Articles about “markets”

Fiscal- and monetary policies – Update from the Investment Division

What has occurred since yesterday ? Gus Backus celebrated in the 1960s some successes in the German Pop music charts. It is remarkable that in the 50s he also scored two top ten hits in the USA. In the chorus in one of his songs he sings: “Who should pay that, who ordered that, who […]

ECB bond purchases unconstitutional – Update from the Investment Division

What has occurred since yesterday ? Yesterday the German Constitutional Court has ruled that the Asset Purchase Program of the European Central Bank partly violates the German constitution. Via that program bonds of more than two trillion Euros were purchased since 2015 to bring liquidity to the markets and the economy. As the German constitutional […]

„Rough, nice and easy“ – Update from the Investment Division

What has occurred since the long weekend? The song „Proud Mary“was written by John Fogerty, the front man of the rock band Creedence Clearwater Revivial. There are many cover versions of this song. The best known is probably from Tina Turner. That version starts with the line “…we’re gonna take the beginning of this song […]

Losses at beginning of week – Update from the Investment Division

What has occurred since the long weekend? Last week began on a positive note in the markets for risk assets. The US leading index, S&P500, gained 3.6% from Monday to Wednesday. This was triggered by the following positive news: In a study, the drug Remdesivir showed success in treating COVID-19 patients. The US Federal Reserve’s […]

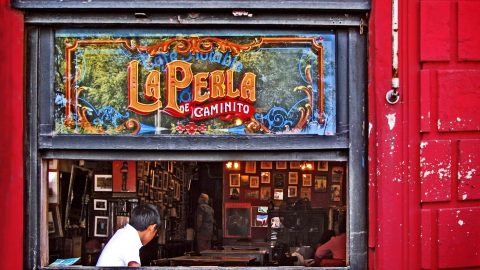

Argentina cries (again) – Update from the Investment Division

Argentina is crying (again): This time not for Eva Peron – but Argentina’s plans for debt restructuring are meeting with resistance. Update from the Investment Division.

Upward trend at the beginning of the week – Update from the Investment Division

At the beginning of the week stock markets continue the upward trend of the previous week and the WTI oil price falls in double digits to a multi-year low. What will we see this week?

Stock market rally– Update from the Investment Division

What has occurred since yesterday ? Markets Stock markets continued to rally yesterday. Europe was up slightly by 0.65%. USA clearly in positive territory at approx. 3%. Asia is slightly in negative territory as of this morning. The oil price fell back down to USD 20.30 (WTI). Gold remained strong at USD 1720 per ounce. […]

Reduction in Covid-19 deaths – Update from the Investment Division

What has occurred over the weekend ? On Friday and also over the weekend some movement happened in the talks between Russia and Saudi Arabia about possible oil production cuts. After the last talks of OPEC+ about a month ago ended without an agreement between those two countries Saudi Arabia increased the oil production unilaterally. […]

Increasing oil price – Update from the Investment Division

Yesterday the rise in oil prices was particularly noteworthy in the markets. What do rising oil prices mean for the global economy?

Our update from the Investment Division.

Positive summary of last week – Update from the Investment Division

What has occurred over the weekend? Equity markets had a good week. The US-equity index S&P 500 gained + 10,3%. Also the European markets gained significantly. The EuroStoxx 50 gained 7,5%. A bit negative were the losses on Friday (S&P 500 – 3,4%, EuroStoxx 50 – 4,2%). Volatility in the markets remained on a higher […]

For 3 day win streak – Update from the Investment Division

What has occurred since yesterday ? Global equity markets closed yesterday the third day in a row with strong gains. The US leading equity index increased by 6,2%. The European exchanges could see gains of 1% to 3%. The credit risk margins für High Yield Corporate Bonds decreased again considerably. Also on the markets where […]

“Mr. Market” two positive days in a row – Update from the Investment Division

What has occurred since yesterday ? Two positive days in a row on the American stock markets. Something we saw the last time on 11. + 12.2020. Mr. Market was in a good mood over the last two days. After the US-American equity index S&P500 gained almost 9% on Tuesday it increased also yesterday by […]

Bull movement – Update from the Investment Division

What has occurred since yesterday ? Bull movement. Prices of risky asset classes, e.g. equity increased. Of course the question remains if it is just a short, technical upward spurt or a stable base. The reason for the better mood in the market is the agreement in the USA on a USD 2000 billion stimulus […]

Father of value investing – Update from the Investment Division

What has occurred since yesterday ? Benjamin Graham focused on fundamental equity analysis and became widely known as the “father of value investing”. Equity should only be purchased at a discount to its fundamental value. In his book “The Intelligent Investor” Graham creates a character called Mr. Market, a fellow who turns up every day […]

Coronacession

The world is in a state of emergency, with the corona pandemic constituting a global health, economic, and financial crisis. The term “Coronacession” has been created as a chimaera of corona and recession. The central question is how deep the emergency runs and how long it will last. The speed of the development is breath-taking. […]

The ordinary becomes special – Update from the Investment Division

What has occurred since yesterday ? Sometimes the ordinary becomes something special. To prove the validity of this heuristic, we will use the database of our Bloomberg terminal once again. On the 24,060 trading days of the leading US index S&P500 since 1928, the average daily change has been +0.02%. In contrast, for almost a […]

ARGENTINA CRIES (again) – Status Quo and Quo Vadis

The developments surrounding the election in Argentina & presidential challenger Alberto Fernandez are currently frightening investors. Are we looking at a “default”? Our fund manager Felix Dornaus analyzes the situation.

Stock markets in 2018 – market activity dominated by politics and volatility

2018 was a year of politics in the stock markets. Find out which three major topics dominated the international market activities in the current year.

Market view: Increased uncertainty

The performance of most asset classes in the year to date has been mixed, to put it euphemistically. Is there a common underlying factor? Can we expect to see a better second half of the year?

A brief history of time.. and markets

In the nineteen-sixties, mathematician Benoit Mandelbrot noticed something that experienced traders had known for long: that time at the stock exchange does not always run the same. Read about the relativity of time here.

Financial Markets Monitor June: a lot going on

An Investment Committee again! A month can pass quickly, especially if there is a lot going on in the markets. In light of recent market events (Italy, Turkey, Argentina), I was surprised that our risk stance has not changed since our last Investment Committee meeting. Obviously, it takes a lot to get us out of […]

Financial Markets Monitor May: positive opportunities outnumber negative ones

Positive opportunities still outnumber the negative ones on the capital markets – that was the conclusion of our Investment Committee. Our willingness to take risks is still optimistic and also moderately higher than in April.

Market Monitor: After the market correction, confidence outweighs

The year 2018 had started on such a promising note – is what we all were thinking. But at the beginning of February, the market taught us a lesson. As a result, the discussions at our first Investment Committee of the year at the beginning of February were interesting ones.

Turkey and the feeling of summer time sadness

We are almost approaching the end of the summer but it looks like we are back to April 2015 in Turkey. The election outcome and aftermath did not work as politicians had desired and the efforts to form a government have failed so far.