All articles on the topic “Markets”

Financial markets outlook: equities and high-yield bonds remain first choice

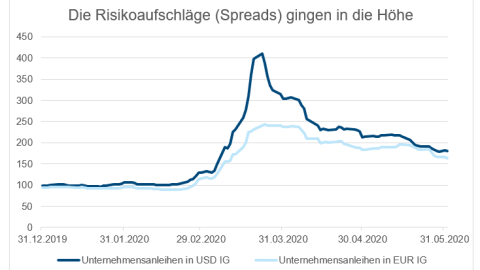

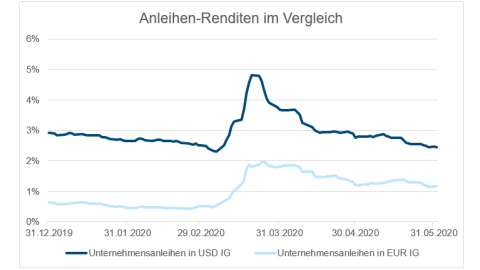

On top of the corona situation, two additional developments have been crucial for the development of the financial markets. The central banks have been pursuing a very expansive regime on a global scale, and at the same massive stimulus packages have been passed in an effort to get the economy up to speed again

Trump declares war on Chinese companies behind TikTok and WeChat

US President Donald Trump has escalated his fight against the Chinese-owned social media services TikTok and WeChat, and in the process also caused new tensions in the trade dispute with China.

Corporate earnings provide tailwind – Update from the Investment Division

The surprisingly good corporate earnings provided a tailwind & the price of gold continued to rise. Update from the Investment Division.

Shares in positive territory – Update from the Investment Division

The US stock market was lifted by technology stocks such as Apple and Microsoft & earnings growth so far is -10.5%. Update from the Investment Division.

TikTok ban in the USA – Update from the Investment Division

TikTok is the focus of the dispute between the US and China & corporate bonds posted their best month in June. Update from the Investment Division.

FOMC Meeting – Update from the Investment Division

Yesterday, the Fed was the focus of attention & the increase in Covid 19 infections could put further pressure on the economy. Update from the Investment Division.

„I just can’t get enough“– Update from the Investment Division

In one hit the Black Eyed Peas sang “I just can’t get enough”. Even governments and central banks seem to have fallen in love with economic stimulus packages. Update from the Investment Division.

Losses for risk investments – Update from the Investment DivisionOutlook.

The markets for risky assets ended last week with losses. The main reason was the escalating tensions between China and the US. Update from the Investment Division.

EU summit: Agreement on billion-euro aid package – Update from the Investment Division

The EU heads of state and government have agreed on a billion euro aid package. It is the largest in the history of the EU. Update from the Investment Division.

Marathon talks on EU Corona aid packages – Update from the Investment Division

The weekend was marked by marathon talks between EU leaders. So far, no agreement has been reached. Update from the Investment Division.

Canada’s central bank – Update from the Investment Division

Canada’s central bank has left the key interest rate unchanged and no change in monetary policy stance is expected at today’s meeting of the Governing Council.

Stock markets in the corona crisis – Update from the Investment Division

The stock markets continue to be caught between the economic recovery on the one hand and the rising number of new infections in the USA on the other. Update from the Investment Division.

Corona crisis continues to weigh heavily on the aviation industry

Despite the recent border openings, the corona pandemic continues to impact the aviation industry.

Are technology shares the new utilities?

The last few months in particular have impressively shown us that IT is a critical factor for our society. Are technology companies and their shares what utilities used to be?

Increasing new infections – Update from the Investment Division

After the easing measures new global infections continue to rise. The stock markets remain unimpressed by this. Update from the Investment Division.

Trading session in Asia – Update from the Investment Division

Asian stock exchanges traded significantly higher & new infections with the Covid-19 virus reach new record levels. Update from the Investment Division.

US Consumer Confidence – Update from the Investment Division

Consumer confidence is rising in the USA. An index that measures consumer confidence is the largest growth and has clearly exceeded expectations for the index. Update from the Investment Division

Travel industry hoping for rapid recovery after border opening

With the opening of many European countries’ borders, the travel industry, which has been severely affected by the response measures to the coronavirus pandemic, is also hoping for a revival of travel and tourism, which has virtually come to a standstill.

„I‘ m easy like a sunday morning“ – Update from the Investment Division

The Commodores around Lionel Richie landed a hit with their song “Easy” in 1977. The monetary policy of the central banks remains just as “easy”. Update from the Investment Division

Markets are gaining again – Update from the Investment Division

“Markets recovery”: High yields, EU peripheral government bonds and emerging market bonds posted gains. Update from the Investment Division.

Rollercoaster ride for markets – Update from the Investment Division

“Rollercoaster ride continues”: Most stock exchanges were clearly in the red & the markets ignore the new infections in China. Update from the Investment Division

“Now it starts again”: – Update from the Investment Division

New wave of Covid-19 cases from Beijing market spreads to Liaoning and on Friday there was a countermovement on the stock markets. Update from the Investment Division.

Stock market rally – Update from the Investment Division

Yesterday it seemed as if the stock markets needed to catch their breath after the rally of the last few weeks. It was the seventh day that the S&P 500 suffered a daily loss. Update from the Investment Division.

Decoupling the real economy – Update from the Investment Division

Stock market prices have risen sharply despite the crisis, but the gap between the financial and the real economy continues to widen. Update from the Investment Division.

German government approves EUR 130bn stimulus package to “emerge from the crisis with a bang”

Germany’s government wants to cushion the consequences of the Corona crisis with a massive economic stimulus package. This show of strength is intended to revive the economy and consumption of citizens and avert a severe recession.

India: Narendra Modi – the prime minister as crisis winner?

A year ago India was one of the fastest growing economies in the world. Today the world looks completely different because of COVID-19. But no matter how bad the conditions in India are, Prime Minister Modi’s popularity is on the rise. Could he really emerge from the crisis as a profiteer?

„Ain’t no Mountain High Enough“ – Update from the Investment Division

“Ain’t no Mountain High Enough”: The mountains of debt that governments are accumulating know hardly any limits at present. Update from the Investment Division.

China’s recovery trend continues

As the „first in, first out” country of the COVID-19 crisis, China is gradually returning to normal. The April activity numbers indicate that China’s domestic economy has been resilient and has continued to recover from the COVID-19 disruption.

Security law for Hong Kong – Update from the Investment Division

What has occurred since yesterday? Politics 1 – Further tensions between the USA and China. As reported China is attempting to implement a national security law in Hong Kong. Since the UK handed over Hong Kong to China in 1997 the concept “One state, two systems” is in place. That granted Hong Kong a far-reaching autonomous […]

Positive start of the week – Update from the Investment Division

Our young swans are allowed to go back to school and Hong Kong stabilized despite tensions with China. Update from the Investment Division.

Car industry suffers from corona pandemic

The Corona crisis has also caused the automotive industry to suffer a sharp drop in sales. The sharpest drop in new registrations was recorded in Italy and Spain. China provides a glimmer of hope.

Hands remain shaky – Update from the Investment Division

The “Black Swan” is what stock market experts call an unexpected event and the daily news continues to influence events on the stock markets. Update from the Investment Division

Postitive end of the week – Update from the Investment Division

The end of the week on the stock markets was more positive than the beginning of last week. Update from the Investment Division.

Musk launches Tesla production – Update from the Investment Division

What has occurred since the yesterday ? Elon Musk has always been a colorful character. Until now, he could also adorn himself with the fact that his products help save the world. Especially the Tesla electric cars. Yesterday he added another chapter to his extraordinary story by announcing that he will resume production at the […]

Slow economic recovery – Update from the Investment Division

On Friday the markets for risky assets received a double boost. The reason for this is a rapid economic recovery after the sharp containment measures. Update from the Investment Division.

Trade deal between USA and China – Update from the Investment Division

What has occurred since yesterday ? The global equity markets closed yesterday in positive territory. The US markets could see gains of ca. 1%. In Europe the gains were ca. 1,5%. In the last days the trade conflict between the USA and China overshadowed the markets once again. However, from that corner came positive news […]

Fiscal- and monetary policies – Update from the Investment Division

What has occurred since yesterday ? Gus Backus celebrated in the 1960s some successes in the German Pop music charts. It is remarkable that in the 50s he also scored two top ten hits in the USA. In the chorus in one of his songs he sings: “Who should pay that, who ordered that, who […]

ECB bond purchases unconstitutional – Update from the Investment Division

What has occurred since yesterday ? Yesterday the German Constitutional Court has ruled that the Asset Purchase Program of the European Central Bank partly violates the German constitution. Via that program bonds of more than two trillion Euros were purchased since 2015 to bring liquidity to the markets and the economy. As the German constitutional […]

„Rough, nice and easy“ – Update from the Investment Division

What has occurred since the long weekend? The song „Proud Mary“was written by John Fogerty, the front man of the rock band Creedence Clearwater Revivial. There are many cover versions of this song. The best known is probably from Tina Turner. That version starts with the line “…we’re gonna take the beginning of this song […]

Losses at beginning of week – Update from the Investment Division

What has occurred since the long weekend? Last week began on a positive note in the markets for risk assets. The US leading index, S&P500, gained 3.6% from Monday to Wednesday. This was triggered by the following positive news: In a study, the drug Remdesivir showed success in treating COVID-19 patients. The US Federal Reserve’s […]

High volatility also in the price of gold

Gold plays a role as a “safe haven” in times of crisis. But the price is anything but stable.

Labour day: High unemployment challenges economic policy-makers

It is now that we are becoming acutely aware of how important work is for us, with the job market data taking to centre stage on this year’s Labour Day. The number of people who are out of a job because of the pandemic has increased drastically. Numerous measures, such as reduced working hours in Austria, have been taken in an effort to contain the situation. We expect a positive trend reversal later in the year.

Corona crisis dampens expectations for business figures

The first reporting season of 2020 in the USA is dominated by the corona crisis. What trends can be seen from the Q1 figures for the rest of the year?

The long-term consequences of the corona pandemic – an analysis

The corona pandemic has plunged the world into an economic crisis. Erste AM chief economist Gerhard Winzer analyzes the 10 most important points about recovery, economic policy, inflation and the duration of the slump.

Argentina cries (again) – Update from the Investment Division

Argentina is crying (again): This time not for Eva Peron – but Argentina’s plans for debt restructuring are meeting with resistance. Update from the Investment Division.

Upward trend at the beginning of the week – Update from the Investment Division

At the beginning of the week stock markets continue the upward trend of the previous week and the WTI oil price falls in double digits to a multi-year low. What will we see this week?

Corona and the oil market

The oil market won’t escape the corona virus unscathed either. Within only two weeks, oil recorded its best and its worst day of the millennium so far.

Stock market rally– Update from the Investment Division

What has occurred since yesterday ? Markets Stock markets continued to rally yesterday. Europe was up slightly by 0.65%. USA clearly in positive territory at approx. 3%. Asia is slightly in negative territory as of this morning. The oil price fell back down to USD 20.30 (WTI). Gold remained strong at USD 1720 per ounce. […]

Easter weekend with a difference – Update from the Investment Division

What has occurred since last Friday ? This Easter weekend was quite different compared to other Easter weekends of the past. Even if our countries will be on the forefront to loosen the lock-down over the next months not much could be felt from any resurrection yet. At least the OPEC-countries and their allies including […]

Reduction in Covid-19 deaths – Update from the Investment Division

What has occurred over the weekend ? On Friday and also over the weekend some movement happened in the talks between Russia and Saudi Arabia about possible oil production cuts. After the last talks of OPEC+ about a month ago ended without an agreement between those two countries Saudi Arabia increased the oil production unilaterally. […]