target of 2%. In order to achieve this goal, they have raised key interest rates and are implementing a restrictive monetary policy. The higher key interest rates will weaken economic growth and also the labour market. Whether this can be achieved without a recession or whether there will be a “soft landing” is currently the subject of heated debate.

Cyber-Roundup 2022: Tesla shareholders demand action on social issues

At the beginning of August, this year’s Tesla Annual General Meeting took place under the name “Cyber Roundup”. The number of shareholder proposals on environmental and social issues reached a new maximum this year.

ERSTE FAIR INVEST – “S” moving to centre stage

About a year ago, the social impact fund ERSTE FAIR INVEST was launched. Reason enough to take a closer look at the fund, which focuses on the “S” in ESG. In addition, fund manager Bernhard Selinger explains in an interview what the term “fair” actually means.

ESG investments – “S” is for sexy?

Human rights, child labor, arms production, … – the range of social issues in the ESG universe is long. Besides environmental and governance aspects, social issues are becoming increasingly important when it comes to sustainable investment. A possible EU social taxonomy could bring new standards for sustainable investments and thus bring the “S” in ESG even more into focus.

Jackson Hole – Focus on Monetary Policy

This week, the highly acclaimed Jackson Hole Economic Symposium will take place. Fed Chairman Jerome Powell’s speech will be the center of attention.

Very tight labor market in the USA

Many economic indicators point to weakening economic momentum. Meanwhile, the US labor market continues to be very robust, which recently mitigated the immediate risks of recession in the United States.

OPEC+ Agrees Minimal Increase in Production Volumes

Hopes were pinned on a significantly higher increase to put the brakes on the soaring oil prices. At present, it is mainly the oil companies that are benefiting from this, as they recently reported record profits.

Croatia entering Eurozone – Farewell to Kuna

Croatia’s entry into the euro area is a done deal. Ivana Kunstek, Senior Fund Manager at Erste Asset Management Croatia, talks about her home country’s path into the eurozone.

The Euro – a Snapshot

For more than 20 years, the euro has been the instrument of payment for around 340 million people. What is the current state of our currency and what opportunities and challenges does the euro face?

Energy commodities and inflation – where are we going?

Prices for energy and food have risen significantly, putting a strain on consumers’ wallets. If the Russia-Ukraine war does not ease, the situation may deteriorate even further.

Recession Risks

Ahead of the upcoming interest rate decision by the Federal Reserve, a number of economic indicators point to increasing risks of growth or recession. There are also uncertainties regarding the further development of inflation and the effectiveness of monetary policy measures.

WIIW Forecast Sees Eastern European EU Countries Well-Equiped to Handle Consequences of War and Inflation

For this year, experts at the Vienna Institute for International Economic Studies (WIIW) expect economic growth of 3.3% on average for the EU members in Central, Eastern and Southeastern Europe.

Mega interest rate hikes indirectly increase purchasing power

Gerhard Winzer, Chief Economist at Erste Asset Management, provides an overview of recent economic developments and explains, among other things, what structural problems the euro is facing.

Japan Faces Possible Monetary Policy Change Following Upper House Election

Prime Minister Fumio Kishida’s ruling LPD won a resounding victory in the upper house election. With a solid majority, Kishida could now initiate reforms in security and energy policy. In addition, the extremely loose monetary policy that has been in place for years is being put to the test.

Mixed outlook for the second half of the year

Ahead of the upcoming reporting season, several negative factors dominate the markets. Tamás Menyhárt, Senior Fund Manager at Erste Asset Management, sums up the stock market year so far and shares his views on the further development.

An extraordinary half year

The first half of the year on the financial markets was characterized by price declines in equities and bonds, rising inflation, and the war in Ukraine. What developments does Erste Asset Management expect for the second half of the year?

Fund savings plan: Why it pays off to persevere

The bears have gained the upper hand on the stock markets. How investors and savers can overcome this phase and why perseverance could pay off right now.

Central Banks Attempt to Prevent Inflationary Spiral

Since the beginning of the year, the bond markets have been in a bear market. What are the implications for the economy? Erste Asset Management Chief Economist Gerhard Winzer analyzes three models in relation to the development of inflation and their implications.

Travel Industry Expects Strong Summer Season After Two Years of Crisis

For companies in the tourism and travel industry, this could mean a return to profitability despite staff shortages and higher fuel prices.

Increasing growth risks

Inflation, the war in Ukraine and monetary policy are driving the markets and stoking fears of an impending recession. Initial economic indicators also point to gloomy growth prospects.

Toothless central banks: will the interest rate increases remain ineffective?

Rising credit rates and prices for goods and services are hampering consumer demand. Which future scenario can be expected? Interview with Péter Varga, Senior Professional Fund Manager at Erste Asset Management.

Way Out Recession?

The prices of risk asset classes are subject to downward pressure. Is an inflation spiral likely to occur? Will the increase in key interest rates trigger a recession?

High inflation rates increase downside risks

Inflation rates continue to rise, prompting central banks to accelerate rate hikes. Which models for the future inflation development are conceivable? Erste Asset Management Chief Economist Winzer analyzes which scenarios are imaginable in the future.

Despite high inflation, U.S. Treasury Secretary Yellen sees little risk of recession

Sentiment among U.S. consumers has fallen to a record low due to high inflation. How does this data affect the economy? Is a recession looming? Are solid corporate results being ignored?

Austria goes green

The first green bond of the Republic of Austria was issued on 24 May 2022 and is meeting with high demand. The majority of the proceeds will go towards clean and sustainable transport, e.g. the expansion of the railway network. In which other areas will the Green Bond invest?

The return of the yield was short and painful

Due to the rapid rise in yields, almost all types of bonds have suffered significant price losses since the beginning of the year. But now you have the chance to take advantage of the higher yield level. Find out the best way to do this in today’s blog.

World Economic Forum in Davos Sees World at Turning Point After Pandemic-Induced Break

The World Economic Forum in Davos, Switzerland, focused on the topics of the Ukraine war, inflation, supply chain problems, food shortages and climate change. How do top politicians and leading economists assess the situation?

Alternative investments defy market losses

The losses of equities, bonds and gold since the beginning of April have put the limelight on the asset class of alternative investments. What are the characteristics of such an asset? Can this slow the downturn? And how can you invest?

Growth fears

Inflation has been the underlying factor in economy for some time. A recovery of GDP on a pre-pandemic level should be reached soon. The probability of a growth phase has increased. What further developments are expected?

Hawkish and bearish

Expectations of key interest rate hikes have been the most important driving factor for the capital markets since the beginning of the year. The Federal Reserve Chairman reiterated the Fed’s hawkish and bearish stance. How will the financial environment change in the second half of the year?

China’s Strict Zero-Covid Strategy Is Slowing Down Economic Recovery

China’s economy is on a downward slide: exports and freight traffic are at their lowest level since the beginning of the pandemic. Investors are turning their backs on the country. Has the bottom now been reached?

ECB and price stability – an oxymoron?

Is the ECB reacting too late to the rising inflation? Is the massive money supply a ticking time bomb? All eyes are on the European interest rate policy.

Tightening of financial condition

The global economy has been confronted with two stagflationary events in the last two years: the Covid-19 pandemic and the war in Ukraine. What factors are influencing the uncertainty in the markets? Erste Asset Management Chief Economist Winzer analyzes which scenarios are conceivable in the future.

The End of Loose Monetary Policy

The US Federal Reserve is turning the interest rate screw hard and accelerating the exit from its ultra-expansive monetary policy. Will it get a grip on high inflation? And how will the economy cope with higher interest rates?

Our ESG partners’ view on nuclear energy and sustainability

The EU Commission announced that certain activities involving nuclear power and natural gas will be included in the EU taxonomy. Small Modular Reactors are seen as an investment opportunity. How are energy suppliers and the financial sector dealing with this?

Investment update: Increased volatility on the stock markets

The financial markets started this week with high volatility. The US leading index S&P 500 suffered a loss of more than 2% since Monday, while the European index EuroStoxx 600 is almost 3% lower. What will we observe in the coming days?

Streaming Industry Shake-Up: Pioneer Netflix Losing Customers for the First Time

After the Netflix share price crash: Are the golden days for streaming providers like Netflix and Amazon over? What new plans could inspire investors?

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

France Presidential Elections: Second Voting Round between Macron and Le Pen

A tight race is shaping up in the run-off election for the French presidency in a fortnight. What concerns both candidates is the preservation of purchasing power and the high prices for oil and natural gas. How will the financial markets react to the election result?

The hour of the hawks

In the US, interest rate hikes to a level of 3% by the end of 2023 have become likely. When will the European Central Bank follow? Erste Asset Management Chief Economist Gerhard Winzer analyses the interest rate policies of the central banks.

Massive Investments to Solve Chip Industry’s Supply Bottlenecks as Demand Soars Further

The increased demand for semiconductors continues to cause supply bottlenecks. This is why the EU wants to boost Europe’s share of the global market in semiconductor production. In particular, computers and mobile phones as well as consumer electronics are in demand.

The invasion of Ukraine by Russia and its massive effects

Within two years, the global economy has been confronted by two negative events or, indeed, shocks: the Covid pandemic was the first one, having not only killed six million people globally at this point, but having also caused an unprecedented slump in the global economy and the subsequent recovery. The second one, i.e. the invasion of Ukraine by Russia, is of a geopolitical nature and has triggered a commodity price shock.

Water risks in investment – more than just a drop in the bucket?

Drinking water is one of the earth’s limited resources. Water shortage can entail a variety of implications. On the occasion of World Water Day, Walter Hatak, Head of Responsible Investments at Erste Asset Management, analyzes the risks of water consumption.