Despite the recent border openings, the corona pandemic continues to impact the aviation industry. Although the industry association IATA has recently reported an upturn in key performance indicators for June and thus the first effects of the corona relaxation measures, the positive effects are currently primarily evident in domestic flights. However, the number of global flight bookings in late June remained around 80 per cent below the previous year’s level, IATA announced.

Despite the recent border openings, the corona pandemic continues to impact the aviation industry. Although the industry association IATA has recently reported an upturn in key performance indicators for June and thus the first effects of the corona relaxation measures, the positive effects are currently primarily evident in domestic flights. However, the number of global flight bookings in late June remained around 80 per cent below the previous year’s level, IATA announced.

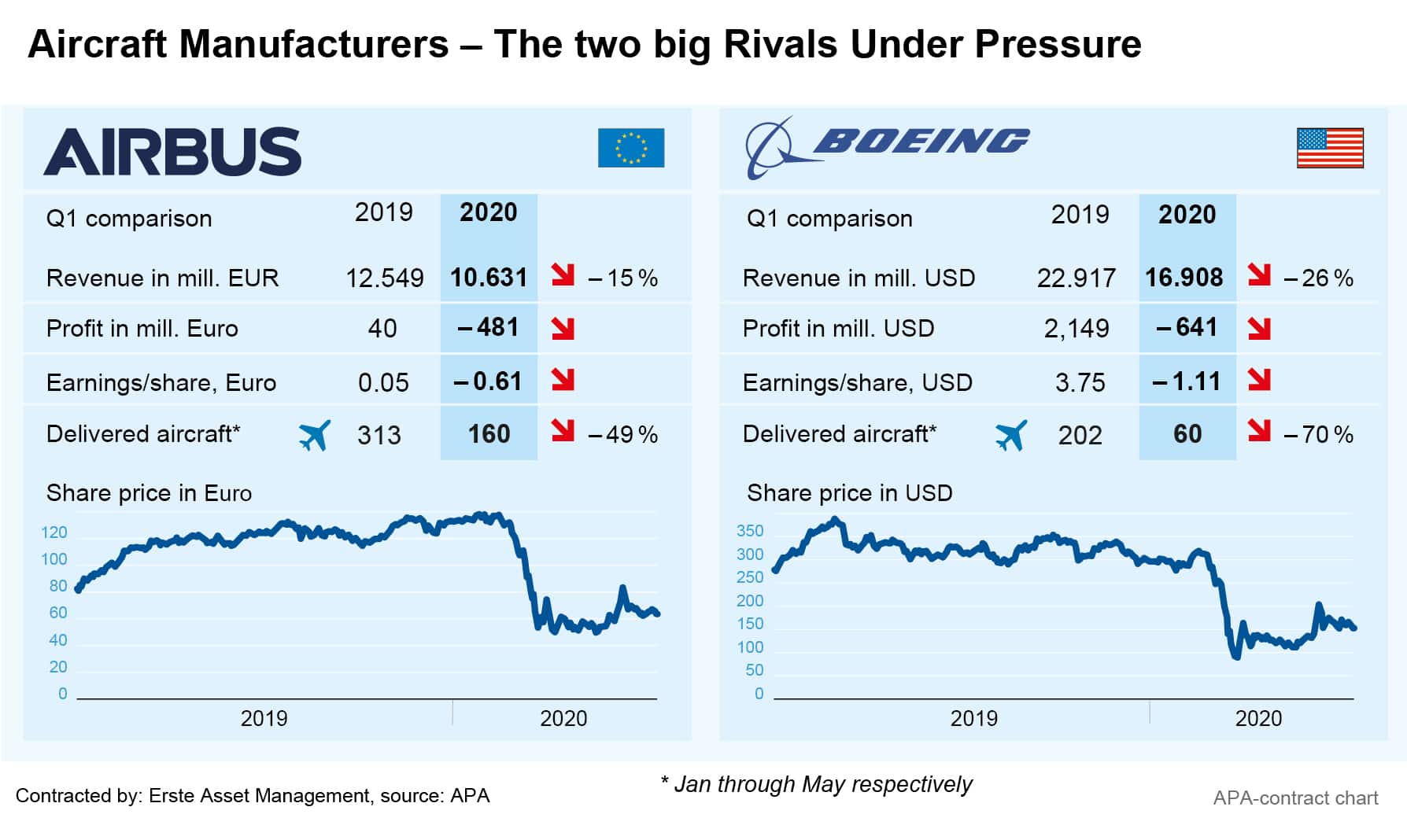

Apart from the airlines, the two largest aircraft manufacturers and arch rivals Airbus and Boeing are also massively impacted: Airbus plans to cut about 15,000 jobs worldwide in response to the aviation crisis. In Germany alone, about 5,100 jobs will be affected, the aircraft manufacturer recently announced. In addition, Airbus plans to cut 5,000 jobs in France, 900 in Spain, 1,700 in Great Britain, and over a thousand at other locations worldwide.

“The industry is in an unprecedented crisis”, Airbus announced. Air traffic is not expected to recover before 2023 and may not return to pre-corona levels until 2025. According to broadcaster NDR, Airbus Labor Director Marco Wagner spoke of the worst crisis in aviation history. No area at Airbus would be spared, said Wagner, adding that Airbus will probably be a smaller company overall after the crisis.

Airbus CEO Guillaume Faury had already prepared the company’s employees for hard times on several occasions, and had spoken of a situation threatening the company’s existence, especially since a second corona wave could further delay any expected recovery.

As a result of the corona crisis, Airbus did not receive any new aircraft orders in June, as had already been the case in May. At present, many completed aircraft are parked, airlines currently not accepting them because of the collapse in the market caused by the corona crisis. Production is to continue, but temporarily at a slower pace, with only 40 of the best-selling A320 series to be produced per month.

737 Max flight ban puts additional pressure on Boeing

The US aircraft manufacturer Boeing has also already launched a massive cost-cutting programme to stabilise its financial position. At the end of April, the company announced that it would cut ten per cent of its jobs worldwide, about 16,000 jobs.

Boeing is not only suffering from the Corona crisis, but also continues to suffer from the flight ban on its Boeing 737 Max planes. After two crashes in Indonesia and Ethiopia with a total of 346 fatalities, Boeing’s best-selling aircraft type has been placed under a worldwide flight ban since March 2019. A faulty control program is considered the main cause of the accidents.

Most recently, the Boeing 737 Max completed its first test flights for recertification by the FAA. This marks an important milestone, but a number of other hurdles remain, such as the evaluation of flight data. The grounding will only be lifted when the FAA safety experts are convinced that the aircraft meets all standards. If all goes well, the 737 Max could be certified again in the coming months.

With the Corona crisis the situation has been exacerbated for Boeing. The US aircraft manufacturer is also suffering from the order slump in the industry. In May, Boeing delivered only four commercial aircraft as opposed to 30 in May of 2019, even though the 737 Max was already subject to take-off bans at that time. The order situation also remains critical. In May only nine new orders came in and the wave of cancellations continues: In the course of the year to date, a total of 602 orders were lost by the end of May.

Airlines continue to rely on massive government aid

Meanwhile, the airlines, which have been severely affected by the crisis, continue to rely on cost cutting and large-scale state aid. AUA parent company Lufthansa, for example, has recently decided to make further savings. The number of management positions is to be reduced by 20 per cent, and 1,000 administrative jobs will also be cut.

Lufthansa had to be saved from bankruptcy with a EUR 9bn government financial package due to the business slump caused by the pandemic. According to the executive board, the airline group has a long-term personnel surplus of 22,000 full-time positions, as the management expects a permanently smaller fleet. Agreements with unions on cost reductions are to prevent the affected employees from having to be laid off.

The crisis has also led to a return of state involvement. As a result of the rescue package, the German state is now Lufthansa’s largest single shareholder, owning 20.5 per cent. The controversial state shareholding had made the Lufthansa rescue dubious for a while, however, in the end the shareholders voted in favour of the rescue package, including the state’s entry.

Lufthansa subsidiary AUA was also rescued using state funds in part, with the Republic of Austria and owner Lufthansa each contributing EUR 150m in addition to a state-guaranteed EUR 300m bank loan.

KLM Royal Dutch Airlines secured a state loan of EUR 3.4bn at the end of June to overcome the crisis. This means that the aviation group Air France-KLM can count on financial aid to combat the effects corona crisis of more than EUR 10bn that is either directly state-funded or state-guaranteed. France is supporting KLM’s sister company Air France with EUR 7bn.

Now the industry is hoping for positive effects arising from the opening of the borders. Based on its forecast models, IATA expects further recovery in the demand for flights during Q3, with domestic flights in particular leading the recovery. However, according to IATA estimates, 2019 levels will not be reached again until 2023. The big question remaining is whether a possible second corona wave could slow down the ongoing recovery.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.