1st of May – a historic holiday

One look at the history of labour relations shows the reason why 1 May was chosen for this holiday. Labour Day dates back to the 19th century in the USA. Industrial workers had to contend with dismal working conditions and low wages back then. Therefore, in 1886 the trade and worker unions declared a general strike that would last several days, and they did so on 1st of May. The main goal was to cut the daily work schedule to eight hours.

1st of May had been chosen because in those days, the old labour contracts would expire on that day in the USA, and new ones had to be signed. That’s why 1st of May was also referred to as “Moving Day”. About 400,000 employees from 11,000 companies participated on the first day of the general strike, among them workers from the industrial town of Chicago. Chicago experienced a violent clash between demonstrators and the police on the third day during a protest. It was triggered by a fragmentation bomb that had been thrown at the police. Numerous people died or were injured. In the end, the unions managed to assert their demands. On 1st of May 1890, the 8-hour working day came into effect in the USA.

On this year’s Labour Day, there is not much to celebrate. The number of unemployed could grow to 50 million due to the global pandemic. However, there is still the chance that we may recover from the economic standstill and cut the unemployment rates.

Sharp decline in employment in the short term

Several indicators suggest a drastic decline in employment and a significant increase in unemployment, respectively, across many countries (e.g. the number of applications for unemployment benefits). The International Monetary Fund (IMF) estimates the unemployment rate for 2019 at 4.8% in terms of working population, and it expects it to rise to 8.2% this year. For 2021, the IMF envisages a decline to 7.2%. For 2020, this means an increase in unemployment of 70%. Even in 2021, unemployment will still be 30% above the original level. The World Bank puts the size of the working population at 616 million in the high-income countries. This translates into about 30 million unemployed last year. This number could rise by 20 million to 50 million in 2020.

As if that had not been bad enough, the entire damage to the labour market is substantially bigger. The International Labour Organization (ILO) estimates that the number of hours worked by globally employed people declined by 10.5% in Q2 2020 relative to Q4 2019. This seems easily absorbable only at first glance. Total hours worked are calculated by multiplying the number of people employed by weekly work hours. On the basis of a 48h work week, this translates into a loss of 305mn full-time equivalents.

Shadow economy particularly hard hit

This situation has the most severe impact on the weakest members of society, as it affects in particular the shadow economy (also referred to as informal sector). ILO estimates that about 1.6 billion shadow economy workers could lose their livelihood. This is almost half of the global workforce (3.3 billion people). In the first month of the crisis, informal workers may have lost some 60% of their income.

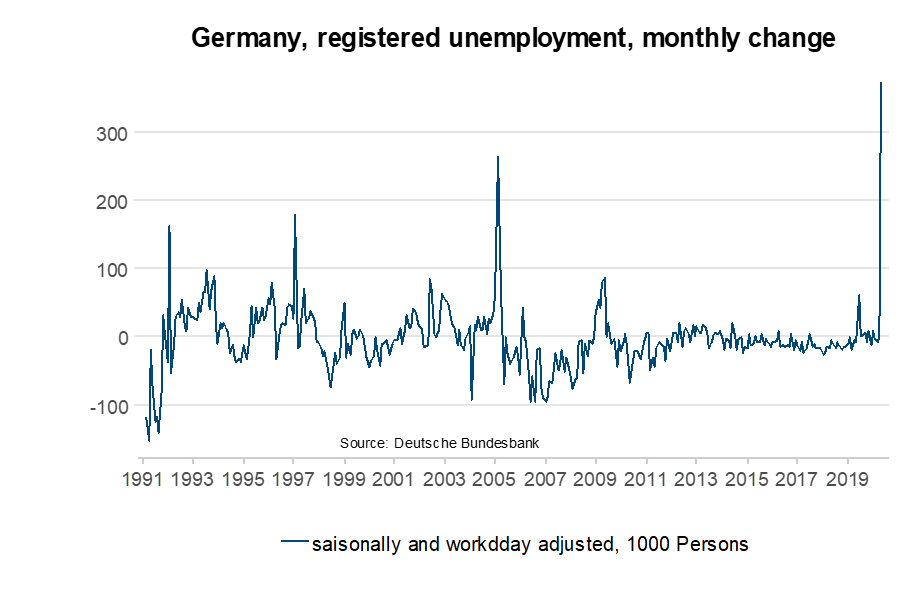

Giant leap in unemployment in Germany

Unemployment rate will decrease – permanent effects to be expected

The announcements of a gradual loosening of containment measures have become more plentiful in the second half of April. The catastrophic economic indicators for the month of April will improve a bit in May. However, the damage will be sustainable. In some European countries, reduced-hours work schemes have been implemented to help the situation, but income has been lost all the same. In addition, unemployment rates will not have fully fallen back to the initial level even by the end of 2021, and the global income gap between “poor” and “rich” countries will widen further.

Policy-makers challenged

In the coming quarters, the economic framework for the coming ten years will be set. Option no.1: public austerity schemes in order to reduce the increased debt. This would probably lead to sustainably low economic growth amid increased unemployment (secular stagnation). Option no.2: stimulus packages after the bailout-schemes. This would come with the chance of recovering lost GDP and cutting unemployment to the original level.

Coordinated action important

But that is not all. The individual countries have to act in a coordinated fashion in order to maximise the overall stimulus effect. Also, the stimulus programmes would have to be symmetrical. Their size should not be based on the rating of the respective country, but on the economic necessity. This does not only refer to the tense relationship between the various EU states. Rather, it refers not the least to the emerging and low-income countries, which have significant capital needs (USD 2,500bn, according to a recent estimate by the IMF).

Conclusion:

Improved economic indicators will help calm the situation on the labour market. The emergency stop of the economy has hit the shadow economy hardest. What long-term effects are to be expected depends on the economic policies in the coming quarters. Internationally coordinated stimulus programmes and the support of low-income countries would help.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.