Articles about “government bonds”

Bella Economia: Italy’s path to pre-crisis levels and what the “Superbonus” has to do with it

The Italian economy is stagnating – it has only recently returned to pre-crisis levels. Tight budgets, an uncertain political environment and an ageing population are hindering growth. High investments are expected to achieve the turnaround. On the bond market, investors are confident that this can be achieved.

Best of Charts: News from the inflation

Even though inflation has weakened recently, it remains an important topic for private individuals as well as for companies and the markets. What might happen next in terms of inflation and how long will the restrictive monetary policy stay with us? A look at some important financial charts will shed some light on this.

The Good, the Bad and the Hawk

Last week brought good, bad and inflation-fighting news, all from the US. At the start of the new trading week, the focus is on the turbulence surrounding Silicon Valley Bank.

Hawkish holidays from the Bank of Japan

Last week, the Japanese central bank made the last major monetary policy decision of 2022, bringing an eventful year to an end – also from a central bank perspective.

Transition Phase

So far this year, high inflation rates have been the driving factor on the financial markets. This could now change, as Chief Economist Gerhard Winzer writes. Disappointingly weak indicators of economic activity could now increasingly come into focus.

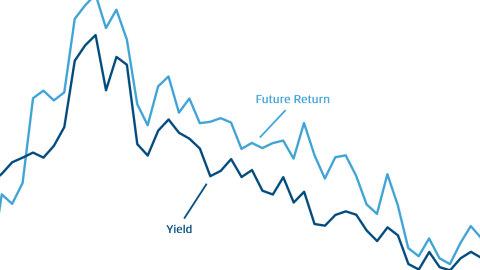

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

Central Banks Attempt to Prevent Inflationary Spiral

Since the beginning of the year, the bond markets have been in a bear market. What are the implications for the economy? Erste Asset Management Chief Economist Gerhard Winzer analyzes three models in relation to the development of inflation and their implications.

The return of the yield was short and painful

Due to the rapid rise in yields, almost all types of bonds have suffered significant price losses since the beginning of the year. But now you have the chance to take advantage of the higher yield level. Find out the best way to do this in today’s blog.

Do Eastern European bonds offer opportunities?

The war in Ukraine led to losses for Russian bonds. In an interview for OUR VIEW, fund manager Anton Hauser explains why government bonds from Eastern Europe offer an alternative.

Yield curve management

In recent days, equities and other risky asset classes have come under pressure despite the fact that in the year to date the optimism about an economic recovery has been on the rise. Is that a case of “buy the rumour, sell the fact”? Had the good news already been priced into the market? Or is there another mechanism that could be driving the future development?

Coronacession

The world is in a state of emergency, with the corona pandemic constituting a global health, economic, and financial crisis. The term “Coronacession” has been created as a chimaera of corona and recession. The central question is how deep the emergency runs and how long it will last. The speed of the development is breath-taking. […]

Strong growth and rising rates

At the beginning of 2018, economic indicators are confirming the recovery scenario. Above all, the yields of government bonds are on the rise. Why is that the case, and what does it mean for the financial market as a whole?

After the interest rate hike is before the interest rate hike?

Imagine a fairy that grants you three wishes. What would you wish for? The answer would be very easy for me. I would just like to know if the economy is caught up in a recession of has embarked on an expansionary phase a year from now…

Challenging environment on the Stock Exchange

The recovery from the slump on the equity markets we saw at the beginning of the year is coming to an end. The rally is losing steam. The search for new supporting factors in addition to the expansive central bank policies is difficult. In line with the general strategy “sell on highs”, we took the […]

Turbulent capital markets: what to expect in 2016?

The price declines on the equity markets at the beginning of the year suggest a decline in investor confidence. Is this justified? Please find a few hypotheses for 2016 in the following:

The return of volatility

Earlier this year the president of the ECB said we would have to get used to elevated levels of volatility. And it is true, the market environment has changed. The years 2009 to 2014 were subject to an asset price reflation regime. High rates of return were coupled with low volatility. This relationship has now […]

Parallel currency in Greece?

Last Sunday, the Greek people decided with a clear majority to follow the proposal of their government. With 61.3%, the No camp rejected the conditions of the expired adjustment program. Thereby, Greece is one step closer to an exit from the Eurozone and the European Union.

The confrontation of the doves

The most important central bank in the world, i.e. the US Fed, made an announcement yesterday that attracted a large deal of attention from investors. The bank withdrew its assurance to remain “patient” before the Fed funds rate would be increased. This paved the way for a possible abandonment of the zero interest rate policy, […]