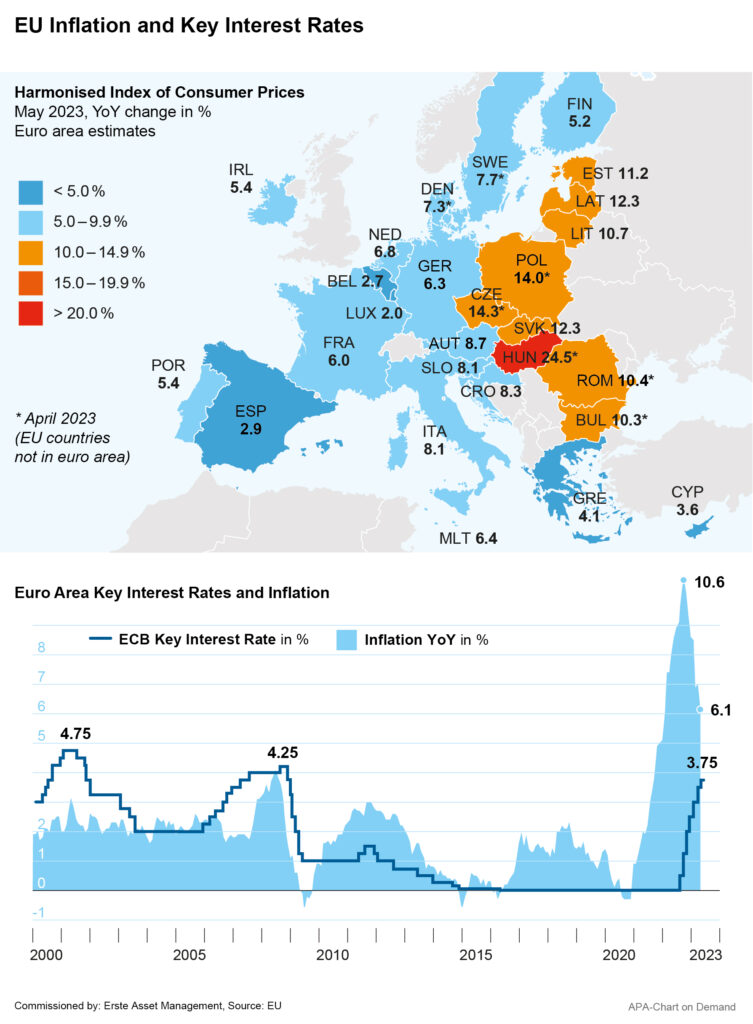

The recent sharp rise in inflation in Europe may have passed its peak. Most recently, the statistics office Eurostat reported a surprisingly significant slowdown in inflation for May. According to an initial estimate, consumer prices rose by 6.1 per cent year-on-year last month, while inflation still lay at 7.0 per cent in April.

On a country-by-country basis, inflation within the euro area is particularly high in the Baltic states, reaching double digits. Comparatively low inflation rates can be found in Belgium (2.7 per cent) and Spain (plus 2.9 per cent).

Drop in energy prices dampens inflation

The main driver for the decline in euro area inflation was a drop in energy prices, which fell by 1.7 per cent in May – following an increase of 2.4 per cent in April. Prior to that, the sharp rise in the price of imported natural gas due to the war in Ukraine significantly drove inflation upwards.

Prices for food, alcohol and tobacco, on the other hand, continued to rise, albeit less sharply than recently: the price increase in May was 12.5 per cent, compared with 13.5 per cent in April. The core rate of inflation, which excludes the subject-to-fluctuation food and energy prices, fell to 5.3 per cent from 5.6 per cent in May.

Meanwhile, consumers’ expectations regarding inflation have also gone down: According to an ECB survey, consumers in the euro area expect an inflation rate of 2.5 per cent within three years.

British Inflation Back to Single Digits for the First Time in Months

Outside the EU and the euro area, a similar picture presents itself. UK inflation fell to 8.7 per cent in April, the lowest level since March 2022. Previously, the UK was the only Western European country to report double-digit inflation; in the fall, marking the highest inflation rate in four decades at 11.1 per cent. Now inflation is back in the single digits for the first time in seven months.

While UK citizens continue to suffer from high food prices, the significantly cheaper cost of electricity and gas has also had a positive impact on the British Isle. In Switzerland, which was spared any strong inflationary surges in the first place, the inflation rate fell from 2.9 percent in March to 2.6 per cent in April.

This could also reduce the pressure on central banks to counter high inflation by raising interest rates. Previously, the ECB had been fighting price increases – fueled mainly by high energy and food prices – with a series of interest rate hikes. After several years of zero and negative interest rates, the central bank has raised its key interest rate at an unprecedented pace since July 2022 in a total of seven interest rate steps, to its current level of 3.75 per cent. The Bank of England recently raised its key interest rate for the twelfth consecutive time to 4.5 per cent.

Figures give hope for end of interest rate hikes, but no all-clear from central banks yet

The declining inflation rates give hope for a nearing end to interest the rate hikes, but central banks are reluctant to give the all-clear just yet. The official inflation target of 2.0 per cent set by the ECB and the Bank of England has not yet been reached. “A big part of the journey is over, but there is still the last stretch,” cautioned ECB Vice President Luis de Guindos.

ECB Executive Board member Isabel Schnabel also doesn’t see an end to rate hikes in the fight against inflation. “We need to see convincing evidence that inflation is returning to our two percent target in a sustainable and timely manner. We have not reached that point yet,” Schnabel told the Belgian daily De Tijd in an interview conducted in late May.

It is therefore a question of great interest for all stakeholders whether Europe’s central banks will stick to their rate hike course when they make their interest rate decisions soon. The ECB’s next interest rate decision is due on next Thursday, June 15. The Bank of England and the Swiss National Bank (SNB) will decide on their interest rates on June 22.

Return to normality after years of low interest rates

However, even if the central banks do raise their interest rates, some financial experts believe the financial markets’ reactions could be less severe than in the past. Stock markets may even see rate hikes as a sign of central bank confidence in the resilience of the economy and a return to normalcy.

Some economists see the past 15 years of extremely low inflation and interest rates as an anomaly. Even if inflation rates decline and interest rate hike paths come to an end, we may not see a return to the levels of this exceptional phase. For many experts, this is supported by the fight against climate change and decarbonization.

“The ecological transformation of national economies requires major investments, which will drive up costs and thus inflation in the medium term,” Princeton-teaching economist Markus Brunnermeier told the German Handelsblatt in a recent interview. ECB Director Isabel Schnabel also warned months ago that investments in climate-friendly policies could have lasting effects on price levels.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.