The breath-taking performance of the technology sector in recent years brings back memories of the year 2000. But how does today differ from then? How can we explain the strong performance, and is there still upward potential?

From potential to reliable return

I need to preamble this by saying that valuations and profitability today are not comparable to 2000. About 20 years ago (in April 2000), share price valuations in the technology sector were at their peak after years of climbing. Then, the environment was one of big expectations of profitable business. The erstwhile valuations – around that time and even in later years – were substantially higher than today. The profitability of many companies could not be compared to today’s standards.

Applications with future: from autonomous vehicles to video gaming

It is not without reason that valuations and profitability have improved significantly over the recent ten years. The rapid technological development in the past decade has shown why technology companies are worth the money. The changes in the technology sector over the past 20 years is impressive. Applications from the technology sector are used pretty much everywhere across all sectors:

- Communication (mobile telephony, home office, 5G)

- Entertainment (video streaming, video gaming, social networks)

- Commerce/retail (online shopping, logistics)

- Payment services (digital payment online and offline, digital currencies)

- Safety (autonomous vehicles, production automation)

- Big Data (AI, data analysis, data interpretation)

Given the massive bandwidth of applications, the positioning of the technology sector is more robust than in the past. In addition to the fields of application, the relevance of IT applications and products has increased drastically as well. We have seen in recent months in particular how much of a critical factor IT can be.

Corona made home office socially acceptable

Remote computing (cloud computing) facilitated a (frequently) smooth transition from working in an office to working from home. Video telephony or at least clean solutions for audio calls would also be helpful. Consumers were able to procure consumer articles despite lockdowns and closed shops without problems, thanks to online shopping and online payment. And video streaming filled in for cinemas. Those are just a few examples.

There was no way around using IT services. This supports the profitability of producers. More important, to me, is the fact that these developments that we have seen in recent months are not new; they have been around for years, as corroborated by data. The recent past has reinforced, accelerated, and manifested those trends.

Stable earnings expectations for 2020

Company results and expected sector results suggest a favourable development in 2020 despite the corona crisis – after all, technology companies have posted double-digit profit growth again (as of 30 June 2020: source: Bloomberg). Whereas the consensus expects a decline in earnings of 20% in 2020 for the globally developed equity market, IT companies are expected to maintain stable earnings this year.

CONCLUSION:

The question of whether technology companies are today what utilities used to be is justified. From a strategic perspective, the economic boom years of 2010 to 2019 were as favourable for IT companies as the events of 2020. The demand for IT products rises both in times of crises and of boom. Technology companies provide solutions that have become indispensable. These are features with which we have traditionally credited utility companies.

Invest in technology shares by investing the ERSTE STOCK TECHNO fund

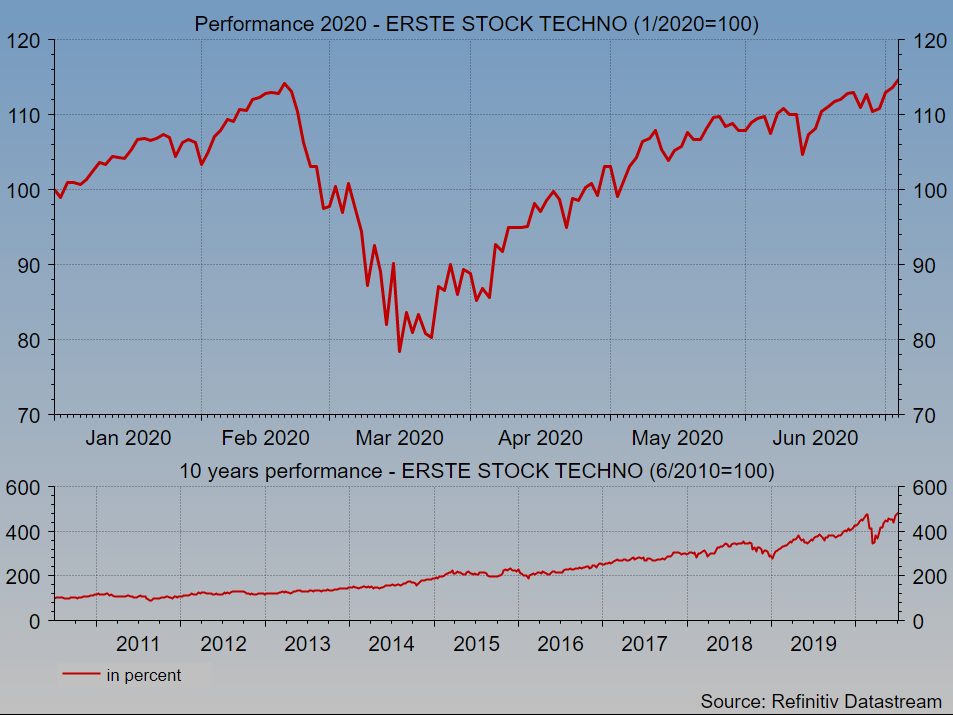

The technology equity fund ERSTE STOCK TECHNO <Achtung: deutscher Link> (please refer to the chart below) reflects the success story of technology shares in the recent decade. The fund management team focuses on high-quality, high-growth companies, the majority of which are based in the USA. The investment process takes into account environmental, social, and governance factors.

An investment in technology shares provides the investor with the chance of attractive gains, but at the same time he/she has to bear in mind the often elevated price fluctuations and the resulting risk of loss. We recommend a holding period of at least six years. By signing up for a fund savings plan (s Fondssparen),you can start with regular contributions of as little as EUR 50.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.