„If you’re going through hell, keep going!”

Sir Winston Spencer Churchill

The year 2018 had started on such a promising note – is what we all were thinking. But at the beginning of February, the market taught us a lesson. As a result, the discussions at our first Investment Committee of the year at the beginning of February were interesting ones.

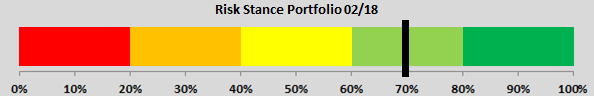

The risk stance of our Committee, which queries the risk appetite of the participants, has fallen slightly from 79% in December to 70%, which, however, is still clearly aggressive. The assessment of the group has changed significantly with regard to the market though. Here, we as a group believe that the risk appetite has fallen to neutral territory (48%), from 61% in December. In addition, the distribution within our group has become more divided. While the term “bimodal” would be excessive in describing our view of the markets, the large degree of uncertainty is also reflected in the distribution.

Source: Erste AM

This means that we remain very optimistic about the development of the markets in the coming months – i.e. one reason to remain invested in risky assets.

Inflationary pressures in the US

At the end of 2017 we already pointed out (and I relayed this in our last Market Monitor in December 2017) that the future development of the US inflation was one of the central parameters for the markets in 2018. “The Philipps curve is dead” and “This time it’s different!” were the explanations as to why the rate of inflation was just not going to rise in 2017 despite the good economic performance. According to our opinion stated then, inflation was going to increase in 2018, and the US Fed would come under pressure to raise interest rates more quickly and significantly than expected by the market. This would in turn also affect the long-term interest rates, i.e. government bond yields should rise in such a scenario.

Heavy market reactions in early February

In January, we did indeed see yields rise, and at the beginning of February, another strong US labour market report also suggested pressure on wages. Given that the “this time it’s different” mantra works only until it doesn’t, the market’s reaction to the numbers was not surprising.

However, what did surprise us was the extent of the reaction. Along with the aforementioned re-evaluation of interest rate expectations, the exposure in some very popular assets (e.g. VIX futures) seems to have played an important role.

No “real” inflation problem

What’s in store now? Even last December we expected inflation to rise in 2018. We maintain this position, but do not believe in a massive rise (core PCE deflator at 2%), nor do we see a real problem with inflation (i.e. a continued upward trend beyond 2%). Judging by the inflation expectations priced into the market, the market itself is holding the same view, which may pose a certain degree of risk. Accordingly, the current turbulences should remain contained. As soon as the interest rate expectations have adjusted to the new situation, the market should calm down again in this scenario.

Thrust by US tax reform

This takes us to the second large issue of our discussion: the fiscal stimulus in the USA. The agreement on the new debt ceiling in the USA and the tax reform passed in December will result in massive fiscal stimulus, in a phase where the US economy is growing above potential already (as measured by different estimates of the output gap). Overall this means another boost for the already solid economic growth in the USA.

Since the model is unfunded, the fiscal impulses will be mainly reflected in an expanded budget deficit. Together with the high current account deficit, this is a classic case of a twin deficit that the USA is running here. It is definitely positive for growth in the short run, but in the long run it will turn into a problem on numerous levels. And as long as the economy in the USA remains as good as it is now, it should prevent the equity markets (and other risky assets) from shedding too much value on a sustainable basis.

Overall, the EIC discussion has confirmed our assessment: we do not expect the current cycle to have come to an end at this point. As Winston Churchill said, “If you’re going through hell, keep going!”. This is exactly what we will be doing, albeit more cautiously than in 2017.

What does that mean in terms of our positioning?

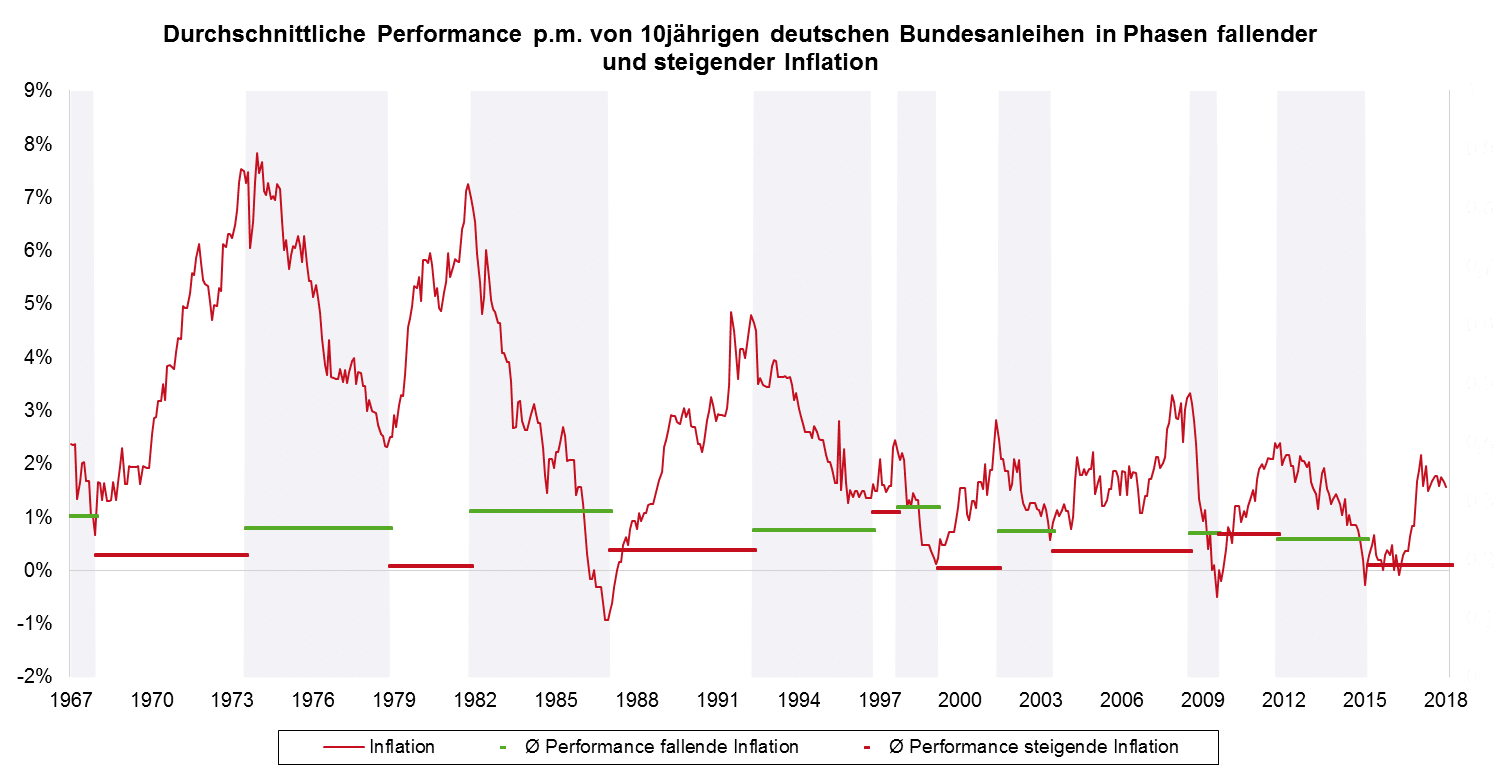

- Government bonds unattractive. We continue to regard safe government bonds and the interest rate risk associated with them as unattractive. Rising key-lending rates and inflation are no good environment for bonds per se, as the following graph shows, which charts German inflation since 1967 in phases of rising and falling inflation. The graph also illustrates the average monthly return of German government bonds in each phase. The rate of return in phases of rising inflation clearly underperforms the rate in phases of falling inflation.

Source: Erste AM

- Stocks: Stay is announced. From our point of view, equities should continue to offer upward potential. We think there is a chance of the new highs being set in 2018 one more time. However, the ride may become bumpier, with the recent months giving investors a first taste. It should therefore become difficult to take profits efficiently as part of a tactical allocation and to sustain a significant equity allocation in the first place. We have thus reduced our equity position relative to 2017, but still maintain a sizeable allocation in this segment. We use roughly half of the maximum bandwidth at this point. We believe that the key strategy in the current phase of the market is riding it out.

- Bonds: focus on corporate bonds and emerging markets

In the fixed income segment, our asset allocation remains focused on credits and emerging markets, which to us seem significantly more attractive in their risk/return profile than government bonds. Credits with low duration (e.g. short-term bonds from emerging markets) seem particularly attractive.

- Why is the US dollar not rising? The USD is especially interesting at the moment. We are holding no active USD position in our asset allocation. Why? At the moment, the USD is falling. In the 80s, the last time twin deficits were a big issue in the USA, they – and a determined Fed – caused the USD to appreciate massively

“May you live in interesting times”, as a famous Chinese curse goes. 2018 is an interesting year already!

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.