What were the biggest challenges last year, and what are the opportunities in 2019? Emerging markets fund manager Péter Varga answers the most important questions.

ARTICLES IN THE TOPIC “Bonds”

Latin America overview: Venezuela a classic debt rescheduling candidate

Oil production, state crisis, costly restructuring: Venezuela is in crisis. What’s next? Our analysts Christian Gaier & Felix Dornaus provide the answers.

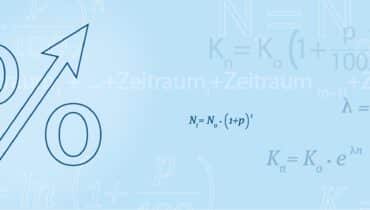

Low Return on Assets – where can savers still find decent interest rates?

Many savers are fed up with investing their saved-up capital at low interest rates. The question everyone is asking themselves now is how to earn a good yield on one’s hard-earned capital in times of low interest rates like nowadays?

Attractive yields for emerging markets bonds in local currencies

On 17 October 2018, ERSTE BOND LOCAL EMERGING celebrated its 10th anniversary – a perfect time to have a closer look at the asset class “Emerging markets bonds in local currency ”. More in our Blog.

BCA Investment Conference in Toronto: How to navigate wealth to prosperity in a late stage of the business cycle

Every year the independent investment research provider BCA organizes an outstanding event for investment professionals from all over the world to come together and have a vibrant discussion about recent challenges in financial markets.

YIELD RADAR: September 2018

Annualised real global GDP growth amounts to slightly above 3%. The composition of growth is not homogenuous. While the US economy grows strongly, the weakening loan growths puts weight on the economic activity in China. Find out more in the current yield radar.

Turkish lira – what are the reasons behind the current crisis?

The Turkish lira reflects the difficult situation Turkey is currently in. This year alone, the currency has shed more than 45% of its value to date. Interview update with Anton Hauser, Senior Fund Manager, Eastern Europe bonds.

Russian bonds should see good performance

In this interview Anton Hauser, senior fund manager at Erste Asset Management and expert for Central and East European (CEE) government bonds , talks about the difficult first half of 2018 and illustrates possible future scenarios.

A niche product with solid returns: hybrid and subordinated bonds with investment grade rating

Author: Christin Bahr, Product Management Securities Erste Group It has been half a year since the launch of the new hybrid bond fund. Reason enough for us to talk to Roman Swaton, Senior Fundmanager.

High yields and a potential turnaround make LATAM bonds an interesting investment

Autor: Christian Gaier, Head of Fixed Income Rates, Sovereigns & FX, Erste AM I would like to share my impressions from my latest investor conference in London that I attended on 16th January 2017. The conference was organized by Banco Bilbao Vizcaya Argentaria (BBVA), a leading global financial group with a strong franchise in 35 […]