On the occasion of the World Water Day, Erste Asset Management published its first water footprint for its sustainable equity funds five years ago. Two years ago, we added the water footprint of our sustainable fixed income funds. This way, we do not only set an important example to convince companies to publish their water data, but Erste Asset Management can also integrate this important information in their investment decisions.

“For years and generations, wars have been fought over oil. In a short matter of time, they will be fought over water.”

This quote by US Vice President Kamala Harris expresses the increasing environmental relevance of water very clearly[1]. The switch to a more sustainable use of water is unavoidable: drinking water, one crucial basis of existence, is becoming increasingly scarce. Although water covers the majority of our planet, only a marginal part of it can be consumed as drinking water. What makes the situation more dire is the fact that the increasing water demand due to the growing world population is in diametrical opposition to the increasing contamination of water by intensive agriculture and the reduction of natural water reserves due to long periods of drought. The World Economic Forum therefore regards a global water crisis, together with a shortage of other important natural resources, as one of the ten biggest global risks in the coming ten years[2], more important than, for example, the global government debt crisis.

Water shortage can entail a variety of implications such as stricter regulation of water consumption, massive price increases, production delays, or even the closing-down of production facilities. Therefore, the assessment of water risk is advisable also from an economic perspective.

Regional component is significant

In contrast to the CO2 footprint, the water footprint also crucially hinges on information from the local component. Companies whose production sites are based in regions with high water stress levels, are exposed to a high degree of water risk, even if the water consumption is average by sector comparison. It makes a difference whether a production site is located in Cape Town, which has had a hard time avoiding the complete suspension of its water supply in recent years, or close to the Alps, which are often considered the “water castle of Europe”.

The categorisation we use at Erste Asset Management into low, medium, and high stress regions is based on the risk classification of the World Resources Institute, which takes into account physical, regulatory, and reputational risks (for more information please visit: World Resources Institute).

Data coverage for water is improving

At the most recent publication of water and environmental data by listed companies for fiscal 2021, the data coverage accounted for 72.9% for the equity funds that we took into account. This means that in comparison to the initial measuring of the water footprint in 2017 (46.8%), the coverage has increased significantly. The coverage in our fixed income funds is 38.5%; here, we can see clear upward potential*.

*Sources: Bloomberg, MSCI-ESG, ISS-oekom, calculations by Erste Asset Management, water and sales data from fiscal 2021

Taking into account water risks when selecting assets

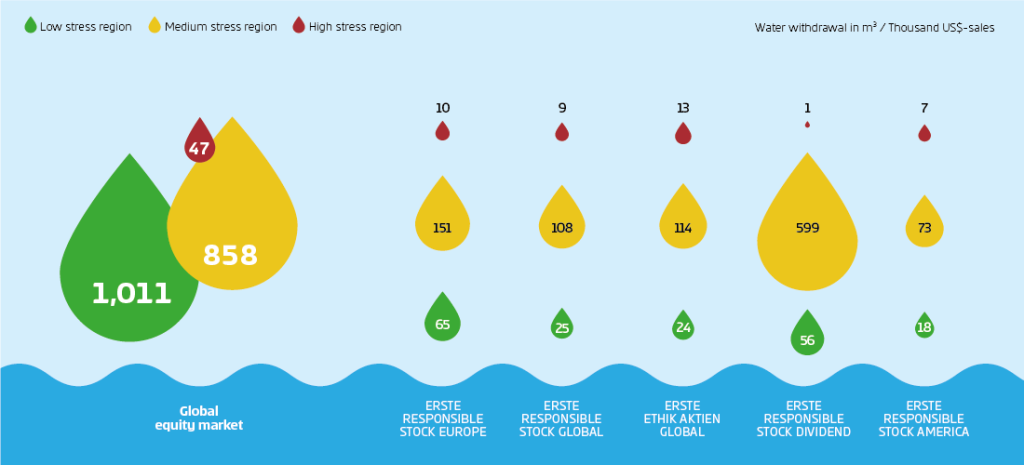

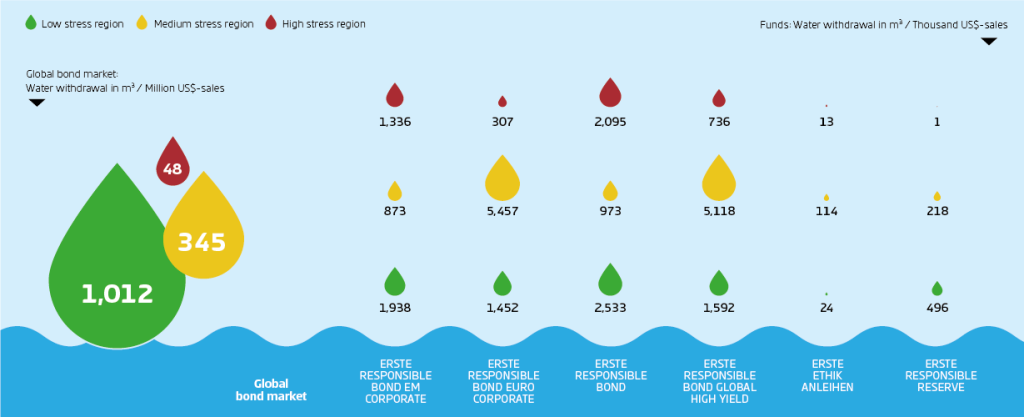

We select companies for our sustainable funds while bearing in mind their responsible use of water; this has been a successful strategy: in comparison with the global equity market, sustainable funds perform significantly better both in terms of overall assessment and risk regions.

This is due to our comprehensive ESG analysis. In order to reduce water risks, the sustainability analysts of Erste AM take into account the management and the regional distribution of the withdrawal of water in the company evaluation. In calculating the in-house ESGenius rating, we register among other things to what degree a company operates in dry risk areas and how much it depends on the withdrawal of water there. Also, the measures taken to improve water consumption towards a higher degree of sustainability are part of the assessment.

EVALUATION WATER FOOTPRINT

Global equity market vs. sustainable equity funds

EVALUATION WATER FOOTPRINT

Global fixed income market vs. sustainable fixed income funds

When establishing the average water intensity of the companies held by the various funds, we rely on the volume of water withdrawn by the respective companies as key ratio. Water intensity measures water consumption in cubic metres per USD 1,000 worth of sales.

[1] Sen. Kamala Harris Predicts Wars Will Be Fought Over Water | CNS News

[2] WEF_The_Global_Risks_Report_2022.pdf (weforum.org)

ERSTE RESPONSIBLE STOCK DIVIDEND

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK DIVIDEND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK DIVIDEND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK DIVIDEND as described in the Fund Documents.

ERSTE RESPONSIBLE BOND EM CORPORATE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND EM CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND EM CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND EM CORPORATE as described in the Fund Documents.

ERSTE RESPONSIBLE BOND EURO CORPORATE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND EURO CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND EURO CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND EURO CORPORATE as described in the Fund Documents.

ERSTE RESPONSIBLE BOND

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND as described in the Fund Documents.

ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the Fund Documents.

ERSTE RESPONSIBLE RESERVE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE RESERVE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE RESERVE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE RESERVE as described in the Fund Documents.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK EUROPE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK EUROPE as described in the Fund Documents.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE ETHIK AKTIEN GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE ETHIK AKTIEN GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE ETHIK AKTIEN GLOBAL as described in the Fund Documents.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK AMERICA as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK AMERICA, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK AMERICA as described in the Fund Documents.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE ETHIK ANLEIHEN as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE ETHIK ANLEIHEN, consideration should be given to any characteristics or objectives of the ERSTE ETHIK ANLEIHEN as described in the Fund Documents.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.